[Asia Economy Reporter Choi Dong-hyun] As the government's real estate regulations become increasingly stringent, homebuyers and experts generally put more weight on the expectation that housing prices will eventually rise in the second half of this year.

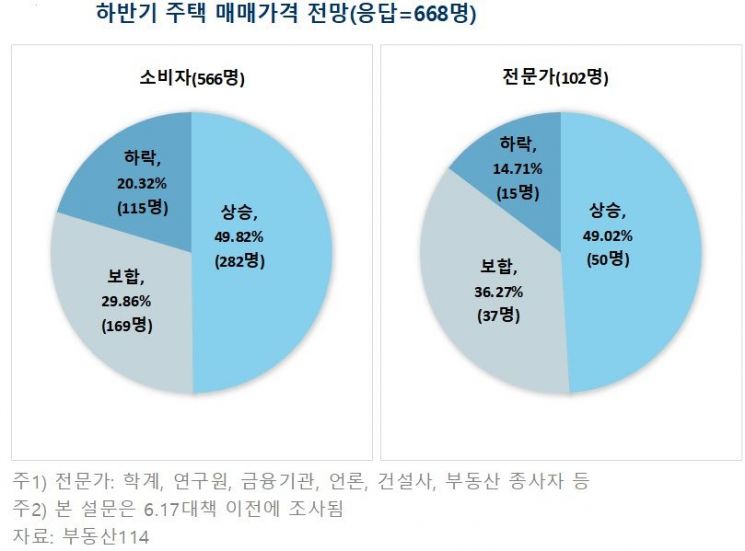

On the 24th, Real Estate 114 conducted a survey titled '2020 Second Half Housing Market Outlook' from the 1st to the 15th of this month, targeting 668 people nationwide (566 homebuyers and 102 experts). The results showed that 49% of respondents expected sales prices to rise. In contrast, those anticipating a decline accounted for only 14% to 20%. In particular, real estate experts (including academia, research institutes, financial institutions, construction companies, and real estate professionals) judged the possibility of price drops to be even lower. This is interpreted as the upward trend in housing prices not being broken despite the government's strengthened real estate regulations.

The majority of responses expecting sales price increases cited 'Rising apartment prices in Seoul and the metropolitan area (43.07%)'. This is attributed to price increases in Seoul and the nearby Gyeonggi and Incheon regions during the first half of the year. The next highest response was 'Influx of demand to less expensive areas due to a balloon effect (27.11%)'. Due to government loan regulations, there has been steady buying demand in areas densely populated with mid- to low-priced apartments. Additionally, factors such as ▲ Intensified supply shortage in downtown Seoul (10.84%) and ▲ Revitalization of the apartment pre-sale market (9.04%) were also selected as reasons for housing price increases.

Meanwhile, among respondents who predicted a decline in sales prices, 57.69% cited the 'Possibility of an economic recession caused by COVID-19'. Since the outbreak of the novel coronavirus disease (COVID-19) in the first half of the year, both domestic and global economic growth rates have turned negative, raising concerns about a downturn in the real economy, including real estate. Other reasons for price declines included ▲ Weakening buying demand due to loan regulations (13.08%), ▲ Lack of transaction volume due to price burdens (10.77%), and ▲ Increase in selling volume due to tax burdens (9.23%), in that order.

Regarding the outlook for jeonse (long-term lease) prices in the second half, 63.96% of consumers and 76.47% of experts overwhelmingly expected prices to rise. Factors likely to stimulate jeonse prices include a probable decrease in new apartment move-in volumes, the government's implementation of the three lease laws such as the Jeonse and monthly rent cap system, the extension of mandatory residency periods for subscription eligibility, and the reduction of benefits for rental business operators. Only about one in ten respondents (9.54% of consumers and 4.90% of experts) expected jeonse prices to fall.

Among the 440 respondents who expected jeonse prices to rise, 45.68% answered that increased jeonse demand is due to weakened buying sentiment. As housing prices rise in Seoul and the metropolitan area, and loan regulations have been significantly tightened through the designation of adjustment target areas and speculative overheating districts, even genuine buyers find it difficult to actively purchase homes. Additionally, 20.45% cited 'Lack of move-in volumes in some popular areas such as Seoul'. Move-in volumes are expected to decrease in the second half compared to the first half, with further reductions anticipated in 2021.

The main reason selected for the expectation of jeonse price declines was 'Increase in jeonse listings due to past gap investments (40.68%)'. As the use of jeonse as leverage in housing transactions has increased nationwide, landlords with limited financial capacity are expected to continue releasing jeonse-type listings rather than monthly rent. However, since the government has launched extensive regulations on gap investments following the June 17 real estate measures, it is unlikely that gap investment-driven jeonse listings will increase in the second half.

Yoon Ji-hae, Senior Researcher at Real Estate 114, said, "Despite the economic downturn caused by COVID-19 and the government's real estate regulations, both consumers and experts are highly optimistic about the possibility of price increases." She added, "Due to the impact of the December 16 and June 17 measures, the rate of increase in areas densely populated with high-priced homes and speculative overheating districts is expected to slow compared to the past. However, the balloon effect centered on adjustment target areas and non-regulated areas with fewer restrictions is likely to continue." She further predicted, "Especially with the historically low interest rates leading to an influx of liquidity into the real estate market, the phenomenon of 'regional price leveling' centered on mid- to low-priced homes in the metropolitan area is expected to continue in the second half."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.