The Win-Win Payment System Previously Limited to Banks Now Expanded to Non-Bank Financial Institutions

[Asia Economy Reporter Ki Ha-young] Hyundai Commercial announced on the 5th that it will participate in the 'Win-Win Payment System' for the first time among non-bank sectors to expand corporate options and enhance user convenience.

Following the 'Measures to Improve Transaction Practices between Large Corporations and Small and Medium Enterprises and to Expand Win-Win Cooperation,' announced on December 15 last year as part of revitalizing the Win-Win Payment System, non-bank financial institutions can now participate in the Win-Win Payment System, which was previously limited to banks only.

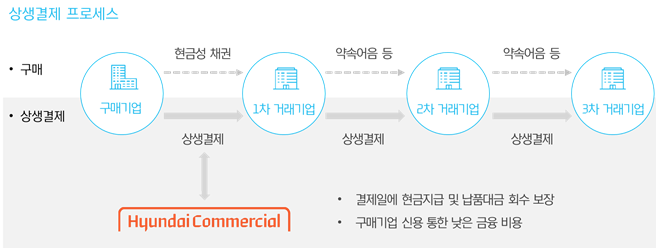

The Win-Win Payment System is operated by the Large Corporation and Small and Medium Enterprise Agricultural and Fisheries Cooperation Foundation and the Ministry of SMEs and Startups. It is a system where the trading company (supplier) is guaranteed cash payment on the payment date and can also convert payment amounts into cash early at low financial costs comparable to those of large corporations or public institutions before the payment date.

By participating in this system, purchasing companies can improve the default rate of trading companies and reduce indirect management costs through payment monitoring, and private companies benefit from additional points during the evaluation of the Win-Win Growth Index.

Additionally, since September 21, 2018, the Win-Win Payment System has been expanded to second- and third-tier subcontractors, mandating that first-tier subcontractors who receive payment through the Win-Win Payment System also pay their subcontractors via the same system, thereby ensuring payment collection stability for subcontractors.

Subcontractors using Hyundai Commercial’s Win-Win Payment System have a wider range of options, as they can receive additional financial products such as corporate facility investment, future receivables securitization, and idle real estate development, in addition to existing Win-Win Payment products.

Meanwhile, Hyundai Commercial has also launched a platform that supports payment settlements targeting sales distribution network clients outside the purchasing value chain of large corporations. Through this platform, Hyundai Commercial promptly responds to clients’ funding needs and provides various value-added services.

A Hyundai Commercial official stated, “We have created an opportunity to support the stable business operations of small and medium enterprise partners facing cash flow difficulties amid the economic downturn caused by the COVID-19 pandemic.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.