[Asia Economy Reporter Jo In-kyung] The Ministry of the Interior and Safety announced on the 5th that all business owners nationwide with a total floor area of their business premises exceeding 330㎡ must report and pay the 'Resident Tax Property Portion' to the local government where the business premises are located by the 31st of this month.

Resident tax is a local tax paid by business owners as a minimum cost for administrative services provided by local governments. It is taxed at a rate of 250 KRW per 1㎡ according to the total floor area of the business premises, and if the reporting and payment of the resident tax property portion are neglected, additional penalties (such as a 20% non-reporting penalty) will be imposed.

Some local governments are providing support measures such as full or partial exemption of the resident tax property portion or extension of the payment deadline for business owners affected by the novel coronavirus infection (COVID-19).

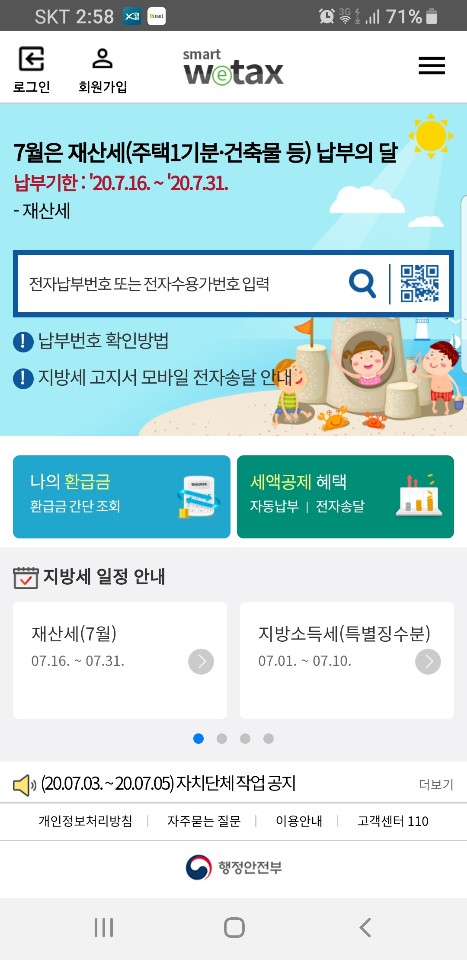

The Ministry of the Interior and Safety advised that since the government's social distancing measures are ongoing, taxpayers can safely and conveniently pay local taxes of all local governments nationwide by using the 'Wetax' website (www.wetax.go.kr) or the mobile app 'Smart Wetax' instead of visiting city, county, or district offices in person.

For more details, please check with the tax departments of city, county, and district offices nationwide or the Wetax website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.