Stock Market Stagnates This Month Amid COVID Resurgence and North Korea Issues

Individuals Net Buy Inverse ETFs... Purchased 469.2 Billion KRW of Gopverse

Institutions Take Opposite View... Bought 416.9 Billion KRW of KODEX Leverage

[Asia Economy Reporter Song Hwajeong] In June, amid concerns over the second wave of the novel coronavirus infection (COVID-19) and North Korea-related issues causing the stock market to remain sluggish, individuals and institutions appear to have differing outlooks on the future market. Individuals have been buying inverse exchange-traded funds (ETFs) this month, betting on a decline, while institutions have been purchasing leveraged ETFs, anticipating an index rise.

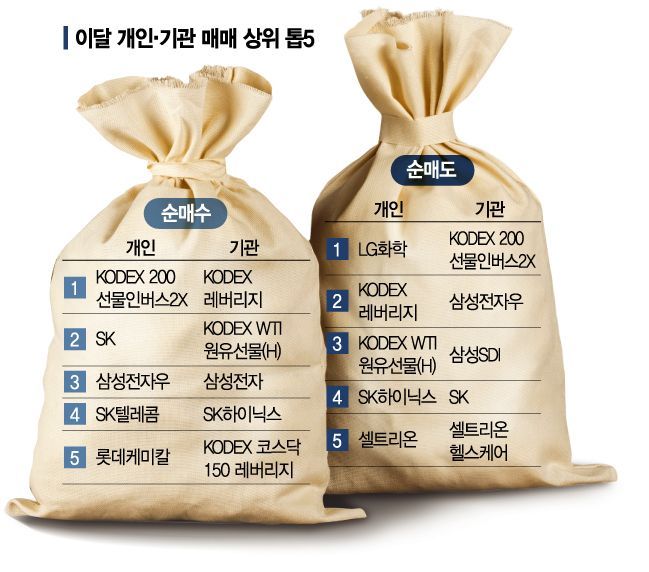

According to the Korea Exchange on the 19th, individuals have bought KODEX 200 Futures Inverse 2X worth 469.2 billion KRW so far this month, making it their largest purchase. Individuals also net bought KODEX Inverse by 86.1 billion KRW. Conversely, they sold KODEX Leverage by 407.5 billion KRW and KODEX KOSDAQ150 Leverage by 155.3 billion KRW.

Institutions showed the exact opposite movement. Institutions net bought KODEX Leverage by 416.9 billion KRW this month, making it their largest purchase. They also net bought KODEX KOSDAQ150 Leverage by 206.1 billion KRW. On the other hand, they sold KODEX 200 Futures Inverse 2X, which individuals bought the most, by 492.3 billion KRW, ranking it first in net sales. They also sold KODEX Inverse by 96.5 billion KRW.

Go Kyungbeom, a researcher at Yuanta Securities, analyzed, "The index adjustment since the 12th has stimulated inflows into futures inverse leverage ETFs, which had been in a lull," adding, "The cumulative net purchase amount of KOSPI 200 Futures Inverse Leverage ETFs since April has increased to 1.84 trillion KRW." He further explained, "The concentration of KOSPI 200 ETF trading like this is due to high speculative demand for the double decline effect commonly called 'Gopbus'."

The contrasting ETF trades between individuals and institutions reveal their differing perspectives on future market outlooks. Inverse ETFs are designed to generate profits when the underlying asset declines, serving as a means to defend returns in a bear market. Conversely, leveraged ETFs are designed to yield twice the returns when the underlying asset rises. Individuals appear to be betting on further declines as the index adjusts in June, while institutions are betting on a rise.

The market is expected to continue its adjustment for the time being. The KOSPI has risen 6.76% over the past month but fell 1.99% in the past week. The KOSDAQ also rose 2.98% over the month but dropped 2.61% weekly.

Moon Namjung, a researcher at Daishin Securities, said, "The stock market decline since mid-June is narrowing the gap between overheated stock prices and weak real economy indicators, while also making investors pay more attention to negative rather than positive news," adding, "This healthy adjustment, which lowers price burdens, is progressing to achieve better performance in the future."

Roh Donggil, a researcher at NH Investment & Securities, analyzed, "Concerns over a second wave of COVID-19 and noise around additional U.S. stimulus measures are burdens on the KOSPI, and the re-emerged geopolitical risks on the Korean Peninsula could also affect the stock market," adding, "While the geopolitical risks on the Korean Peninsula are a cautionary factor due to the possibility of further provocations by North Korea, they have not yet significantly impacted the domestic financial market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)