Impact on Compensation for Suspended Repurchase Funds Due to Contract Cancellation from Core Information Misrepresentation

Effects on Fund Repurchase Suspension Compensation

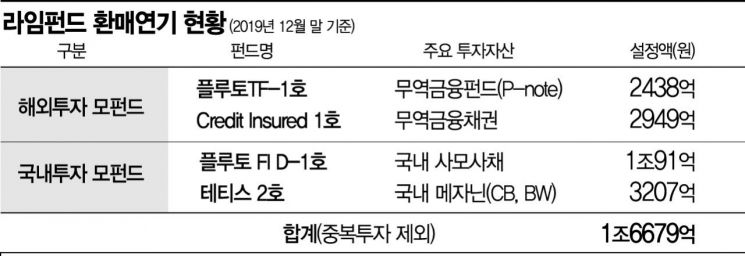

[Asia Economy Reporter Ji-hwan Park] The Financial Supervisory Service's Dispute Mediation Committee decided on a higher compensation rate for the Lime Trade Finance Fund than previous dispute mediation cases, based on the judgment that Lime Asset Management and the distributors continued to sell the fund while deceiving investors about key information such as returns and investment risks, despite being aware of the fund's insolvency in advance. This constitutes grounds for contract cancellation under civil law. Attention is also focused on how this contract cancellation decision for the Trade Finance Fund will affect compensation for damages in other recent private equity fund cases.

Until now, the usual compensation rate by the FSS Dispute Mediation Committee ranged from 20% to 50%. However, in cases where the financial companies' fault was clear in terms of product sales appropriateness, suitability, or unfair solicitation, higher responsibility was assigned. A representative case is the 80% compensation rate decision made by the overseas interest rate-linked derivative-linked product (DLF) mediation committee on December 1 last year. At that time, a recommendation was made to compensate 80% of the loss for a '79-year-old dementia patient with no investment experience and hearing impairment,' which was the highest compensation rate ever until then. In 2014, the maximum compensation rate of 70% was recommended during the Dongyang Group fraudulent commercial paper (CP) incomplete sales incident. On December 12 last year, the KIKO mediation committee recognized incomplete sales responsibility for six banks that sold the product and recommended compensation of 15% to 41% of the loss.

The FSS judged that in the case of this Trade Finance Fund, Lime Asset Management and Shinhan Financial Investment continued to sell the fund by changing the management method to conceal the insolvency even after recognizing the fund's deterioration. In actual damage cases, signs of moral hazard by Lime Asset Management and distributors have been gradually revealed.

Victims suffered significant damage due to Lime Asset Management's false investment proposal documents and sales staff arbitrarily recording investor profiles. Mrs. A, a housewife in her 70s, joined the Trade Finance Fund when already 83% of the principal was impaired. However, the bank staff explained and handed over the investment proposal documents that Lime Asset Management had falsely and inaccurately prepared, and arbitrarily recorded Mrs. A's investor profile as aggressive despite her lack of investment experience.

Mr. B, a worker in his 50s, visited the bank in July last year requesting a safe product that could be managed for one year, but the bank staff recommended investing in the Trade Finance Fund, claiming it was safe because it was insured, despite signs of insolvency already being apparent.

There is growing interest in how this mediation committee decision will affect compensation for damages in other private equity fund cases in the future. Above all, if illegal acts by asset managers and distributors are confirmed, the likelihood of siding with victims has increased. However, the compensation rate may vary depending on the timing and extent of the damage, such as prior notice, different investments, and the timing of insolvency occurrence.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.