Financial Authorities "Under Multifaceted Review"

Significant Concerns Over Potential Side Effects

"Simultaneous Safety Measures Needed"

Many Listings but M&A Stalled

[Asia Economy Reporters Hyojin Kim and Minyoung Kim] As the voice of the savings bank industry demanding deregulation of mergers and acquisitions (M&A) grows louder, financial authorities are showing signs of deepening concerns over the scope, content, and timing of such deregulation. This is because they must consider the need for 'traffic control' within the market due to polarization among savings banks and the reorganization of small and low-income financial functions through this, as well as the potential side effects similar to past savings bank bankruptcy incidents.

According to financial authorities on the 7th, the Financial Services Commission is currently reviewing various options for partial deregulation of savings bank M&A rules. A Financial Services Commission official said, "We are carefully examining the matter while listening to the opinions of related experts," adding, "We are considering ways to activate the market while minimizing risk factors."

Currently, a single major shareholder cannot own three or more savings banks, and only up to two savings banks operating in different business areas can be managed. Merging acquired savings banks is also prohibited. These strict regulations have been maintained since the large-scale bankruptcy crisis in 2011.

It was initially expected that the deregulation plan for savings bank M&A would be prepared within the first half of this year. A Financial Services Commission official explained, "It seems that more time is needed to review the detailed matters," adding, "We are actively reviewing it within the broad framework of deregulation."

The Financial Services Commission is reportedly considering not only preparing a separate deregulation plan for M&A but also creating and announcing a comprehensive reform plan for the overall supervision regulations of savings banks. This could take much longer than expected.

The savings bank industry has consistently demanded the need to normalize and revitalize functions through active M&A due to the deterioration of business in some small savings banks and the resulting contraction of savings bank functions. In particular, there is growing concern inside and outside the industry that if some savings banks cannot withstand the advancing wave of digital financial innovation, the damage will directly transfer to low-income people.

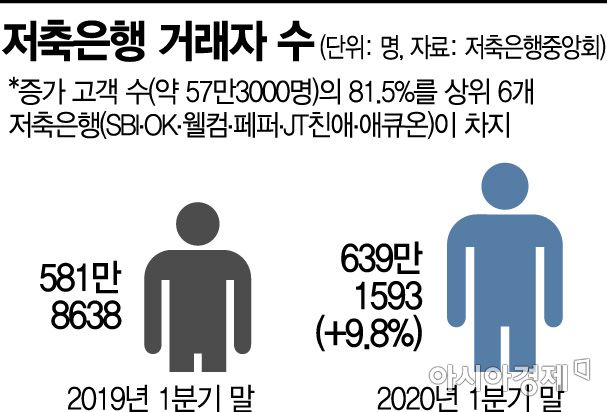

These concerns are surfacing as polarization within the industry. According to the Korea Federation of Savings Banks, the number of savings bank customers in the first quarter of this year was about 6.4 million, nearly 10% higher than the same period last year. More than 80% of these customers were concentrated in six major large savings banks: SBI, JT Chin-ae, OK, Welcome, Pepper, and Accuon.

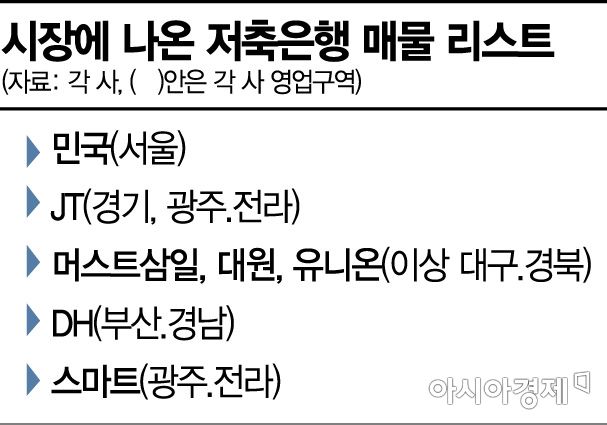

The demand for M&A is already at a considerably high level. Minguk, JT, Must Samil, Daewon, Union, DH, and Smart Savings Banks are on the market. In the case of Minguk Savings Bank, Mugunghwa Trust completed due diligence last year and was in the final stages of sale, but the process is currently halted. It is reported that Mugunghwa Trust is reluctant to purchase due to difficulties such as stringent major shareholder eligibility criteria.

Japanese financial holding company J Trust Group has recently been making efforts to sell JT Savings Bank, which is considered a 'prime asset,' by selecting the law firm Kim & Chang as an advisor, but no interested buyers have yet appeared.

In particular, Minguk Savings Bank and JT Savings Bank, which operate in Seoul and the Gyeonggi-Incheon areas respectively, are attracting considerable market interest.

After savings banks express their intention to sell, some private equity funds or trust companies approach them, but deals repeatedly fall through or remain abandoned without finding a buyer. An industry insider explained, "This phenomenon occurs because M&A between savings banks is prohibited, making it difficult to find suitable major shareholders."

A financial sector official said, "The financial authorities must be deeply concerned," diagnosing, "It is easy to ease regulations, but if problems arise afterward, it is very difficult to correct them." The official added, "Even if regulations are relaxed, corresponding safety measures must accompany them," and "This is probably why regulatory reform requires a long time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.