Concerns Over COVID-19 Resurgence Hit

Four Airlines, Travel, and Casinos

Deficit Expected to Reach 500 Billion Won

[Asia Economy Reporter Oh Ju-yeon] The travel, casino, and airline industries, which were hit hard by the novel coronavirus disease (COVID-19) in the first quarter, are expected to continue suffering large-scale losses in the second quarter due to the ongoing impact of COVID-19. The deficit in these industries is projected to reach 500 billion KRW. In particular, as signs of a COVID-19 resurgence emerge, the earnings consensus for these sectors is declining over time.

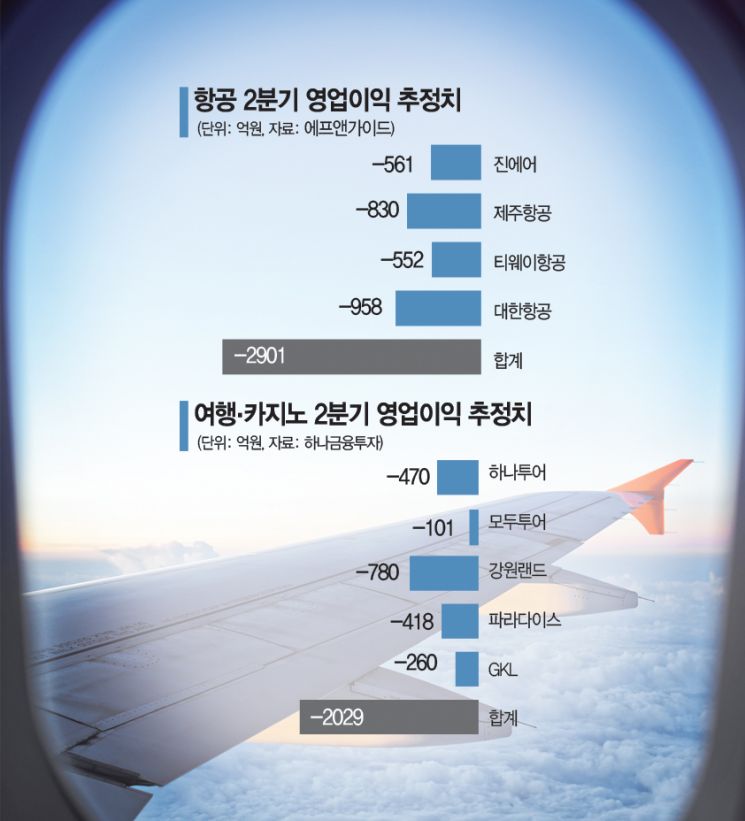

According to financial information provider FnGuide on the 8th, the second-quarter earnings of four domestic airlines, estimated by three or more securities firms, are all expected to show operating losses. As of the end of last month, the combined operating loss of Jin Air, Jeju Air, T'way Air, and Korean Air was 290.1 billion KRW. Jeju Air is expected to increase its loss nearly threefold from 27.4 billion KRW in the second quarter of last year to 83 billion KRW this quarter. Jin Air and T'way Air are also expected to see their losses widen from -26.6 billion KRW and -25.8 billion KRW in the second quarter of last year to -56.1 billion KRW and -55.2 billion KRW, respectively, this quarter. Korean Air is also analyzed to face an unavoidable loss in the high 90 billion KRW range, similar to last year's scale.

The securities industry views the recovery of international flight demand as distant due to the resurgence of COVID-19. Jeong Yeon-seung, a researcher at NH Investment & Securities, said, "Although some routes resumed operations in June, overall flight disruptions continue, and the low load factor could increase the deficit, a burden that may persist into the second half of the year." In May, the international flight load factor of domestic airlines was only 36.7% based on seat capacity. Although domestic demand is recovering, competition among airlines has led to significant fare discounts, making profit generation through passenger transport impossible.

However, Korean Air is receiving differentiated evaluations as it is expected to benefit from the profitability of its cargo division and is proactively strengthening its capital through rights offerings and the sale of idle assets and business units. Until a month ago, Korean Air was expected to incur a large-scale loss of about 200 billion KRW, but recently, the expected deficit has been reduced by about half. This is interpreted as expectations that relatively strong international cargo transport volumes will offset the passenger demand gap.

Combining the second-quarter losses of the airline industry with the performance of the travel and casino sectors, the total loss across these three industries is expected to approach 500 billion KRW.

Hana Financial Investment estimated the second-quarter operating profit of five companies, including two domestic travel agencies and three casinos, and projected a combined deficit exceeding 200 billion KRW. As of the end of last month, Kangwon Land's second-quarter operating profit estimate, based on three or more securities firms, was 15.6 billion KRW, which, although more than a 90% decrease compared to the same period last year, was still expected to remain positive. However, with the rapid onset of the second wave of COVID-19, this outlook has turned negative, and a loss of 78 billion KRW is now anticipated. Additionally, Paradise is estimated at -41.8 billion KRW and GKL at -26 billion KRW, both likely to return to losses compared to the same period last year.

The travel industry is in a similar situation. The combined number of outbound travelers in the second quarter is about 500, and the combined sales of Hana Tour and Modetour are expected to be less than 2 billion KRW. Accordingly, Hana Tour is expected to post a loss of 47 billion KRW and Modetour a loss of 10.1 billion KRW in the second quarter.

The problem is that the outlook for the second half of the year is also uncertain amid the unknown end of COVID-19. Lee Ki-hoon, a researcher at Hana Financial Investment, expressed concern, saying, "There is little chance that the situation will change significantly in the third quarter. If the COVID-19 crisis prolongs until the fourth quarter, some companies will inevitably need to take preemptive liquidity securing measures within the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.