[Asia Economy Reporter Eunmo Koo] The American oil company Chevron is expected to benefit during the global economic recovery period, according to analysis. With low production costs, Chevron has enough resilience to withstand low oil prices, and its global value chain and sound financial structure allow it to continue mergers and acquisitions (M&A) and shareholder return policies in the future.

On the 7th, KB Securities evaluated that Chevron, with its low production costs, has sufficient strength to endure low oil prices. Unprecedented coordinated oil production cuts are underway worldwide to stabilize oil prices, with the Organization of the Petroleum Exporting Countries (OPEC) and OPEC+?including Russia, the United States, and Canada?continuing large-scale production cuts. After implementing significant cuts that reduced production to 80% of previous levels, oil prices have also begun to stabilize.

On this day, Asim Hussein, a researcher at KB Securities, stated in a report, “Chevron’s breakeven production cost is the lowest among major global oil producers,” and explained, “Although global coordinated production cuts have been effective since April, when oil prices temporarily fell below zero dollars per barrel, Chevron can endure even if low oil prices persist.” This means that Chevron can continue oil production even at price levels where companies with higher production costs shut down wells.

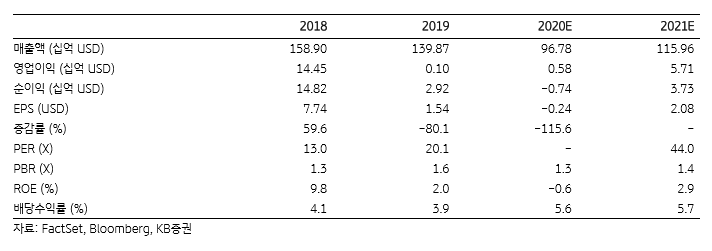

It is also considered a good investment option in a reflation environment. Researcher Hussein said, “Major oil-consuming countries such as the United States, Europe, China, India, and Japan, where economic activities were virtually halted in the first half of the year, are resuming economic activities and aggressively implementing large-scale fiscal stimulus policies to boost the economy,” and forecasted, “As the economy rebounds and oil demand recovers, Chevron’s performance will also improve.”

Since it has established a global value chain, it is analyzed that Chevron can continue M&A and shareholder return policies based on a sound financial structure. Researcher Hussein explained, “Chevron is the second-largest oil producer worldwide, has built an extensive value chain across the globe, possesses the ability to respond to various market conditions, and has a solid financial status,” adding, “Its cash holdings reach $8.5 billion, and its leverage ratio is 1.6 times, which is lower than the competitor average of 2.7 times, giving it the capacity to proceed with dividends, share buybacks, and M&A based on substantial cash reserves and a sound financial structure.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.