Chairman Hyun-Joo Park of Mirae Asset Group. (Photo by Mirae Asset Group)

Chairman Hyun-Joo Park of Mirae Asset Group. (Photo by Mirae Asset Group)

[Asia Economy Reporter Moon Chaeseok] "This decision comprehensively analyzed the degree of legal violation and its effects. The Fair Trade Commission (FTC) has not shifted its stance to 'lenient law enforcement.'"

Cho Sung-wook, Chairman of the Korea Fair Trade Commission, explained this regarding the decision not to refer Park Hyun-joo, Chairman of the Mirae Asset Group, to the prosecution in connection with sanctions for unfair internal transactions within the group.

Since other group heads such as those of Hanjin, Hyosung, Daelim (Daelim Industrial), and Taekwang were referred to the prosecution for similar sanctions, some have raised suspicions that "only Park Hyun-joo was given leniency."

Cho Sung-wook: "Decision Based on Comprehensive Analysis of Legal Violation Degree and Effects"

FTC: "Legal Grounds for Prosecution Referral Not 'Objective, Clear, and Significant Harm to Competition Order'"

On the 27th, the FTC imposed fines totaling 4.391 billion KRW on 10 affiliates of Mirae Asset Group, stating that the group’s affiliates conducted transactions with Mirae Asset Consulting on a considerable scale without reasonable consideration or comparison, thereby unfairly benefiting related parties (the group head and relatives).

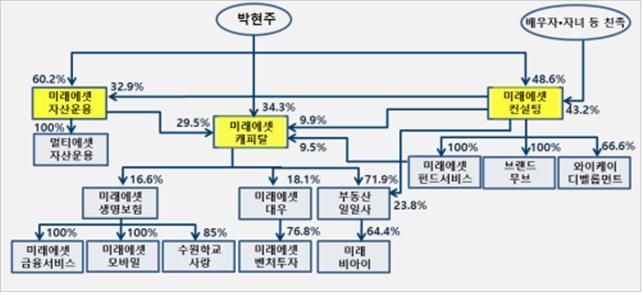

Mirae Asset Consulting is an unlisted company in which special related parties of Mirae Asset Group Chairman Park Hyun-joo hold 91.86% of shares (Park Hyun-joo 48.63%, spouse and children 34.81%, other relatives 8.43%). The group’s governance structure is arranged such that Mirae Asset Consulting controls Mirae Asset Capital and Mirae Asset Global Investments, and Mirae Asset Capital controls Mirae Asset Daewoo and Mirae Asset Life Insurance.

According to the FTC, Mirae Asset Group’s affiliates conducted transactions worth a "considerable scale" (43 billion KRW) with Blue Mountain Country Club and Four Seasons Hotel, operated by Mirae Asset Consulting, without reasonable consideration or comparison with other businesses. The FTC maintained the principle of using only Blue Mountain Country Club and Four Seasons Hotel for customer entertainment and other general transactions, judging this as a clear case of unfair internal transactions.

The Mirae Asset Group argued at the FTC plenary meeting (comprising nine commissioners including Chairman Cho, equivalent to a court ruling) that transactions with the golf course and hotel were not intended to benefit the group head’s family. They explained that these were "simple transactions between affiliates" and that when viewed individually by affiliate, the scale was not "considerable." The claim of "simple transactions between affiliates" was effectively accepted at the plenary meeting.

A Mirae Asset representative explained, "Although the golf course and hotel owners are Mirae Asset Global Investments’ funds, Mirae Asset Consulting operates them inevitably due to legal restrictions. During the three years from 2015, when the FTC investigation took place, internal transactions within Mirae Asset amounted to 43 billion KRW, but Mirae Asset Consulting incurred a loss of 31.8 billion KRW during the same period because the rent was set as a fixed amount rather than linked to sales."

Controversy Over Fairness Due to Lack of Concrete Evidence Compared to Hanjin, Hyosung, Daelim, and Taekwang Group Heads

Civic Groups Criticize Non-Prosecution of Park Hyun-joo’s Family and Corporation as De Facto Leniency

While imposing administrative measures on the group, the FTC did not refer Chairman Park to the prosecution. The reasons cited include ▲ failure to capture concrete evidence of direct instructions, ▲ the case not meeting the prosecution referral criteria under Article 71 of the Monopoly Regulation and Fair Trade Act (MRFTA), which requires "objective, clear, and significant harm to competition order," and ▲ the relatively small sales proportion of affiliates compared to other group heads previously sanctioned for unfair internal transactions.

