Smartphone Shipments Decline but Component Demand Rises

Upward Trend Expected to Continue in Second Half

5G Market Growth... Competition to Expand Market Share Targeting Huawei's Gap Also Influences

[Asia Economy Reporter Minwoo Lee] Although smartphone sales declined in the first half of the year due to the novel coronavirus disease (COVID-19), demand for IT components remained strong. This is interpreted as reflecting manufacturers' strategies to steadily expand component inventories. Component demand is expected to increase in the second half as well. Manufacturers are aiming to expand their market share by filling the gap left by Huawei in the upcoming 5G smartphone market, beyond just recovering from COVID-19.

On the 5th, Shinhan Financial Investment lowered its smartphone shipment forecast for this year from 1.45 billion units at the beginning of the year to 1.2 billion units. First-half shipments are expected to contract by 21% compared to the previous year. By manufacturer, Samsung Electronics and Apple are expected to decrease by 27% and 11% respectively compared to the previous year. This indicates a consumption slump in the IT set industry in the first half due to COVID-19.

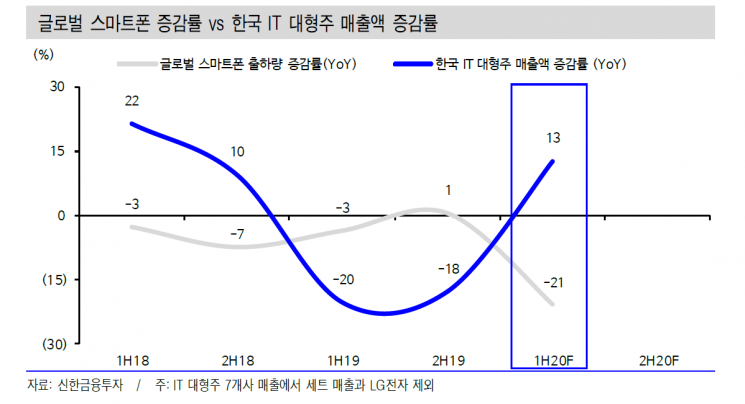

Nevertheless, component demand remains robust. The combined first-half sales of seven major Korean IT companies, excluding LG Electronics, are expected to increase by 13% compared to the same period last year. Despite COVID-19, many domestic and international IT component companies, excluding Samsung Electronics' value chain, have shown favorable first-half performance trends. Hyungwoo Park, a researcher at Shinhan Financial Investment, explained, "In the first half, smartphone manufacturers demanded component demand at the previous year's level despite sluggish set sales," adding, "The continuous and strong first-half sales of component companies are interpreted as an expansion of component inventories by front-end IT set manufacturers such as Huawei and Apple."

This inventory accumulation is attributed to risks of component production disruptions, concerns over escalating disputes between the U.S. and China, and strategies to expand set sales in the second half. Although TV and home appliance businesses saw reduced sales due to COVID-19, competition temporarily eased, likely reducing marketing costs. However, Samsung Electronics' component suppliers were an exception, showing sluggishness. This appears to be due to proactive inventory adjustments. Researcher Park stated, "Unlike Apple and Chinese manufacturers, Samsung Electronics' mobile division immediately began managing component inventories in the first half, significantly reducing orders for components such as cameras, cases, and substrates in April and May," forecasting, "Samsung value chain companies' second-quarter sales are expected to decrease by 20-60% compared to the previous quarter."

However, from this month, Samsung Electronics' component demand is expected not only to rebound but also to increase further. Expectations for recovery after COVID-19, along with the anticipated decline in market dominance due to Huawei's component procurement difficulties and the opening of the 5G smartphone market, are expected to be key factors.

Apple, which maintained the strongest orders in the component industry in the first half, is in a similar position. Although its performance was better than competitors, component orders increased compared to the previous year despite smartphone shipments still declining by more than 10% year-over-year. In Apple's supply chain, expanded component production, early mass production, and demand for 5G components exceeding expectations have been confirmed. Researcher Park said, "This reflects Apple's intention to expand market share by filling Huawei's gap in 2021 based on 5G marketing and iPhone price reduction strategies," adding, "While it is uncertain whether consumer demand for new iPhones will actually support this, there are more than two months until the iPhone launch, which can confirm this, so aggressive component orders are expected to continue until the launch."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.