[Asia Economy Reporter Park Cheol-eung] A bill to reduce the comprehensive real estate holding tax (Comprehensive Real Estate Tax, 종부세) burden on single-homeowners has been proposed.

On the 3rd, Bae Hyun-jin, a member of the Future United Party (Mirae Tonghapdang) representing Songpa-eul, Seoul, announced that she had taken the lead in proposing a partial amendment to the Comprehensive Real Estate Tax Act to reduce the 종부세 for genuine single-homeowners. This is an effort to legislate the pledge made during the general election.

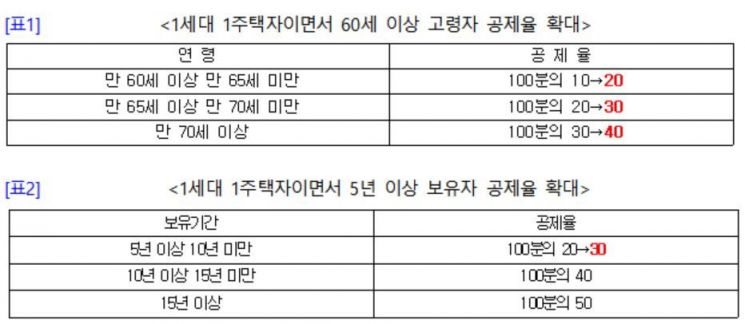

The bill includes expanding the deduction rate for single-homeowners who are elderly aged 60 or older and long-term holders of over 5 years. It also aims to lower the fair market value ratio, which is currently increasing by about 5% annually under the government enforcement ordinance. Currently at 90%, it is scheduled to be 95% next year and 100% in 2022, but the bill proposes to legislate it at 80%.

Considering the rise in housing prices, the bill also includes raising the tax base deduction amount for housing from 600 million KRW to 900 million KRW (1.2 billion KRW for single-homeowners).

Representative Bae said, "I have prepared the representative pledge promised to the residents of Songpa in the April 15 general election as the first bill," adding, "Starting with the real estate tax reform bill to reduce the 종부세 for genuine single-homeowners, I will do my best to ease the tax burden on the people and protect private property rights through legislative activities for the realization of official prices and reduction of transaction taxes in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)