On June 3rd, Lee Byung-geon, a researcher at DB Financial Investment, stated, "Due to the benefits to untact industries from the COVID-19 situation, growth in Talkboard sales, expansion of commerce, and expectations for subsidiary IPOs, Kakao's stock price has risen approximately 73% YTD, and the PER based on this year's expected earnings consensus has increased to about 70 times. Kakao Bank, as a highly growth-oriented bank, can have a differentiated valuation from traditional banks. The bottom is formed by simple remittance/payment, and business expansion is expected to increase corporate value." He set Kakao's target price at 300,000 KRW.

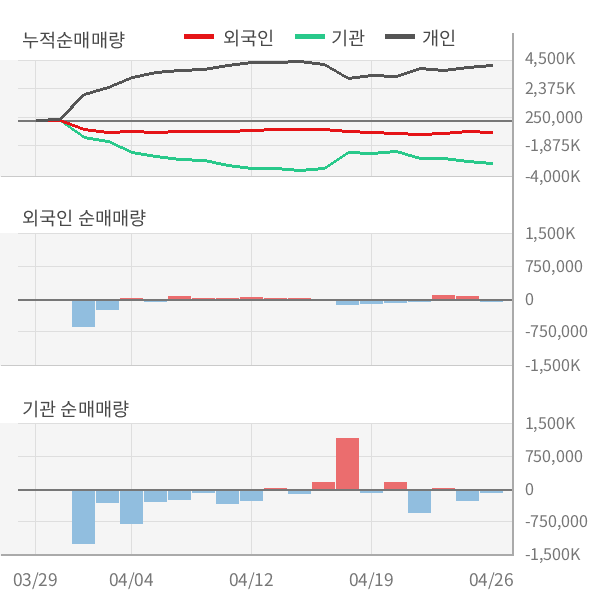

Over the past five days, individual investors have net bought 828,758 shares of Kakao, while foreigners and institutions have net sold 180,711 shares and 656,739 shares, respectively.

※ This article was generated in real-time by an automatic article generation algorithm jointly developed by Asia Economy and the financial AI specialist company Thinkpool.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.