[Asia Economy Reporter Onyu Lim] The rental price index for medium-to-large commercial properties in Seoul, which had been rising for 10 consecutive quarters, declined in the first quarter of this year due to the impact of the novel coronavirus disease (COVID-19). The commercial districts with a high proportion of floating population, such as Apgujeong and Gangnam-daero, were particularly hard hit. However, there was almost no change in vacancy rates.

According to the 'Recent Trends and Implications of Seoul Commercial Real Estate' report by Woori Financial Management Research Institute on the 30th, the rental price index fell in all 50 commercial districts in Seoul during the first quarter. The rental price index refers to the rental market price that new tenants must bear at the time of the survey, not the rent paid by existing stores.

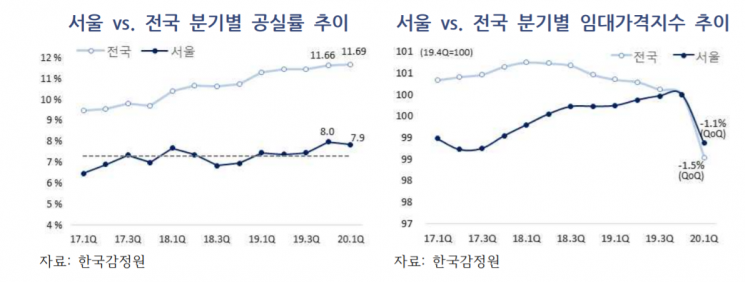

By area size, the rental price index for medium-to-large commercial properties and small-scale commercial properties fell by 1.1 and 1.6 points respectively compared to the previous quarter. In particular, the rental price index for medium-to-large commercial properties had shown a gradual upward trend, rising for 10 consecutive quarters from the second quarter of 2017 to the fourth quarter of last year, before declining. Woori Financial Management Research Institute analyzed, "Commercial real estate often uses promotions such as rent-free periods and management fee support, so rent fluctuations are not significant and tend to lag behind vacancy rates, but the special situation of tenants' sales plummeting due to the COVID-19 shock seems to be reflected."

Regarding vacancy rates, there was little change regardless of the size of the commercial properties. The vacancy rate for medium-to-large commercial properties was 7.9%, which was 0.1 percentage points lower than the previous quarter. The vacancy rate for small-scale commercial properties was 4.0%, 0.1 percentage points higher than the previous quarter.

There were differences among commercial districts depending on the distribution of floating and fixed populations. In the first quarter, areas with a large floating population such as Apgujeong (7.4% → 14.7%) and Namdaemun (5.6% → 8.2%) saw a significant increase in vacancy rates. Woori Financial Management Research Institute explained, "Although vacancies decreased compared to the previous peak when vacancy rates approached 20% due to long-term rent declines in Apgujeong and Nonhyeon Station, vacancy rates remained high at over 10%."

On the other hand, vacancies decreased in areas such as Sillim Station, Suyu, Kyung Hee University, and Wangsimni. Woori Financial Management Research Institute explained, "These are commercial districts with both floating population and surrounding residential demand coexisting, resulting in stable store sales, low vacancies, and rents lower than the Seoul average, making them 'cost-effective' commercial districts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)