[Asia Economy reporters Seulgina Jo and Jinju Han] "It seems that shipments to the U.S. could start within this year." "There are many opportunities overseas. We are also submitting proposals in Southeast Asia."

As 5G investments, which had virtually come to a halt worldwide due to the impact of the novel coronavirus (COVID-19), begin in earnest this month, a favorable wind is blowing through the domestic equipment industry. In particular, the strong anti-Huawei sentiment centered around the U.S. and India is expected to bring a windfall to '5G Korea.' Some equipment companies anticipate overseas sales starting as early as the third quarter.

◆ Full-scale 5G investment by countries= According to the Network Industry Association on the 6th, the domestic equipment industry expects 5G investments to expand in the global market starting this month with the U.S. Federal Communications Commission (FCC) initiating the auction of private broadband wireless service (CBRS) frequencies, and has begun swift preparations for exports.

Dasan Networks, whose overseas sales account for 70%, recently resumed local operations in Europe, including France, following the lifting of shutdowns. A Dasan Networks official said, "Governments worldwide are stepping up to invest in 5G and ultra-high-speed infrastructure in the untact era. Discussions with local telecom operators are underway, and we expect these to translate into sales." The company has also sent equipment supply proposals to Southeast Asia, where 5G investments are under consideration, in addition to North America and Europe.

KMW, which supplies 5G base station equipment to Samsung Electronics and Nokia, is also expecting exports to the U.S. within this year. A KMW official stated, "The FCC frequency auction, originally scheduled for April, was postponed to this month, pushing some planned volumes to next year. However, exports to the U.S. could start as early as this year." The official added, "With Huawei sanctions, Samsung Electronics, Nokia, and Ericsson supplying to the U.S. telecom industry, the volume for domestic companies is expected to increase." In the securities sector, companies such as Oisolution, Seojin System, and RFHIC are also identified as beneficiaries alongside KMW.

The domestic equipment industry took a direct hit from investment contractions in the first half of the year due to COVID-19. However, equipment supply contracts are gradually being discussed, mainly with overseas telecom operators, signaling a slow recovery. The Japanese telecom industry, which announced plans for 5G commercialization at the beginning of the year, began network investments this month. India is also conducting 5G pilot tests ahead of its planned 5G commercialization in the second half of the year.

◆ Windfall from the spread of anti-Huawei sentiment= The global spread of the U.S.-led anti-Huawei sentiment is also a boon for the domestic equipment industry. Earlier, Canadian telecom operator Telus decided to exclude Huawei and entrust Samsung Electronics with equipment supply for its 5G rollout next year. U.S. Secretary of State Mike Pompeo stated at the end of last month in a declaration that "the tide is turning toward trusted 5G equipment providers," noting that "telecom operators worldwide are ending transactions with Huawei," citing examples such as the Czech Republic, Poland, Sweden, and Denmark.

Moreover, India, a new battleground for global 5G equipment providers, has recently turned its back on China following violent clashes in the Himalayan border region. Considering that global telecom operators typically contract with multiple equipment providers, this presents an opportunity for domestic companies to replace Chinese firms.

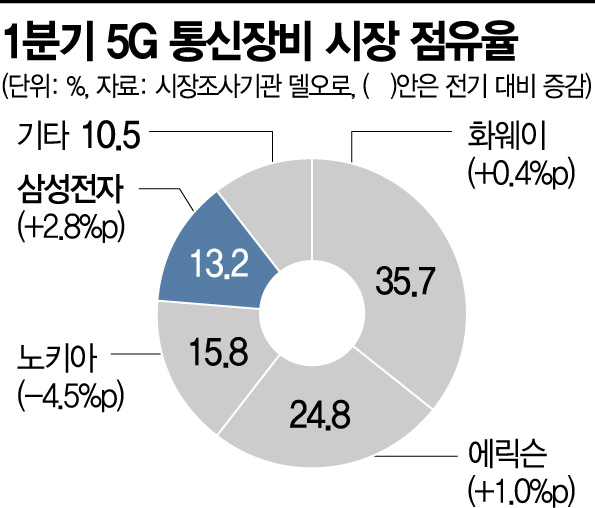

According to market research firm Dell'Oro, Samsung Electronics' market share in 5G communication equipment rose 2.8 percentage points quarter-on-quarter to 13.2% in the first quarter. Industry leader Huawei (35.7%) maintained its lead, but its growth was limited to 0.4 percentage points, which was attributed to contracts with domestic companies.

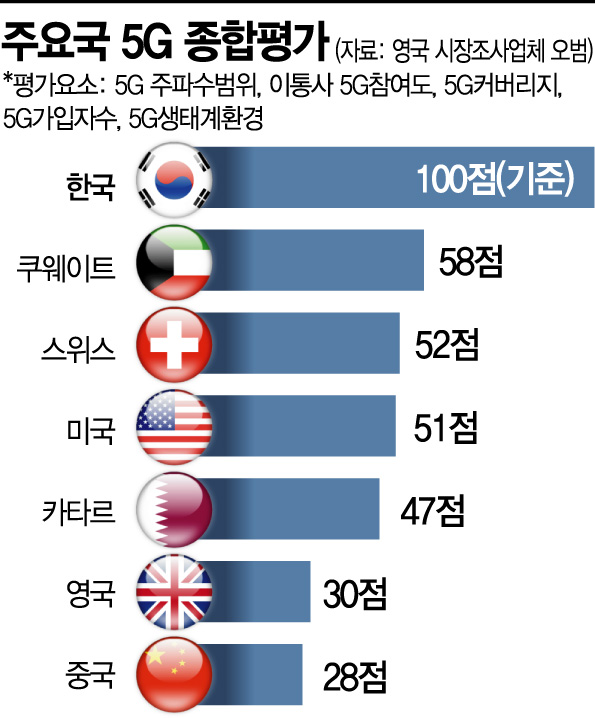

This is also seen as possible because of Korea's '5G leadership,' having been the first country in the world to commercialize 5G. According to a comprehensive evaluation of the 5G industries of major countries by UK market research firm Ovum, when Korea is set as the benchmark (100 points), countries such as the U.S. (51 points), Switzerland (52 points), and the UK (30 points) fall short of even half of Korea's level.

An official from the Ministry of Science and ICT said, "Following COVID-19, rapid 'digital transformation' is taking place worldwide, and the need for network investment is increasing significantly," adding, "Not only Samsung Electronics but also domestic mid-sized and small equipment companies are expected to benefit." However, a Network Industry Association official noted, "Since network construction is not starting immediately, the overall industry is still facing difficulties," adding, "The key will be the 5G investment drive by each government."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)