Bank of Korea Overseas Economic Focus

[Asia Economy Reporter Kim Eun-byeol] The Bank of Korea stated on the 31st that close attention should be paid to the economic shocks and risks faced by emerging markets due to the spread of the novel coronavirus infection (COVID-19).

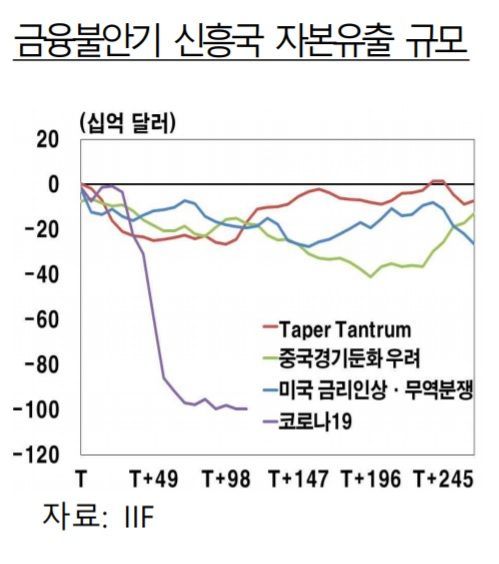

In the 'Overseas Economic Focus' released that day, the Bank of Korea said, "There is a possibility that the massive liquidity supplied by advanced country central banks such as the U.S. Federal Reserve (Fed) could cause financial instability in emerging markets during the process of withdrawal after COVID-19 subsides," adding, "Since the basic economic conditions and fiscal situations of emerging markets have deteriorated during the recent COVID-19 response, if financial instability reappears in the future, concerns about the deterioration of external soundness in emerging markets could become greater than now."

Advanced countries are overcoming the COVID-19 crisis first and withdrawing the liquidity injected into the market, while the funding capacity of organizations such as the International Monetary Fund (IMF) has also significantly decreased, which could destabilize financial markets in emerging countries. Similar phenomena were observed during the global financial crisis and the European debt crisis.

The Bank of Korea also pointed out that food production may decrease in the future due to lockdown measures, which is another risk for emerging markets. Lockdowns have caused a shortage of agricultural labor, and food processing plants such as meat processing facilities have been closed, raising concerns about reduced food harvests and supply in the second half of this year. In fact, difficulties in securing foreign labor have been identified in the U.S., Europe, India, and other regions, and disruptions in the supply of agricultural materials such as fertilizers are also expected.

The Bank of Korea stated, "If global food supply disruptions occur in the future, the difficulties of emerging markets may intensify," adding, "Rising agricultural product prices could reduce consumption of other products and services excluding food, potentially delaying economic recovery in major emerging countries. If food prices surge sharply, the hardships of vulnerable groups in emerging markets could worsen, possibly expanding into social unrest." In 2007-2008, when food prices surged due to export restrictions, protests broke out in Indonesia, and riots occurred in Bangladesh.

There is also a possibility of inflation occurring in emerging markets during the economic recovery process. The Bank of Korea explained that if the supply of goods and services, whose demand rebounds rapidly during the recovery, is delayed, price instability due to supply-demand imbalance may arise. The Bank added, "In emerging markets, if the value of their own currency falls significantly causing exchange rates to rise sharply, import prices could stimulate domestic prices."

Furthermore, the Bank said, "The likelihood of a crisis occurring due to fiscal soundness and foreign currency liquidity problems in emerging markets in the short term is not high," but added, "It is necessary to closely monitor risks that may materialize after the COVID-19 situation subsides."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)