Economic Recovery Impossible Within the Year if COVID-19 Resurges

"Speed of 3rd Supplementary Budget Approval in National Assembly Crucial for H2 Korean Economic Recovery"

[Asia Economy Reporter Kim Hyewon] Amid the COVID-19 pandemic, there is a relatively high likelihood that the South Korean economy will form a bottom in the second quarter and exhibit a gently rising 'asymmetric U-shaped recovery' trend. It is forecasted that South Korea's economic growth rate this year will follow a growth path of lower in the first half (-0.9%) and higher in the second half (1.4%), resulting in an overall 0.3% growth.

However, the direction of the Korean economy depends on factors such as the strength of consumer sentiment recovery, the content and timing of the third supplementary budget (third supplementary budget), the timing of lifting global lockdown measures, the speed of economic improvement in China, and the possibility of a second US-China trade war. In particular, the direction of the economy in the second half will be decisively determined by the promptness of the third supplementary budget, which has a growth rate enhancement effect. It was also pointed out that if the passage of the supplementary budget bill in the National Assembly or the execution timing of the supplementary budget is delayed, the effect of fiscal policy will sharply decrease.

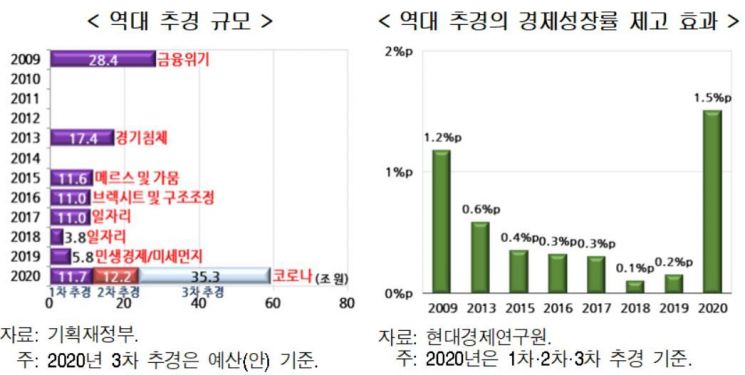

On the 7th, Hyundai Research Institute revealed this in its economic weekly report titled 'Active Economic Stimulus Efforts Needed for Successful Rebound in the Second Half,' estimating that if the third supplementary budget is about 35.3 trillion won, the combined effect of the first, second, and third supplementary budgets would raise the economic growth rate by 1.51 percentage points (with the third supplementary budget contributing 0.90 percentage points). The first and second supplementary budgets (about 24 trillion won) are evaluated to have raised this year's economic growth rate by 0.61 percentage points, providing a certain degree of economic defense effect, but the timeliness of the third supplementary budget will determine the economic direction.

Joo Won, head of the Economic Research Department at Hyundai Research Institute, said, "The combined approximately 59 trillion won from the first to third supplementary budgets will have the effect of increasing this year's economic growth rate by up to 1.5 percentage points," adding, "The direction of the economy in the second half is expected to be decisively influenced by the promptness of the third supplementary budget, so the time it takes for the supplementary budget bill to pass the National Assembly is important."

The success of COVID-19 quarantine measures is expected to affect the strength of consumer sentiment recovery. Since the recent decline in economic growth and recession is mainly due to the contraction of private consumption, it is anticipated that once the COVID-19 situation stabilizes and social distancing is significantly eased, consumption recovery and entry into a normal economic growth trajectory will be possible.

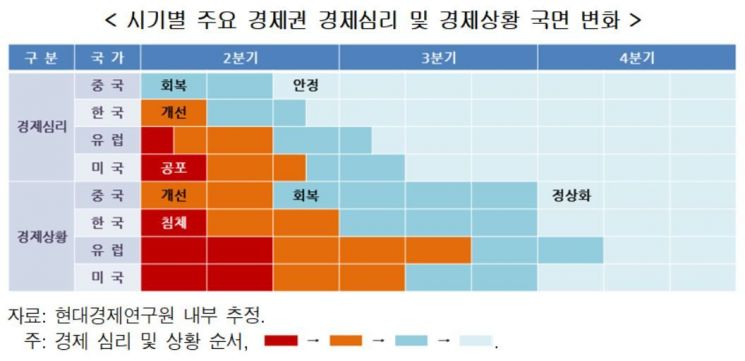

The timing of lifting lockdowns in major economic zones is expected to be a key factor in the recovery of South Korea's export economy. Hyundai Research Institute cautiously expects economic sentiment in Europe and the United States to recover after the third quarter, with the normalization of South Korea's export economy projected around the fourth quarter. However, if COVID-19 resurges due to failures in quarantine measures in major countries, it is judged that normalization of economic activities within the year will be impossible.

The timing and strength of recovery of the Chinese economy, which recorded a sharp contraction of -6.8% in the first quarter, will greatly influence the direction of the Korean economy. China aims for a rebound in the second quarter, but Hyundai Research Institute analyzes that the strength of the rebound is uncertain due to the US-China trade war and insufficient local government stimulus measures. Joo said, "With the slowdown of China's economic growth being inevitable, the key issue is how much negative impact this will have on the Korean economy, which is highly dependent on China," expressing concern that "South Korea's export dependence on China is about 30%, so a crisis in the Chinese economy will lead to a crisis in the overall export economy." Furthermore, if a second US-China trade war occurs, it is analyzed that a full-scale confrontation will be inevitable, including not only tariffs as in the first trade war but also technology regulations, export and import quota regulations, and designation as a currency manipulator.

Hyundai Research Institute advised that to break free from the impact of COVID-19 and achieve an economic rebound, it is necessary to create economic stimulus momentum rather than raising potential growth rates, and to prioritize economic policies that can be implemented immediately in the second half, allowing the private sector to respond and produce immediate effects. It was pointed out that recent economic policies are mixed with short-term stimulus measures and mid-to-long-term growth potential expansion strategies.

In particular, while the first and second supplementary budgets in the first half of this year were fiscal policies to defend against economic recession, the third supplementary budget in the second half should be a full-fledged economic stimulus. Joo said, "Public investment should focus on areas ready for immediate effect, such as SOC projects that have passed the existing preliminary feasibility study, and private investment should narrow its targets to attracting private capital that can be combined with public investment rather than policies difficult to implement quickly in the second half, such as fostering new industries, reshoring, and deregulation."

He added, "We need to move away from one-time income compensation-oriented domestic demand support measures and aim for permanent real income increases through tax cuts and freezing public service fees," and said, "With the summer vacation season, when household spending is concentrated, approaching, we need to consider what policies are possible amid the conflicting relationship between quarantine and consumption promotion." Regarding the supplementary budget, he emphasized, "Given the possibility of a large amount of unused funds within the year due to the historically largest scale of the first to third supplementary budgets, focus should be placed on monitoring implementation performance," and stressed, "It is also necessary to ensure pinpoint strikes (precise fiscal execution capability) to secure clarity of fiscal input targets, appropriateness of expenditure scale, maximization of effects, and timeliness so that fiscal policy effects can be fully realized."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)