From Financial Sector 'Meggi' to First-Tier Banks

Establishing as Internet Banks

Fast Loans Deposited Within 10 Minutes

Popular Among 2030 Generation Customers

[Asia Economy Reporter Kim Min-young] KakaoBank, the ‘catfish’ of the financial sector celebrating its 3rd anniversary this month, is experiencing explosive growth in loan operations by leveraging attractive interest rates and convenience. It is evaluated that its loan business has been firmly established, with the outstanding balance of personal loans sold over the past three years exceeding 14 trillion won. As KakaoBank is expected to take an aggressive approach with differentiated strategies from commercial banks, such as not only personal loans but also loans for self-employed individuals and mid-interest loans, competition with commercial banks is anticipated to become even fiercer.

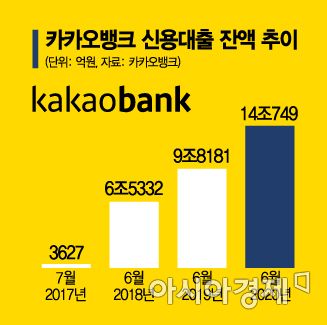

According to the financial sector on the 6th, as of the end of last month, KakaoBank’s outstanding balance of personal loans was recorded at 14.0749 trillion won. The outstanding balance in the first month of launching personal loan products after starting operations in July 2017 was 367.2 billion won. This means it has grown 38.3 times in just three years.

The outstanding balance of personal loans includes not only individual personal loans but also small emergency loans under 3 million won, overdraft loans, and loans for individual business owners. About a year after its launch, at the end of June 2018, it recorded 6.5332 trillion won, and by June last year, it had reached 9.8181 trillion won.

The ‘quick loan’ service, which allows customers to receive funds within 10 minutes without visiting a bank, has captivated customers in their 20s and 30s. Especially, the convenience of KakaoBank’s personal loans became widely known in conjunction with the sudden ‘Donghak Ant’ stock investment boom in the first half of the year. Stories like “I got a personal loan from KakaoBank in a few minutes and invested in stocks to make money” were frequently heard.

The interest rates are also relatively low. For high-credit salaried workers, KakaoBank’s personal loan interest rates start as low as 2.22% per annum. The loan interest rate for individual business owners, mainly freelancers or self-employed individuals with an annual income of over 10 million won, is also attractive at a minimum of 3.25%, compared to commercial banks.

Jeonse deposit loans have also shown explosive growth. This product, which sold only 200 million won in its first month of release in January 2018, recorded an outstanding balance of 3.2703 trillion won at the end of last month.

Loans are executed through smartphone applications and just a few consultation calls, establishing KakaoBank early on as a symbol of non-face-to-face (untact) loans. In contrast, to get a Jeonse loan from commercial banks, customers had to visit branches with documents such as proof of deposit payment, employment certificates, and income verification, which was inconvenient. KakaoBank resolved this with just one digital certificate.

Competition in personal loans with commercial banks is expected to intensify going forward. Major banks such as Shinhan, KB Kookmin, Hana, and Woori have also strengthened their non-face-to-face personal loan operations with easy limit inquiries and low interest rates. Although limited to credit grade 1, Shinhan Bank’s personal loan interest rate reaches as low as 1.69% per annum. The maximum limit is 200 million won, higher than KakaoBank’s 150 million won. A financial sector official said, “It is obvious that existing banks would suffer losses if they compete on interest rates with KakaoBank, which has no offline branches,” but added, “As KakaoBank’s influence grows in targeting young customers in the personal loan market, banks are lowering interest rates to attract customers.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)