Issuance of 30 Billion KRW CB in March 2018... Early Redemption Request Possible from August 30

CB Conversion Price Set at 15,736 KRW, Higher than Current Stock Price

Zero-Interest Funding Secures GMP Standard Production Facilities and Clinical Costs

[Asia Economy Reporter Hyungsoo Park] FutureChem, a developer of radiopharmaceuticals, has launched a large-scale fundraising effort to secure funds for repaying convertible bonds (CB) issued two years ago. Since the current stock price is lower than the CB conversion price, making conversion unlikely, the company intends to raise funds in advance.

According to the Financial Supervisory Service on the 2nd, FutureChem plans a rights offering followed by a general public offering of forfeited rights, aiming to raise 31.9 billion KRW. New shares will be allocated at 0.654 shares per existing share. The subscription period is from the 27th to the 28th of this month. The expected issue price of the new shares is 8,400 KRW, with the final price to be confirmed on the 22nd. Shareholders who receive new shares but do not wish to participate in the capital increase can sell their subscription rights on the market between the 10th and 16th.

FutureChem plans to use the raised funds for repayment of CB principal and interest as well as research and development expenses. Previously, in March 2018, FutureChem issued 30 billion KRW worth of the "2nd Private Placement Convertible Bonds." Currently, 29 billion KRW remains outstanding. The conversion price is 15,736 KRW, which is significantly higher than the closing price of 10,700 KRW on the 1st. The company believes that CB holders are likely to request early redemption. Of the funds raised through the rights offering, 29 billion KRW will be reserved as a standby fund for principal and interest repayment. Bondholders can request early redemption starting September 29. Since the bonds were issued at zero (0) interest, no additional interest payments beyond the principal are required.

Based on funds raised through CB issuance, FutureChem completed the establishment of a Good Manufacturing Practice (GMP)-standard radiopharmaceutical production facility at Ewha Womans University Seoul Hospital in Magok District, Gangseo-gu, Seoul. They also established GMP-standard production facilities at Kosin University Gospel Hospital in Busan.

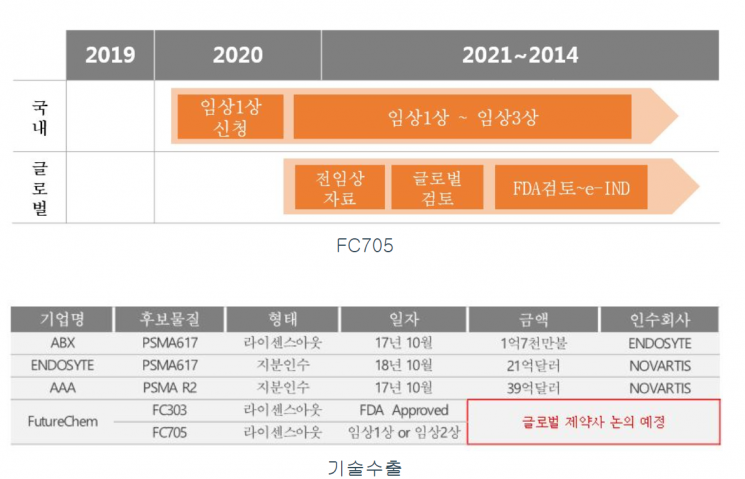

They have also secured clinical trial funding. FutureChem holds FC303, a radiopharmaceutical candidate for prostate cancer diagnosis, and FC705, a candidate for prostate cancer treatment. In June last year, they applied for domestic Phase 1 clinical trials for the prostate diagnostic drug and completed Phase 1 trials in April this year. The U.S. Food and Drug Administration (FDA) approved the Investigational New Drug (IND) application for the Phase 1 clinical trial of ProstaView (FC303), a prostate cancer diagnostic radiopharmaceutical. The Phase 1 IND for the prostate treatment drug was approved by the Ministry of Food and Drug Safety in May. They are preparing to submit an IND application to the U.S. FDA in the second half of this year.

Raising funds through interest-free CB was a good option at the time for future growth. However, as the stock price declined, the burden of early redemption increased.

As of the end of Q1 2020 on a consolidated basis, FutureChem's debt ratio stood at 564.4%. The reliance on borrowings was 69.7%, indicating poor financial stability. Over the past three years, the company has recorded net losses, and the current ratio on a consolidated basis dropped from 1060.6% at the end of 2017 to 88.4% at the end of Q1 this year. The quick ratio worsened from 969.4% at the end of 2017 to 84.9% at the end of Q1.

If the outstanding convertible bonds are repaid through the rights offering followed by a general public offering of forfeited rights, the debt ratio will decrease. However, due to the industry's characteristics and high R&D expenses, continuous losses may require additional fundraising. From last year through the end of last month, FutureChem spent 2.92 billion KRW on research and development of the prostate cancer diagnostic radiopharmaceutical (FC303) and the prostate cancer treatment radiopharmaceutical (FC705).

Although they have not yet covered cost of goods sold and selling and administrative expenses, FutureChem's sales have steadily increased over the past three years. The average cost of goods sold ratio on a consolidated basis was 109.3%. The average selling and administrative expense ratio was also 106.9%. Even if they develop a radiopharmaceutical pipeline, if they fail to turn operating profit positive, the financial structure may continue to deteriorate.

Meanwhile, the largest shareholder, CEO Jae-yoon Ji, holds 9.63% of the shares. Including shares held by related parties, the total stake is 22.64%. CEO Ji plans to participate in the capital increase for 50% of the allocated shares. After the rights offering, the largest shareholder's stake is expected to decrease to 7.72%.

FutureChem will issue 3.8 million new shares through the rights offering, which corresponds to 65.37% of the current 5,812,686 shares outstanding. Since none of the newly issued shares will be subject to lock-up, the large volume of shares released may exert downward pressure on the stock price.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.