Full-scale Launch of 'Mobile Cash Card Service'

Hong Kyung-sik, Secretary General of the Financial Informatization Promotion Council (and Director of the Financial Settlement Bureau at the Bank of Korea), is demonstrating a payment using a mobile cash card service at a mart.

Hong Kyung-sik, Secretary General of the Financial Informatization Promotion Council (and Director of the Financial Settlement Bureau at the Bank of Korea), is demonstrating a payment using a mobile cash card service at a mart.

[Asia Economy Reporter Kim Eunbyeol] From now on, anyone with a commercial bank account will be able to withdraw cash from ATMs and other machines using a smartphone app without needing a plastic Cash IC Card (cash card). Payments can also be made through the mobile app using a cash card, not just credit or debit cards. Recently, a preference for using cash cards has emerged among younger generations, and with the addition of mobile functionality, cash card usage is expected to steadily increase in the future.

On the 3rd, the Bank of Korea announced that it will officially launch the bank account-based mobile debit service (hereafter referred to as the mobile cash card service), which has been jointly promoted by banks participating in the Financial Informatization Promotion Council (FIP Council). The FIP Council is a financial sector consultative body chaired by Bank of Korea Deputy Governor Yoon Myeon-sik, which has been advancing financial informatization projects. It currently consists of a total of 30 institutions, including financial companies and related organizations.

The mobile cash card service is a service that provides the Cash IC Card (hereafter cash card) service, which is currently based on plastic cards, through a mobile platform. Anyone with a bank account can use the service simply by downloading the mobile cash card app.

The biggest advantage is that users can withdraw cash from ATMs/CD machines using this app. By simply recognizing the app with the smartphone reader on the ATM, cash can be withdrawn with a smartphone at any bank (16 banks by the end of this year). Although some banks have previously offered the function to withdraw cash via apps, it was only available at ATMs of the bank where the account was held.

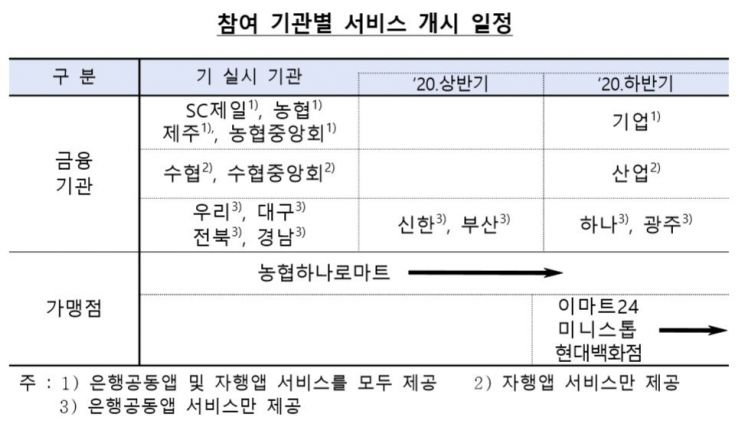

After activating the app, payments can also be made using the QR code or barcode displayed on the screen. Starting today, payments can be made at about 300 Nonghyup Hanaro Mart directly operated stores. When the app is recognized by the mobile payment reader, the payment amount is immediately deducted from the account. It is expected that by the second half of this year, the service will also be available at Emart24, Ministop, Hyundai Department Store, and others.

The banks starting the service from today are SC First Bank, Nonghyup, Jeju Bank, Nonghyup Central Association, Suhyup, Suhyup Central Association, Woori Bank, Daegu Bank, Jeonbuk Bank, and Gyeongnam Bank, totaling 10 banks. Shinhan Bank and Busan Bank will start the service within this month, and Industrial Bank of Korea, KEB Hana Bank, and Gwangju Bank will begin in the second half of the year.

A Bank of Korea official said, "In response to the trend of payment methods based on mobile devices, embedding cash cards into smartphones is expected to enhance consumer convenience," adding, "In particular, since cash deposit and withdrawal services can also be used on a mobile basis, the burden of carrying plastic cards will be alleviated."

Compared to the average merchant fees of 2.07% and 1.48% for credit cards and debit cards respectively last year, the lower cash card fees of around 0.3% to 1% are also expected to be welcomed by merchants. Unlike credit cards, cash cards do not incur costs related to issuing bank’s funding, voucher processing, bad debt handling, or credit evaluation, and the timing of payment deposits to merchants is generally advanced from three days to the next day.

As of the end of last year, the total number of issued cash cards was 250 million, increasing at an average rate of 9.7% over the past five years. Among these, about 120 million cash cards with debit functions issued by banks account for 48.8% of the total. Last year, the number of cash card transactions was 141,300, a 293.3% increase compared to the previous year, and the transaction amount rose by 7.58 billion KRW, a 75.8% increase.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.