[Asia Economy Reporter Inho Yoo] The newly launched 21st National Assembly on the 30th of last month is expected to strongly drive the legalization of real estate regulations based on the power of the ruling party majority.

There are growing expectations that unfinished real estate policies such as the monthly rent reporting system and the increase in comprehensive real estate tax (종부세, Jongbu-se) rates will become a reality.

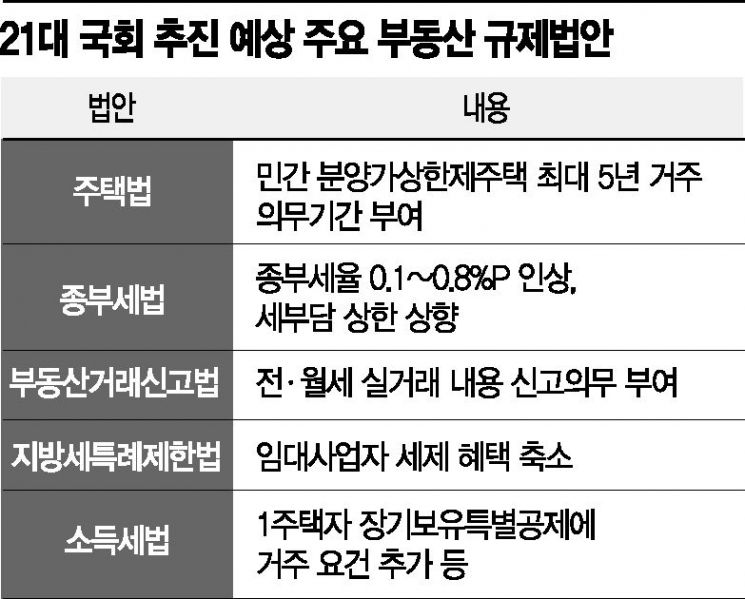

According to political circles and the real estate industry on the 1st, the 'super ruling party' holding 177 seats in the 21st National Assembly is expected to actively pursue amendments to the Housing Act and the Comprehensive Real Estate Tax Act to increase pressure on the real estate market.

At the 21st National Assembly members-elect workshop of the Democratic Party of Korea held on the 27th of last month, real estate measures were announced as one of the five major tasks alongside parliamentary and power institution reforms, fair economy, and defense reform. The workshop specifically mentioned amendments to the Housing Act related to real estate measures.

The industry expects that the first step will be to impose a mandatory residence period of up to five years on apartments subject to the private land price ceiling system through amendments to the Housing Act. This bill was already proposed in September last year during the 20th National Assembly but failed to pass due to opposition from the opposition party, the United Future Party.

The Ministry of Land, Infrastructure and Transport, the competent authority, plans to push for the passage of the amendment again within this year. The Ministry holds the position that it is urgent to prepare a bill that imposes a residence obligation on private land housing subject to the price ceiling system to prevent apartment subscription supply from turning into speculation.

Earlier, in October last year, the Ministry of Land revised the Enforcement Decree of the Housing Act to extend the resale restriction period for apartments subject to the private land price ceiling system from the previous maximum of 4 years to 10 years. They plan to block speculative demand by applying a strengthened residence obligation period on top of this.

However, some argue that imposing a residence obligation on private apartments could lead to constitutional issues due to infringement of basic rights and cause side effects such as housing instability for low-income households due to a decrease in rental listings.

Professor Kwon Dae-jung of Myongji University’s Department of Real Estate said, "Applying residence obligations and sales bans on private land apartments may infringe on property rights and freedom of residence, which could be unconstitutional. If homeowners are required to live in newly sold apartments for five years, the number of rental listings will inevitably decrease, potentially causing rental price increases."

The amendment to the Comprehensive Real Estate Tax Act is expected to be passed early in the 21st National Assembly due to the government’s strong will to firmly pressure owners of high-priced homes.

The amendment bill proposed after the December 16 real estate measures last year includes raising the comprehensive real estate tax rates by 0.1 to 0.3 percentage points for single-homeowners and owners of two homes outside regulated areas, and by 0.2 to 0.8 percentage points for owners of three or more homes or two homes in regulated areas. Although the bill was not passed in the 20th National Assembly, the government is determined, stating "there will be no easing of the comprehensive real estate tax."

The monthly rent reporting system, which failed to pass the 20th National Assembly, is also likely to be reintroduced. On the 20th of last month, the Ministry of Land announced this year’s comprehensive housing plan, stating it would create a rental market where landlords and tenants coexist and would pursue amendments to the Real Estate Transaction Reporting Act to introduce the rental reporting system.

This amendment would require landlords or real estate agents to report actual transaction details such as deposits, rents, and contract fees to the relevant local governments.

Additionally, the Ministry of Land is pushing for stronger management of rental business operators. This includes reducing tax benefits such as acquisition tax and property tax for rental business operators through amendments to the Local Tax Special Cases Act or restricting registration of rental business operators who are minors or whose registration has been canceled due to serious violations through amendments to the Private Rental Housing Act.

Experts are concerned that the government’s excessive real estate regulations could lead to market contraction. Park Won-gap, Senior Specialist at KB Kookmin Bank, said, "In the 21st National Assembly, the likelihood of various amendments for real estate market stabilization being legislated or implemented has increased compared to previous assemblies. Since high-end homes in Gangnam and reconstruction volumes are sensitive to government policies, the overall real estate market is expected to contract."

Reporters Inho Yoo and Jaewon Moon sinryu007@

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.