More Freedom Than Apartment Loans

Seoul Officetel Sale Prices Rose 0.03% Last Month

Actual Transaction Prices Also Surpassed Previous Highs

Dogok Tower Palace 140㎡ at 2.2 Billion Won

[Asia Economy Reporter Donghyun Choi] The officetel market is also stirring due to the balloon effect of the June 17 real estate measures. Large, ultra-high-end officetels located near subway stations or business districts are drawing attention as alternatives to apartments, breaking record prices.

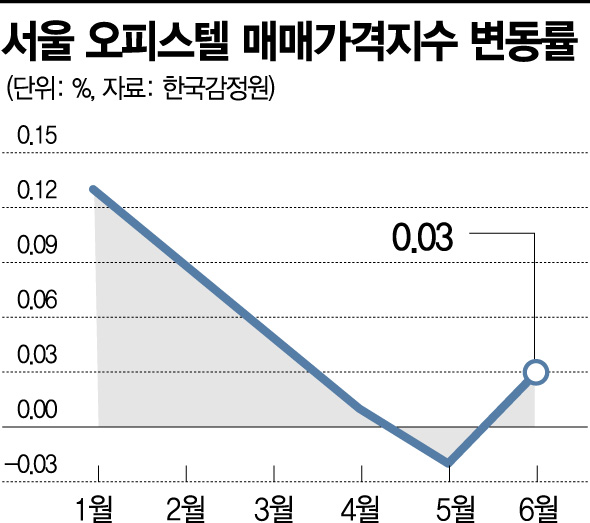

According to the Korea Real Estate Board's 'Officetel Price Trend Survey' on the 2nd, the Seoul officetel sales price index rose by 0.03% compared to the previous month. This index had slowed its upward trend earlier this year and turned downward in May in all areas except the northwest and southwest regions (which remained flat). It has now switched back to an upward trend after just one month.

Transaction volume is also surging. According to the Ministry of Land, Infrastructure and Transport's actual transaction price system, the number of officetel transactions in Seoul from January to May this year, counted within the mandatory reporting period of 30 days, was 5,313, a 56.3% increase compared to 3,399 during the same period last year. The transaction volume for last month, which still has reporting deadlines remaining, was 796, close to the 885 transactions recorded in the same period last year. The final reported transaction volume for June is expected to exceed 1,000.

Actual transaction prices are also breaking previous highs for officetels. Notably, the record price rally is continuing in medium to large-sized officetels, preferred by single-person households, rather than small to medium-sized ones. Last month, all six transactions of ultra-high-end officetels priced over 1.5 billion KRW saw price increases compared to previous transactions. For example, a 140㎡ unit (exclusive area) in 'Tower Palace' in Dogok-dong, Gangnam-gu, was sold for 2.2 billion KRW last month, over 100 million KRW higher than the 2.1 billion KRW transaction price in October last year. Similarly, a 137㎡ unit in 'Hyundai Hyperion' in Mok-dong, Yangcheon-gu, was traded for 1.76 billion KRW last month, up 40 million KRW from April.

The increase in officetel transactions and prices is analyzed to be due to investment demand avoiding regulations. Officetels remain freer from loan and tax regulations compared to apartments. While the loan-to-value ratio (LTV) for Seoul apartments ranges from about 20% to 40% depending on price, officetels allow up to 70%. Even if the sale price exceeds 900 million KRW, mid-term group loans are possible with construction company guarantees. There is no obligation to submit a fund-raising plan. Notably, although the June 17 measures included a rule to recall jeonse loans when purchasing new apartments over 300 million KRW in speculative overheated districts, this regulation does not apply to officetels. A representative from a real estate agency in Mapo-gu said, "As regulations on apartments have recently tightened, more investors are turning to buying and selling officetels to manage large sums of money," adding, "Properties near subway stations are snapped up immediately whether for sale or rent."

Interest in officetels is also prominent in the subscription market. In the first half of this year, six officetel projects were launched in Seoul, including 'Ssangyong The Platinum Seoul Station,' all of which sold out without undersubscription. 'Hillstate Yeouido Fine Luce,' launched on the 15th of last month, received 3,890 applications for 210 units, showing a high average competition rate of 18.52 to 1. In particular, the 4th group (types 28OH, 27OI, 25OJ) had a resident priority competition rate of 99.14 to 1. In May, the 'Hillstate Cheongnyangni The First B Block' 84㎡ OF type recorded an exceptional competition rate of 213 to 1, indicating that demand for new officetel complexes, like apartments, remains strong.

Researcher Hyuntaek Cho of the Commercial Information Research Institute said, "Although the June 17 measures were introduced recently, the rebound in officetels suggests a balloon effect is at work," and predicted, "Officetels are advantageous for mobilizing funds and have lower regulatory intensity, so this trend is expected to continue for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.