Profitability Declines Due to Maximum Interest Rate Reduction

Number of Firms Registered with FSC Decreases at Year-End

Users Fall Below 2 Million for First Time in 9 Years

Private Loan Fraud Reports Surge in April-May

[Asia Economy Reporter Kim Min-young] Loan companies are closing down one after another. Due to the reduction in the maximum interest rate for loan businesses, loan companies with deteriorating profitability are consecutively shutting down or scaling back operations. While the intention to reduce the interest burden on low-income people is good, concerns are rising that a balloon effect is occurring, with low-credit borrowers turning to illegal private loans due to blocked funding sources.

According to financial authorities and the industry as of the second half of last year, the total number of registered loan companies was 8,354, an increase of 44 from 8,310 at the end of the previous year. However, the number of corporate loan companies decreased by 50, from 2,785 to 2,735 during the same period. Only individual loan companies increased by 94.

The number of Financial Services Commission-registered companies with assets exceeding 10 billion KRW also decreased by 145, from 1,500 at the end of 2018 to 1,355 at the end of last year. Meanwhile, the number of companies with less than 10 billion KRW, which report to local governments, increased by 189, from 6,810 to 6,999 during the same period.

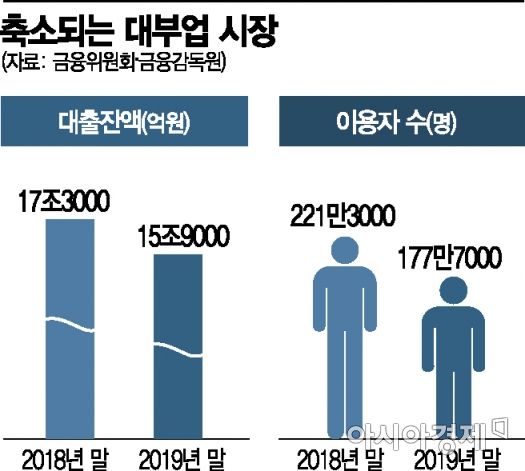

As the large corporations that dominate the market decreased, the total number of loan users also sharply declined. As of the end of last year, the number of users was 1,777,000, down by 436,000 from the previous year. The number of loan users falling below 2 million is the first time in about nine years since June 2010.

Loan balances also shrank. At the end of last year, the balance was 15.9 trillion KRW, a decrease of 1.4 trillion KRW compared to 17.3 trillion KRW at the end of 2018.

The financial authorities and the industry have sharply different views on the contraction of the loan market. The financial authorities cited causes such as the suspension of new loans by the Japanese large loan company Sanwa Money and the scaling back of operations by loan companies that acquired savings banks. On the other hand, the industry views that loan companies are voluntarily closing their businesses due to pressure from financial authorities who regard loan businesses as a 'necessary evil' and the reduction of the legal maximum interest rate to 24% per annum, with a growing possibility of further reduction to 20% under the current government.

Also, while the authorities analyze that low-credit borrowers from the loan market have moved to policy financial products for low-income people and the mid-interest loan market, the industry estimates that more than half of the approximately 400,000 people have flowed into illegal private loans. An industry insider said, “Low-income people who cannot even borrow money from loan companies have no place to go but illegal private loans.”

According to the financial authorities, the number of low-credit borrowers reached 3.53 million at the end of last year. Policy financial products for low-income people such as the Sunshine Loan supplied 8 trillion KRW last year, and new supply of Saetdol loans for low-credit borrowers was only 574.7 billion KRW as of 2018.

Since the beginning of this year, due to the novel coronavirus disease (COVID-19), the low-income economy has become more difficult, showing signs of increased use of illegal private loans. According to the Financial Services Commission, reports of illegal private loan damages increased by more than 50% in April and May compared to the same period last year. While an average of 20 reports were received daily last year, 33 reports were submitted in April and 30 in May this year.

The size of the illegal private loan market is estimated at 7.1 trillion KRW with 410,000 users as of 2018. Being a blind spot, the financial authorities only estimate the scale and have not accurately grasped the actual size or conditions. Especially, as the authorities recently announced a limit of 6% interest that illegal private loan operators can charge, the private loan market is expected to become more underground and expand in the future. A financial sector official said, “Even top-tier loan companies are suspending operations due to the reduction of the maximum interest rate,” and added, “Measures are needed to prevent low-credit borrowers from being driven into the illegal private loan market.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.