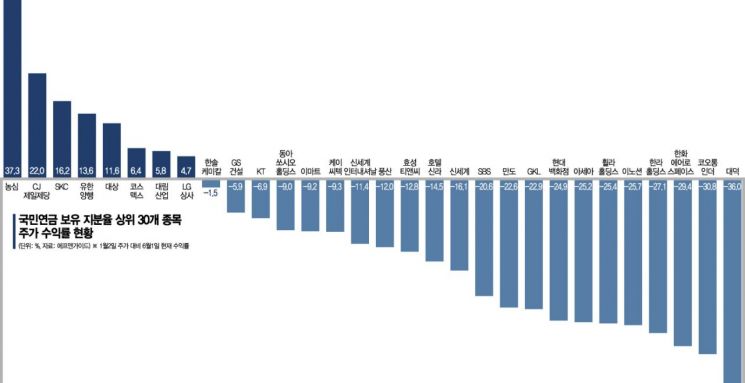

Nongshim and CJ CheilJedang with over 10% stakes yield 23.65%, benefiting from COVID-19

Other 22 companies -18.14%... Daeduck Electronics -36%, Hyundai Department Store -25% showing poor performance

[Asia Economy Reporter Park Jihwan] The National Pension Service (NPS) has achieved an average return of over 20% this year through investments in food industry stocks such as Nongshim, CJ CheilJedang, and Daesang. In contrast, investment returns in consumer sectors like hotels and department stores, as well as mobile phone and parts stocks related to the global economy, were sluggish.

According to an analysis by financial information firm FnGuide of the top 30 companies by NPS shareholding disclosed on the 2nd, the average stock price change from the beginning of the year to the previous day showed a return of -9.53% for these stocks.

By stock, NPS posted high returns in food stocks. The average stock price return this year for Nongshim (37.34%), CJ CheilJedang (22.04%), and Daesang (11.57%), in which NPS holds more than 10% shares, reached 23.65%. This is attributed to the fact that food stocks benefited significantly in terms of performance, unlike other sectors, due to the spread of the novel coronavirus disease (COVID-19). Since the COVID-19 outbreak has not ended, the profit margins of food stocks are expected to widen further, and stock price trends are also anticipated to rise.

Park Sangjun, a researcher at Kiwoom Securities, explained, "With the untact trend sharply reducing outdoor activities, demand for food products such as snacks, as well as stocks, has greatly increased," adding, "As the impact of COVID-19 continues, the performance improvement momentum of food stocks is expected to remain strong in the second quarter."

SKC (16.21%), Yuhan Corporation (13.61%), Cosmax (6.44%), Daelim Industrial (5.81%), and LG Sangsa (4.67%) also performed well with positive returns. For Yuhan Corporation, laseratinib and Janssen bispecific antibody combination pipelines are expected in the second half of the year. SKC is anticipated to benefit from increased film sales due to higher usage of hygiene products related to COVID-19 and expanded demand for European automotive batteries starting next year.

However, the average return of the remaining 22 stocks with high NPS shareholding was -18.14% compared to the beginning of the year. In particular, Daeduck Electronics saw its stock price drop by 36.04%, the largest decline among the 30 stocks. Due to the poor stock performance, NPS has been reducing its stake in Daeduck Electronics. The investment share, which rose to 14.07% at the end of September last year, recently fell by 1.24 percentage points to 12.83%. This is likely because the performance shock for mobile phone and parts companies is expected to intensify from the second quarter onward.

Kim Rokho, a researcher at Hana Financial Investment, said, "The impact of COVID-19 on mobile phone-related stocks is expected to peak in the second quarter," adding, "We are lowering Daeduck Electronics' second-quarter operating profit forecast by 44% from the previous estimate."

Kolon Industries, in which NPS holds a 13.16% stake, saw its stock price fall by 30.84% from the beginning of the year to the previous day. Overseas subsidiaries supplying automotive parts suffered poor performance due to COVID-19, and the fashion business faced a decline in net profit due to sluggish domestic consumption and intensified competition.

NPS also performed poorly in investments in sectors severely impacted by COVID-19, such as hotels and leisure. Returns dropped significantly in Shinsegae (-16.07%), Hotel Shilla (-14.47%), and Hyundai Department Store (-24.91%). Additionally, sensitive consumer goods stocks such as Halla Holdings (-27.08%), Fila Holdings (-25.43%), Innocean (-25.71%), and SBS (-20.56%) showed weak returns.

A financial investment industry official said, "Through the investment stocks of NPS, the largest player in the domestic stock market, we can glimpse the long-term investment direction of institutions," adding, "It is analyzed that NPS could not avoid the shock of COVID-19 this year as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.