Shinhan Life Insurance Pushes to Establish GA Subsidiary

Hanwha Life Insurance Reviews Acquisition of PeopleLife

Seven Life Insurers Have GA Subsidiaries

[Asia Economy Reporter Oh Hyung-gil] Life insurance companies are recently eyeing corporate insurance agencies (GA) that have rapidly grown in size. As GAs have expanded their sales channels to the point of threatening existing life insurers, this is interpreted as an effort to directly establish or acquire existing firms to proactively lead the market landscape. In fact, the number of GA planners has long surpassed the total number of planners employed by insurance companies. It is analyzed that life insurers are actively utilizing GAs to boost sluggish performance amid industry downturns and to strengthen sales organizations that form a key pillar of the industry, thereby expanding their business.

According to the insurance industry on the 3rd, Shinhan Life Insurance, which is set to merge with Orange Life next July, established a GA subsidiary called 'Shinhan Life Financial Services.' Additionally, three managers from Shinhan Life were appointed to build the organization.

This is seen as a measure to prevent the defection of sales organizations that may occur during the merger process with Orange Life and to expand synergy. Shinhan Life is well known for its strength in telemarketing (TM) channels and bancassurance channels, with a particularly high proportion of female insurance planners. In contrast, Orange Life, which mainly operates face-to-face channels, tends to have more male insurance planners.

As a preliminary step before integrating two organizations with different sales cultures into one, the establishment of a subsidiary-type GA aims to minimize potential conflicts and facilitate a flexible merger.

The organizational composition of the GA subsidiary is expected to be centered around Shinhan Life planners wishing to transfer to the subsidiary, planners from other insurance companies, and planners affiliated with GAs. As of April, the number of exclusive planners was 6,042 for Shinhan Life and 5,130 for Orange Life.

Since early February, Shinhan Life has formed a task force (TF) to establish the GA subsidiary. The subsidiary establishment is progressing smoothly, with concrete schedules prepared through consultations with financial authorities.

Hanwha Life is also considering acquiring GA PeopleLife. PeopleLife, founded in 2003 by Chairman Hyun Hak-jin, a former Samsung Life executive, is ranked 10th in the industry. It currently operates 109 branches and plans to expand to 250 branches within the year.

Last year, PeopleLife's operating revenue was 242 billion KRW, a 25.5% increase from the previous year. However, it recorded a net loss of 32.8 billion KRW, continuing its capital erosion status. Hanwha Life, which already owns GA subsidiaries such as Hanwha Financial Asset and Hanwha Life Asset, is expected to strengthen its sales organization through the acquisition of PeopleLife.

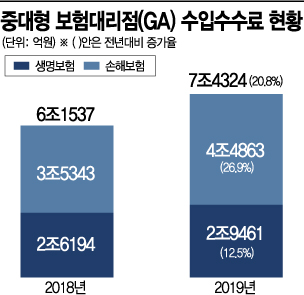

With the recent separation of insurance product creation and sales, the growth potential of the GA business is estimated to be high. Last year, the commission income of medium to large GAs was 7.4 trillion KRW, a 20.8% increase from the previous year. Currently, seven life insurers operate GA subsidiaries, including Samsung Life, Hanwha, Prudential, LINA, Mirae Asset, MetLife, and ABL Life.

An industry insider said, "If planners defect to GAs, insurance companies' sales will inevitably suffer significant damage," adding, "This is likely a measure to prevent planner defection and secure a certain level of sales capability through subsidiary GAs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.