CEPR "Korea's Unlimited RP Purchase Announcement, Long-term Government Bond Yield Effect -0.17%P"

Bank of Korea's Unlimited RP Purchase Deadline at Month-End... Extension Decision by Month-End

[Asia Economy Reporter Kim Eunbyeol] As the spread of the novel coronavirus infection (COVID-19) triggered quantitative easing (QE) measures by central banks worldwide, it has been found that the long-term government bond yield reduction effect from QE was greater in emerging markets than in advanced countries. If the full allotment repurchase agreement (RP) purchase announced by the Bank of Korea in March is classified as a type of QE, its effect on lowering long-term government bond yields was greater than that of countries like Japan. This is because market participants evaluated the QE measures as 'fresh.'

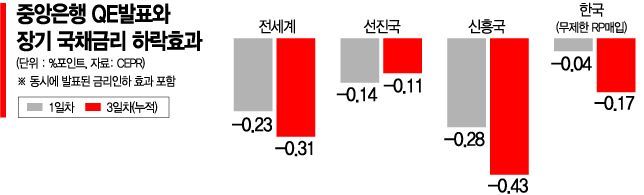

According to the 'Case Study on Central Bank QE in Advanced and Emerging Countries during COVID-19' report released on the 16th by the Centre for Economic Policy Research (CEPR), the QE measures implemented by central banks worldwide due to COVID-19 lowered the 10-year government bond yields of each country by about 0.23 percentage points in just one day. This reflects the effect including simultaneous base rate cuts. Excluding the rate cut measures, the QE effect was about -0.17 percentage points.

The impact after QE announcements was significantly greater in emerging markets than in advanced countries. In emerging markets, the 10-year government bond yields fell by an average of 0.28 percentage points on the day of the QE announcement, whereas in advanced countries, the effect was only -0.14 percentage points. Analyzing the cumulative effect over three days after the QE announcement, emerging markets saw a 0.43 percentage point drop in bond yields, while advanced countries experienced a 0.11 percentage point decrease. This means the QE effect in emerging markets was nearly four times greater than in advanced countries.

Jonathan Hartley, the analyst who authored the report, explained, "In many emerging markets, QE measures were introduced for the first time in response to unprecedented circumstances," adding, "As a result, market reactions were much stronger compared to advanced countries." He also noted, "Although 10-year government bond yields worldwide surged sharply in mid-March, they effectively declined after QE measures, indicating their effectiveness."

In Korea’s case, the full allotment RP purchase measure announced by the Bank of Korea on March 26, i.e., unlimited liquidity supply, was categorized as QE. At that time, Bank of Korea Deputy Governor Yoon Myun-sik even described it as "virtually quantitative easing." The report stated that on the day the Bank of Korea announced the RP purchase measure, the 10-year government bond yield fell by 0.04 percentage points. The cumulative effect over three days after the announcement was a 0.17 percentage point decline in bond yields. This was greater than the Bank of Japan’s (BOJ) bond yield reduction effect (-0.03 percentage points) during the same period.

However, this is interpreted not as the RP purchase itself directly lowering long-term bond yields, but rather as a message that "liquidity can be supplied unlimitedly in emergencies," which maximized the effect of previously implemented base rate cuts. Korea’s QE measure did not involve direct government bond purchases but was intended to support securities firms that faced liquidity shortages due to financial market shocks. Analyst Hartley said, "It is noteworthy that central banks announced QE measures while significantly cutting base rates," adding, "This is also a forward guidance signal indicating that base rates will be kept low for an extended period." When QE measures accompany base rate cuts, the market impact can be greater.

Meanwhile, the unlimited RP purchase measure announced by the Bank of Korea is set to end on the 30th of this month. Currently, the Bank of Korea is reviewing the impact of COVID-19 and market trajectories after July to decide whether to extend the unlimited RP purchase measure. They are also investigating how financial institutions such as securities firms that received liquidity from the Bank of Korea have used the funds.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.