Average Daily Trading Volume and Value More Than Double Compared to Last Year

Preference for Safe Assets... Increased Interest in Low Trading Costs and Tax Exemption Benefits

[Asia Economy Reporter Minwoo Lee] Due to increased demand for safe-haven assets amid the US-China trade dispute and the impact of the novel coronavirus disease (COVID-19), trading in the gold market established by the Korea Exchange (KRX) has surged. Both trading volume and trading value have more than doubled compared to the previous year. It is expected that the cumulative trading value will surpass 1 trillion won for the first time since the market's inception within this year.

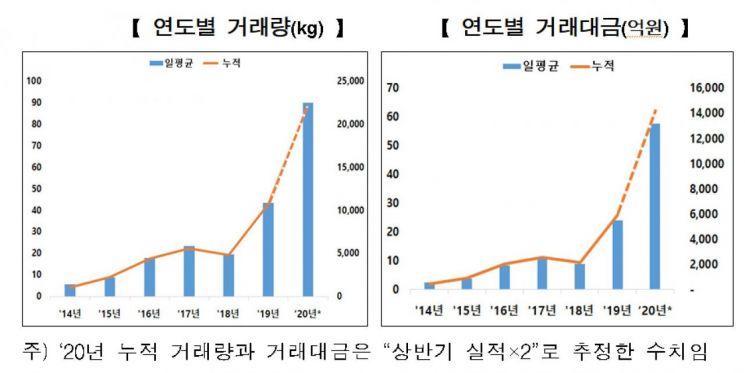

The Korea Exchange announced on the 5th that the average daily trading volume and trading value in the KRX Gold Market for the first half of this year were 90 kilograms (kg) and 5.78 billion won, respectively. These figures represent increases of 106.4% and 139.8% compared to the previous year. In particular, the cumulative trading value reached 710.3 billion won, and it is anticipated to exceed 1 trillion won for the first time since the market was established. The cumulative trading volume also surpassed last year's 10.7 tons, reaching 11.1 tons. Notably, on January 8th, the largest volume ever was traded, amounting to 272.6 kg and 16.4 billion won.

Gold prices are also on the rise. As of the 30th of last month, the price per gram (g) in the KRX Gold Market was 68,640 won, marking a 22% increase from 56,270 won at the end of the previous year. Compared to the market's initial launch at the end of 2014, the price has risen by 42,440 won, or 62.2%.

By investor type, individuals accounted for the largest share at 63.2%, an increase of 7.1 percentage points (P) from the previous year. Institutional investors also increased their share by 1.9%P to 18.7%. However, physical businesses decreased by 8.9%P to 18.2% during the same period. This indicates a shift from a one-directional market at the early stage?where individuals mainly bought (92.4%) and physical businesses mainly sold (83.0%)?to an investment market where various participants repeatedly buy and sell.

Relatively younger investors have also increased. As of March this year, those in their 20s accounted for 18%, and those in their 30s made up 38%, meaning more than half of the market participants are aged 30 or younger. Other age groups include 40s at 29%, 50s at 11%, and 60s at 4%, showing a tendency for participation rates to decrease with increasing age.

A Korea Exchange official explained, "Interest and demand for gold, a safe-haven asset, have increased sharply since the second half of last year due to the US-China trade dispute and the impact of COVID-19. Additionally, while gold banking and over-the-counter markets incur trading costs of 1-7% compared to international prices, the KRX Gold Market allows trading at 100.4% of the international price (including the international price deviation rate and all fees). Moreover, there are no taxes on capital gains, and value-added tax exemptions apply to on-exchange trading, which has been a significant factor."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.