Household Loan Balance at Banks Reaches 920.7 Trillion Won as of May... Increase in Mortgage Loans

[Asia Economy Reporter Jang Sehee] It has been found that household and corporate debt in South Korea is growing faster than in many other countries around the world. If the COVID-19 pandemic prolongs, household and corporate loans are expected to increase even further.

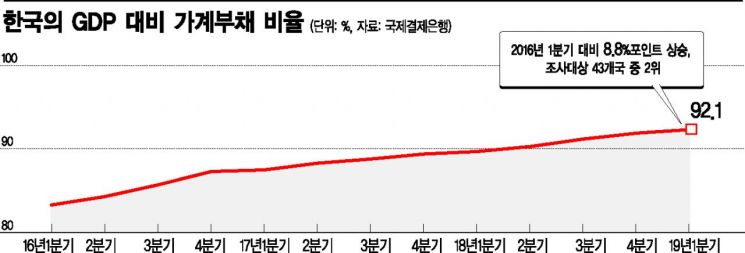

According to the Bank for International Settlements (BIS) as of the fourth quarter of last year, South Korea's household credit-to-GDP ratio was 95.5%, up 1.6 percentage points from the previous quarter (93.9%).

South Korea's increase in household credit-to-GDP ratio ranked first alongside Hong Kong. Following them were Norway (1.0%p), China (0.8%p), Belgium (0.8%p), Thailand (0.6%p), Russia (0.6%p), Brazil (0.6%p), and France (0.5%p), showing rapid growth rates.

Compared to the fourth quarter of 2018, South Korea's one-year increase (3.6%p) was the fourth largest in the world, following Hong Kong (8.3%p), Norway (4.6%p), and China (3.7%p).

In terms of absolute levels, South Korea's household credit-to-GDP ratio (95.5%) ranked seventh after Switzerland (132%), Australia (119.5%), Denmark (111.7%), Norway (104.8%), Canada (101.3%), and the Netherlands (99.8%).

As of the fourth quarter of last year, South Korea's private credit (household + corporate) to GDP ratio was 197.6% (household 95.5 + corporate 102.1), up 2.6 percentage points from the previous quarter. Among 43 countries, this was the third fastest increase after Singapore (7.2%p) and Chile (3.1%p).

The increase compared to the fourth quarter of 2018 (10.0%p) was also third, with only Hong Kong (13.8%p) and Chile (11.1%p) ahead of South Korea. Moreover, this year, it is expected for the first time that the private credit-to-GDP ratio will exceed 200%. This means that the amount of debt held by households and corporations surpasses twice the annual value added created by South Korea's economic agents (households, corporations, and government).

According to the Bank of Korea's 'Financial Market Trends' report, as of May this year, the outstanding household loans at banks amounted to 920.7 trillion won, increasing by 32.4 trillion won this year alone, including 27.2 trillion won in mortgage loans. At the same time, the outstanding corporate loans at banks (945.1 trillion won) were 76.2 trillion won higher than at the end of last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.