Switched to Buying Trend This Month

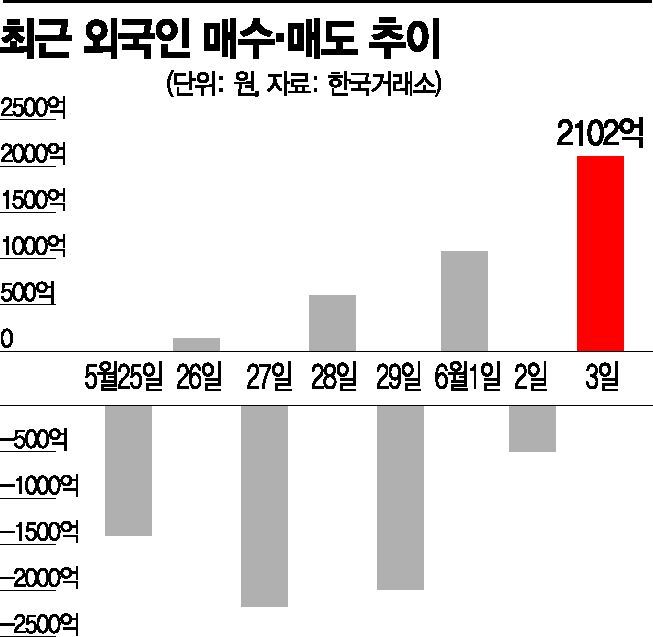

Recorded 210.2 Billion KRW Net Purchase the Previous Day

[Asia Economy Reporter Song Hwajeong] The KOSPI has been rising for consecutive days, closely approaching the recovery of the 2200 level. Despite unfavorable external conditions such as the rekindling of US-China tensions, the stock market continues its strong performance, supported by abundant liquidity. Recently, even foreign investors who had turned their backs on the domestic stock market are showing signs of returning, which is expected to contribute to further gains in the KOSPI.

As of 10:05 AM on the 4th, the KOSPI recorded 2174.80, up 1.29% (27.80 points) from the previous day, continuing its upward trend for five consecutive trading days. With the KOSPI's strength continuing, interest is growing in whether foreign investors will return. On the previous day, foreign investors net purchased 210.2 billion KRW in the KOSPI market, collaborating with institutions to help the KOSPI recover the 2100 level.

Foreign investors have purchased 276.9 billion KRW in the KOSPI market this month. Last month, they net sold 3.8837 trillion KRW. The recent buying of Samsung Electronics, which had been continuously sold during the selling trend, is also interpreted as a signal of foreign investors' return. This month, foreign investors bought 158.6 billion KRW worth of Samsung Electronics, the largest amount among stocks. Roh Donggil, a researcher at NH Investment & Securities, said, "The large-scale buying by foreign investors in the domestic electrical and electronics sector is a factor that can increase the possibility of a shift in supply and demand direction."

Positive changes in foreign investors' investment sentiment are also appearing in the futures market. Kim Dongwan, a researcher at Eugene Investment & Securities, said, "On the previous day, foreign investors showed strong net buying in the futures market, creating an environment where institutions could buy the spot market through arbitrage trading," adding, "From the foreign investors' perspective, buying futures despite their overvaluation signals that their investment sentiment has turned positive, at least in the short term."

For the return of foreign investors, it is suggested that the slowdown in the pace of downward revisions in earnings estimates and the easing of the dollar's strength trend are necessary. Song Seungyeon, a researcher at Korea Investment & Securities, explained, "Three conditions must be met: a slowdown in the increase of COVID-19 cases in emerging markets, a slowdown in the pace of downward revisions of earnings estimates, and the easing of the dollar's strength trend. When these conditions are satisfied, passive fund inflows into emerging market ETFs can resume, marking a turning point for foreign investors' supply and demand."

Recently, as the dollar's strength has eased, expectations for the return of foreign investors have also increased. On the previous day in the Seoul foreign exchange market, the won-dollar exchange rate closed at 1,216.8 won per dollar, down 8.6 won from the previous day. Park Sanghyun, a researcher at Hi Investment & Securities, diagnosed, "The easing of the dollar's strength is likely to act as a catalyst for strengthening risk asset preference, including emerging markets. Although the spread of COVID-19 in some emerging countries has not yet subsided, China's economy is rebounding moderately, and advanced economies are likely entering a rebound phase from the third quarter, suggesting that emerging market economies also have room to rebound with a time lag."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.