[Asia Economy Reporter Park Jihwan] Securities firms received a dismal report card in the first quarter of this year, with profits dropping by more than 50% compared to the previous quarter. This is attributed to the significant decline in profits and losses related to stocks, funds, and derivatives due to the impact of the novel coronavirus disease (COVID-19).

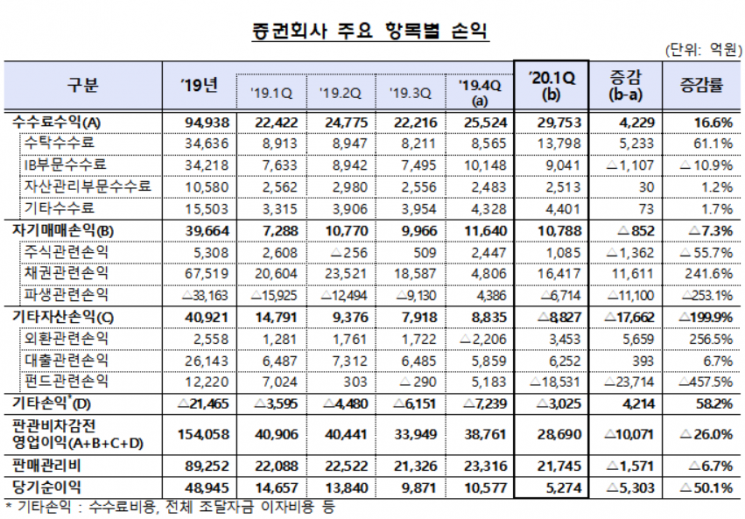

According to the "2020 Q1 Securities and Futures Companies Business Performance (Preliminary)" report released by the Financial Supervisory Service on the 16th, the net profit of 56 domestic securities firms in the first quarter was 527.4 billion KRW, a decrease of 530.3 billion KRW (50.1%) compared to 1.0577 trillion KRW in the previous quarter. Despite a decrease of 85.2 billion KRW and 1.7662 trillion KRW in proprietary trading profits and other asset profits respectively, fee income increased by 422.9 billion KRW compared to the previous quarter, partially offsetting the decline in net profit.

First, fee income in the first quarter was 2.9753 trillion KRW, an increase of 422.9 billion KRW (16.6%) compared to the previous quarter. The increase was largely due to the rise in brokerage fees, which recorded 1.3798 trillion KRW, driven by increased stock market trading volume. This figure rose by 523.3 billion KRW (61.1%) compared to 856.5 billion KRW in the previous quarter. However, fee income from the investment banking (IB) sector decreased by 110.7 billion KRW (10.9%) compared to the previous quarter.

Proprietary trading profits were 1.0788 trillion KRW, down 85.2 billion KRW (7.3%) from the previous quarter. Stock-related profits were 108.5 billion KRW, a decrease of 136.2 billion KRW compared to the previous quarter. The Financial Supervisory Service explained that this was due to a decline in stock disposal profits caused by a sharp drop in the index compared to the previous quarter.

Bond-related profits were 1.6417 trillion KRW, an increase of 1.1611 trillion KRW compared to the previous quarter. This is analyzed to be due to increased bond valuation gains following the downward trend in interest rates. Derivatives-related losses were 671.4 billion KRW, a decrease of 1.11 trillion KRW compared to the previous quarter.

Other asset losses amounted to 882.7 billion KRW, a decrease of 1.7662 trillion KRW (199.9%) compared to the previous quarter. This was due to a sharp increase in losses related to funds linked to stock indices, which recorded a loss of 1.8531 trillion KRW, up 2.3714 trillion KRW from the previous quarter.

At the end of the first quarter, the total assets of all securities firms stood at 578.2 trillion KRW, an increase of 95.3 trillion KRW (19.7%) compared to 482.9 trillion KRW at the end of the previous quarter. Equity capital was 61.6 trillion KRW, a decrease of 200 billion KRW compared to 61.8 trillion KRW at the end of the previous quarter.

During the first quarter of this year, the net profit of all four futures companies was 11.6 billion KRW, an increase of 7.3 billion KRW compared to 4.3 billion KRW in the previous quarter.

A Financial Supervisory Service official stated, "Uncertainties such as the impact of COVID-19 still persist domestically and internationally," adding, "We plan to closely monitor the effects of potential domestic and international risk factors, including the domestic and foreign stock markets, on profits and soundness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)