"Government Should Increase Pressure on Countries Introducing Their Own Digital Services Tax at OECD and Others"

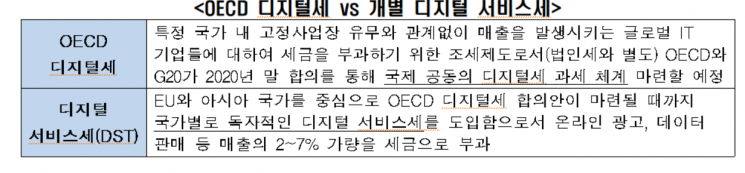

[Asia Economy Reporter Ki-min Lee] As discussions within the Organisation for Economic Co-operation and Development (OECD) on the so-called 'digital tax,' also known as the 'Google tax,' have stalled, individual countries are introducing their own digital taxes called 'Digital Services Tax (DST).' This is expected to increase the tax burden on domestic digital companies.

The Federation of Korean Industries (FKI) announced on the 24th that it shared the latest trends in OECD digital tax discussions and the movements of various countries during a confidential annual meeting with the Korea Committee of the Business and Industry Advisory Committee (BIAC) under the OECD.

The OECD is promoting the introduction of a digital tax that grants taxing rights to the country where revenue is generated, even for global IT companies without a physical presence. Google is considered a target company for the digital tax, hence the nickname 'Google tax.' Although the OECD aims to establish digital tax guidelines by the end of this year, the interests of member countries remain sharply divided. Therefore, even if an agreement is reached, it is predicted that it will take about four to five years to implement.

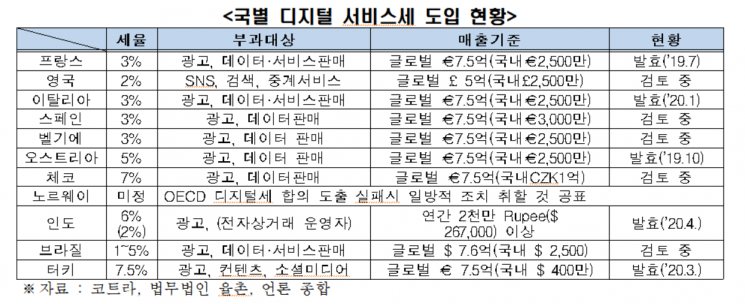

Meanwhile, the number of countries independently introducing DST is increasing. Since France enacted DST in July last year, Western European countries have been considering implementing DST at rates of around 2-3%. Particularly, Eastern European countries such as Austria and the Czech Republic are pursuing high-rate DSTs of about 5-7%. Asian countries including India, Indonesia, Thailand, and Vietnam have either introduced or plan to introduce DST or similar withholding taxes.

Experts express concerns that the DSTs introduced by countries worldwide could increase the tax burden on Korean companies, potentially disrupting their business activities.

Yoon Kim, Chair of the BIAC Korea Committee, emphasized in the opening remarks of the meeting, “As businesspeople, the most concerning issue regarding various transitional digital taxes during the shift to a digital economy is the problem of double taxation.”

Dr. Kyung-geun Lee, active in BIAC’s tax policy group, also pointed out that the introduction of DSTs worldwide raises a high possibility of double taxation becoming a reality. Since DST is a sales tax rather than a corporate tax, it is difficult to receive foreign tax credit recognition within Korea. Dr. Lee further stated, “Unilateral DSTs imposed by foreign countries are not subject to tax treaties, so even if they are treated as corporate taxes abroad, the likelihood of applying foreign tax credits domestically is slim.”

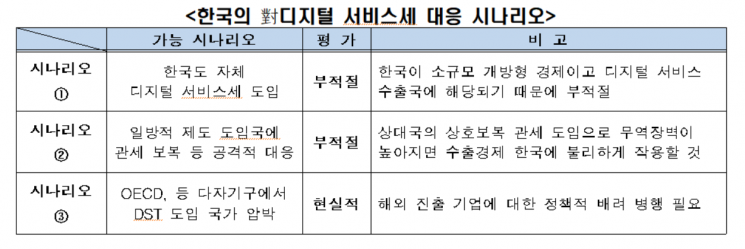

Experts view proactive government response to the digital tax as the most practical solution. Dr. Lee argued that the government should actively engage in multilateral organizations like the OECD and increase pressure on countries that unilaterally introduce DST. He also emphasized the need for policy considerations such as expanding tax credits to alleviate the tax burden on Korean companies operating overseas.

Bong-man Kim, Director of International Cooperation at FKI, said, “There is a possibility that the OECD’s international joint digital tax could expand to global consumer-facing companies like Samsung and Hyundai Motor.” He added, “Alongside responding to digital taxes imposed by individual countries, the government needs to continuously strive through various multilateral organizations and channels to limit the OECD digital tax’s scope to digital companies.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)