Successive Measures Trigger Balloon and Reverse Balloon Effects, Trading Demand Shifts to Seoul

Balloon Effect Within Gangnam Due to Land Transaction Permit System... Apgujeong, Dogok Prices Rise Over 300 Million Won

'Mayongseong' Area, Which Paused Above 1.5 Billion Won, Awakens Again

Concerns Over Supply Shortage Amid Loan Regulations and Stricter Residency Requirements

Possibility of Prolonged Jeonse Crisis... "Measures Have Increased Market Instability"

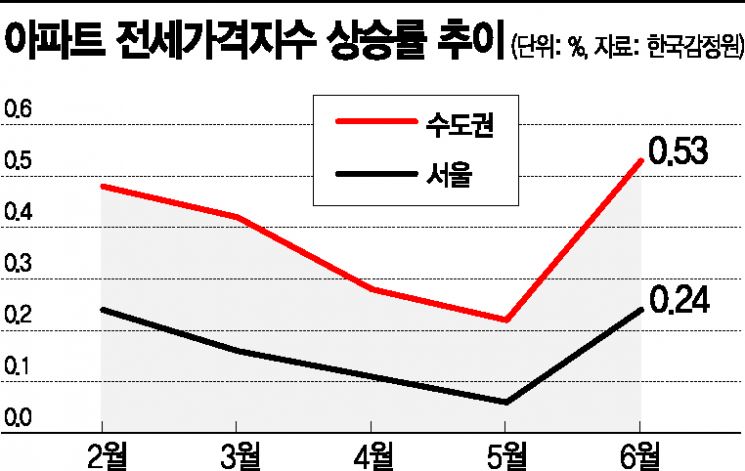

[Asia Economy Reporters Yuri Kim and Mune Won] As the rapid rise in jeonse prices spreads across the Seoul metropolitan area, the previously 'paused' sales prices in the Gangnam area and other parts of Seoul are stirring again due to a 'reverse balloon effect,' prompting increasing calls to revisit the government's real estate policies from the beginning. Since the Moon Jae-in administration took office, it has continuously focused on stabilizing housing prices, issuing more than twenty policy measures, but critics argue that government policies have ultimately exacerbated market failures.

The real estate measures, which began with 'pinpoint regulations' to curb housing prices in Gangnam, subsequently followed the path of the balloon effect, targeting the entire Seoul area, some parts of the metropolitan area, and eventually the entire metropolitan region. The policies were mainly designed to suppress demand. As demand suppression measures were implemented across the metropolitan area, buyers began shifting their attention back to Seoul, including Gangnam. The government even took strong measures by designating areas around major Gangnam development zones such as Jamsil, Samsung, Daechi, and Cheongdam-dong as land transaction permission zones in connection with the June 17 measures, but this immediately triggered a 'balloon effect within Gangnam.'

According to the Seoul Real Estate Information Plaza on the 1st, an 82㎡ unit (buildings 71 and 72) in Hyundai 5th Complex, Apgujeong-dong, Gangnam-gu, changed hands for 2.72 billion KRW (11th floor) on the 24th of last month. This is 320 million KRW higher than the 2.4 billion KRW (10th floor) price in early May. A 114㎡ unit in Dogok Rexle, Dogok-dong, was traded for 3.1 billion KRW (21st floor) on the 26th of last month, up 300 million KRW from 2.9 billion KRW (19th floor) on May 5. The same apartment's 134㎡ unit was sold for 3.35 billion KRW (7th floor) on the 25th of last month, 170 million KRW higher than the 3.18 billion KRW (14th floor) price in April.

Apartments in Mapo, Yongsan, and Seongdong districts (collectively known as Mayongsung) are also showing signs of movement. After the December 16 measures last year, housing mortgage loans for apartments priced over 1.5 billion KRW were blocked, causing these areas to stagnate. However, as prices in Gangnam began to move recently, these regions appear to be following suit. The abundant liquidity in the market is behind this trend. Cash-rich buyers, who can purchase without loans, had been holding back due to the flood of policies and the COVID-19 pandemic but are now moving again. For example, 84㎡ units in Mapo Raemian Prugio, Ahyeon-dong, Mapo-gu, were traded for 1.6 billion KRW on the 11th and 13th of last month (15th floor in Complex 2 and 4th floor in Complex 4, respectively). An 84㎡ unit in Hangaram, Ichon-dong, Yongsan-gu, sold for 1.65 billion KRW on the 6th of last month, and an 84㎡ unit in Seoul Forest Riverview Xi, Haengdang-dong, Seongdong-gu, was traded for 1.6 billion KRW on the 18th of last month.

