[Asia Economy Reporter Oh Hyung-gil] The Risk-Based Capital (RBC) ratio, an indicator of the financial soundness of insurance companies, declined in the first quarter.

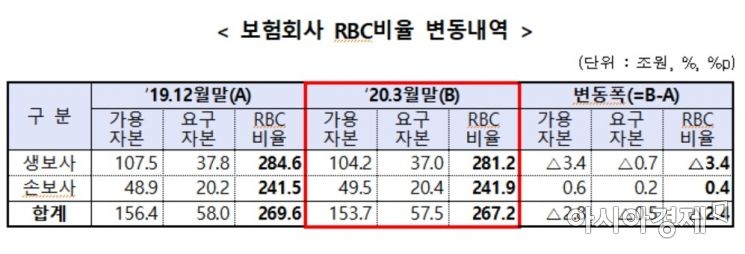

According to the Financial Supervisory Service on the 1st, the RBC ratio of insurance companies at the end of March was 267.2%, down 2.4 percentage points from 269.6% at the end of last year. The RBC ratio is the value obtained by dividing available capital by required capital and is an indicator used to measure the financial soundness of insurance companies. Available capital is the amount of capital that can cover losses caused by various risks faced by insurance companies, while required capital is the amount of loss expected if various inherent risks in insurance companies materialize.

The Insurance Business Act stipulates that the RBC ratio must exceed 100%. The Financial Supervisory Service's recommended level is 150%.

Due to the stock price decline in the first quarter caused by the COVID-19 pandemic and other factors, other comprehensive income decreased, resulting in a 2.8 trillion KRW reduction in available capital. Although credit and market risk amounts increased by 500 billion KRW due to an increase in operating assets, required capital decreased by 500 billion KRW due to a reduction in interest rate risk following the abolition of the interest rate reversal margin risk.

Among life insurance companies, Kyobo Life experienced the largest drop in RBC ratio by 55.5 percentage points, but its ratio remained high at 249.8%. In the case of non-life insurance companies, MG Non-Life Insurance (104.3%) and Hana Non-Life Insurance (128.3%) fell below the Financial Supervisory Service's recommended level of 150%.

A Financial Supervisory Service official stated, "The RBC ratio of insurance companies significantly exceeds the 100% standard required to fulfill insurance payment obligations," adding, "If concerns arise regarding weak RBC ratios, we plan to strengthen crisis situation analysis and capital expansion to proactively enhance financial soundness through supervision."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.