[Asia Economy Reporter Hwang Yoon-joo] On the first anniversary of Japan's export restrictions, there have been calls to prepare for additional Japanese export controls, focusing on non-sensitive strategic items with high import dependence on Japan such as basic hydrocarbons, semiconductor manufacturing equipment, and plastic products.

According to the report "One Year of Japan's Export Restrictions: Import Trends of Regulated Items and Review of Non-Sensitive Strategic Items Dependent on Japan," released on the 30th by the Korea International Trade Association's Institute for International Trade and Commerce, the non-sensitive strategic items designated by the Japanese government are mainly concentrated in basic materials such as semiconductor and display manufacturing equipment, basic hydrocarbons, and plastic products, with most of these items having an import dependence on Japan of 80-90%.

Non-sensitive strategic items are those for which Japan significantly strengthened export screening after excluding Korea from its white list through a legal amendment last year. Since higher dependence on Japan makes these items more vulnerable to export restrictions, it is pointed out that preemptive measures are necessary.

The report stated, "Among non-sensitive strategic items, 100 items were selected based on HS codes that had imports exceeding 1 million USD from Japan and an import dependence on Japan of over 70%. Of these, 56.7% were concentrated in the top three item groups, including semiconductor and display manufacturing equipment and basic materials." It also pointed out that "the dependence on Japan for basic hydrocarbons reached 94.8%, semiconductor manufacturing equipment 86.8%, plastic products 83.3%, and photographic film materials 89.7%."

Currently, for non-sensitive strategic items, since Japan has excluded Korea from its white list, exports are only possible under limited conditions such as individual permits or through companies participating in the voluntary compliance program (ICP) using special general licenses. Compared to before the export restrictions, when general licenses allowed easy and fast export and import, the institutional barriers remain high.

The report analyzed, "Considering that items directly subjected to export restrictions over the past year, such as photoresists, hydrogen fluoride, and fluorinated polyimide, all fall under non-sensitive strategic items, it is highly likely that non-sensitive strategic items will be targeted if Japan implements additional export restrictions."

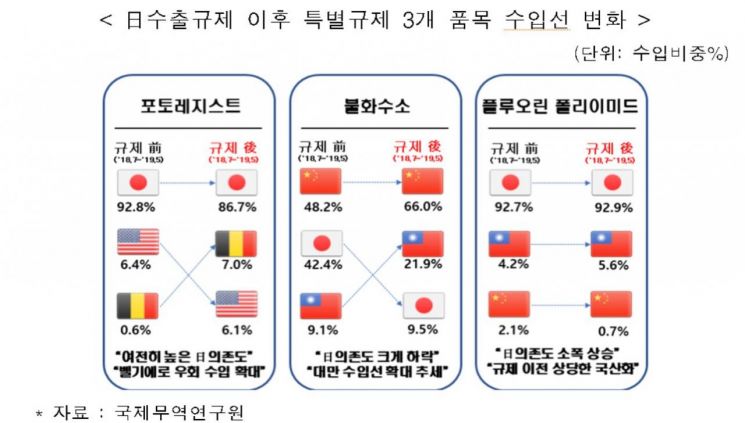

Meanwhile, an analysis of customs import performance for the three restricted items over the past year showed that the import dependence on Japan for photoresists and hydrogen fluoride decreased by 6 percentage points and 33 percentage points, respectively, with import sources diversifying to Belgium and Taiwan. For fluorinated polyimide, the import dependence on Japan remained above 90% before and after the export restrictions, but since domestic production had already progressed significantly compared to other regulated items before the restrictions, direct import disruptions were analyzed to be limited.

Hong Ji-sang, a research fellow at the Korea International Trade Association, said, "Contrary to initial concerns, due to comprehensive efforts by our companies and government to localize regulated items and diversify imports, the domestic supply disruptions that Japan aimed for did not actually occur." He emphasized, "However, since there are unusual movements such as Japan mentioning the possibility of additional restrictions in response to Korea's WTO complaint and the liquidation of Japanese wartime companies' assets, we must closely monitor the situation based on the experience of the past year and prepare for supply chain uncertainties."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)