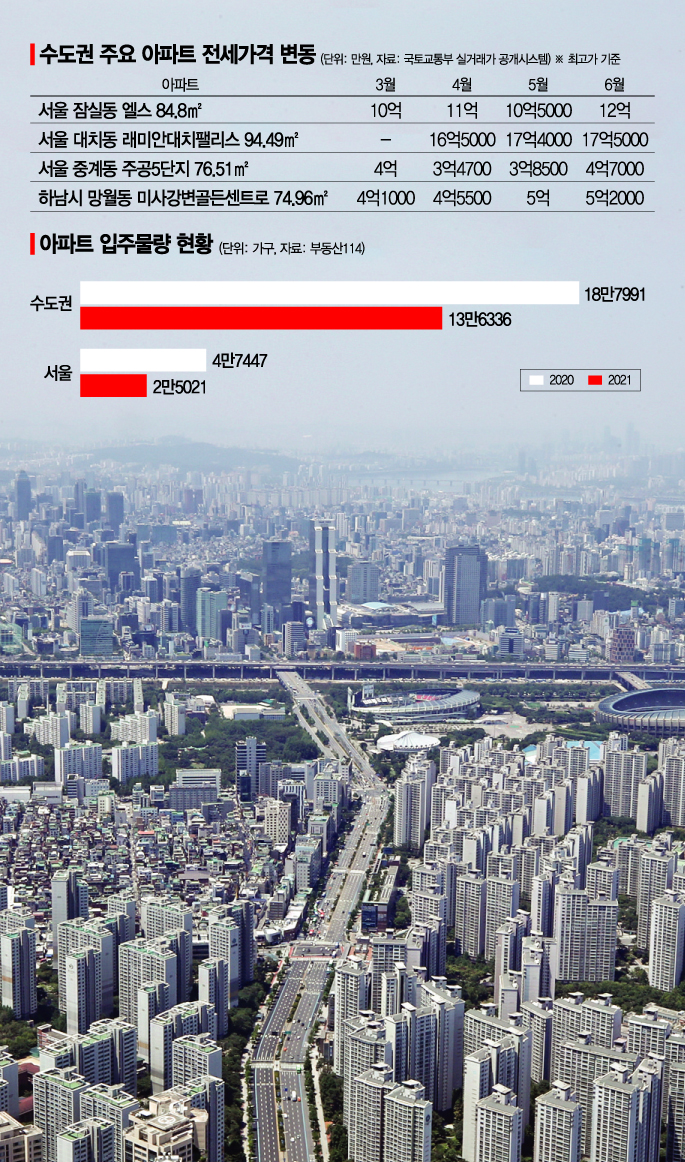

Some voices are even raising concerns about the potential prolongation of this instability. This is due to a combination of factors such as the housing transaction permission system, waiting demand for the 3rd new town and price ceiling subscription, and a decrease in supply. According to Real Estate 114, the number of apartment units scheduled for occupancy in the metropolitan area next year is 136,336, which is more than 50,000 units less than this year's 187,991 units. In particular, the number of apartment units scheduled for occupancy in Seoul next year is expected to sharply decline to 25,021 units, about half of this year's 47,447 units, indicating a worsening supply-demand situation.

Given these circumstances, psychological expectations for mid- to long-term housing price increases are rising. In a survey conducted by Realmeter of 500 adults nationwide, 40.9% of respondents believed that housing prices at the end of the current administration's term would be higher than now. Those who expected little change accounted for 29.4%, and only 17.1% thought prices would fall. Especially, 50.3% expected Seoul housing prices to rise, exceeding half. The same applies to jeonse prices. According to a survey conducted by Real Estate 114 from the 1st to the 15th of last month among 102 experts on the '2020 Second Half Housing Market Outlook,' 76.47% predicted jeonse price increases, while only 4.9% (5 experts) expected declines.

Ultimately, the ones suffering are the actual homebuyers. With soaring housing prices and tightened loan restrictions, they have chosen to wait, but as jeonse prices also fluctuate, their anxiety grows. Eunhyung Lee, a senior researcher at the Korea Institute of Construction Policy, said, "Although the government has been issuing measures one after another, since housing prices are not falling and jeonse listings are decreasing, this trend is expected to continue for the time being." Professor Kyowon Shim of Konkuk University's Department of Real Estate said, "Government policies are rather increasing market instability. The focus on controlling short-term prices has led to policies that could become factors for price increases in the long term. Policies should work in a way that eases the burden on actual buyers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)