Confirmed Interest Rate Application and Principal-Guaranteed Untact-Only Retirement Pension Product

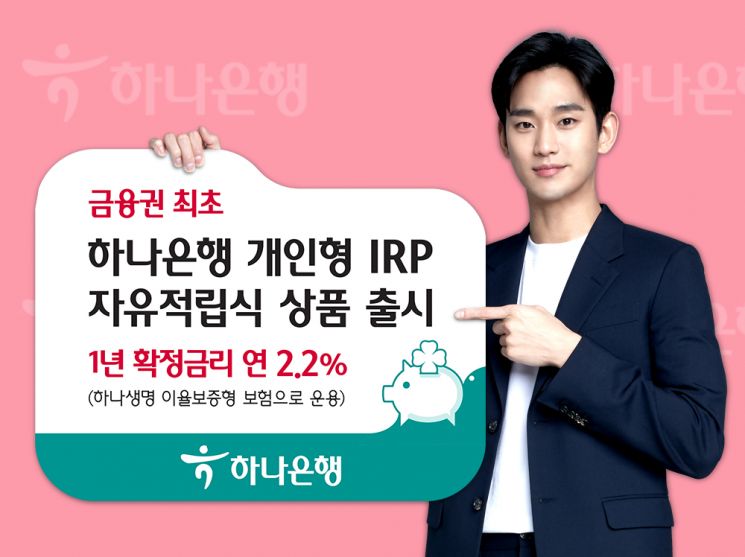

[Asia Economy Reporter Kim Min-young] Hana Bank announced on the 7th that it will launch the financial sector's first retirement pension dedicated flexible installment principal-guaranteed product.

This product is a principal-guaranteed product provided to individual retirement pension (IRP) customers in collaboration with Hana Life Insurance. While existing retirement pension principal-guaranteed products have different maturities and applied interest rates for each purchase, the flexible installment principal-guaranteed product has a fixed maturity and interest rate at the time of the initial purchase. The bank explained that this expands customers' product choices during periods of declining interest rates and helps with stable asset management.

This product is available only to new individual IRP subscribers and customers transferring accounts from other financial institutions through non-face-to-face channels (mobile banking and internet banking). The minimum subscription amount is 10,000 KRW or more, and the subscription period is one year. The planned interest rate as of July is 2.2% (pre-tax yield), and sales will be suspended early once the limit is reached.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.