At a briefing held at the Government Complex Sejong on the 27th, Jung Jin-wook, Director of the FTC’s Corporate Merger Division, explained, "Although Park Hyun-joo mentioned the business direction, profitability, and advantages of Blue Mountain Country Club and Four Seasons Hotel in the early stages of the business, there was no direct instruction for use. Even these mentions were only made at the beginning of the business."

Director Jung added, "While it is true that Mirae Asset Group unfairly allocated work to affiliates, it did not create new transactions out of the blue but merely changed the counterparties, so the degree of legal violation is considered low compared to Article 71 of the MRFTA. Also, the internal transaction sales proportion was 23.7%, much smaller than Taekwang’s 54.24%, so it was judged not to be a 'clear and significant' violation of the law."

Despite the FTC’s explanation, civic groups and others criticized the decision. On the 28th, the Economic Reform Solidarity criticized the FTC’s sanctions on Mirae Asset Group, stating, "The FTC, which previously referred group heads such as Cho Won-tae of Hanjin, Cho Hyun-joon of Hyosung, Lee Hae-wook of Daelim, and Lee Ho-jin, former chairman of Taekwang, to the prosecution for unfair internal transactions, has lost fairness by not prosecuting Chairman Park’s family and major corporations, effectively amounting to 'lenient sanctions.'"

The Economic Reform Solidarity demanded that the prosecution and future investigations clarify whether Chairman Park’s family was involved and urged financial authorities to be cautious in approving issuance of commercial paper.

Jinwook Jeong, Director of the Corporate Merger Division at the Korea Fair Trade Commission, explains the sanction decision process and conclusion regarding the provision of unfair benefits to related parties of Mirae Asset Group affiliates at the Government Complex Sejong on the 27th. (Photo by Chaeseok Moon)

Jinwook Jeong, Director of the Corporate Merger Division at the Korea Fair Trade Commission, explains the sanction decision process and conclusion regarding the provision of unfair benefits to related parties of Mirae Asset Group affiliates at the Government Complex Sejong on the 27th. (Photo by Chaeseok Moon)

Financial Authorities: "One Variable Removed... Resuming Approval Process"

Mirae Asset: "Will Decide on Administrative Litigation After Reviewing Full Resolution Document... Actively Reviewing FTC’s Points"

Financial Investment Industry: "Not the Time for Mirae Asset to Sue FTC Like Samsung Bio-Logics and Securities Commission Case"

Financial authorities and Mirae Asset showed cautious responses. On the 27th, due to the FTC sanctions, the grounds for disapproving Mirae Asset Group’s issuance of commercial paper and other licenses under the Capital Markets Act, citing Chairman Park as an "unqualified major shareholder," weakened. Mirae Asset stated it would decide on administrative litigation after reviewing the full resolution document, but the financial investment industry consensus is that the likelihood is low.

In the financial investment industry, there is a precedent where Samsung Bio-Logics filed administrative litigation against the Financial Services Commission’s Securities and Futures Commission for imposing fines over accounting fraud allegations on November 14, 2018 (Samsung Bio-Logics won in both first and second trials). However, Mirae Asset’s case is viewed differently. Since the issue involves financial authorities’ approval of key businesses such as commercial paper issuance, and prosecution referral was avoided, there is generally no reason to provoke competition authorities and financial authorities by suing the FTC.

During former Chairman Kim Sang-jo’s tenure, the FTC expanded criminal referrals, prosecuting not only executives who violated laws but also employees. However, many cases were dismissed without indictment during prosecution investigations.

For example, in the Hyundai Mobis case, where the company and executives were criminally referred for forcing parts purchases on dealerships, the prosecution dismissed the case in November 2018 due to lack of charges. Similarly, the case where the Korean Institute of Certified Public Accountants was referred for colluding on external audit fees for apartment management was also dismissed.

A Financial Services Commission official said, "Now that one variable regarding licensing is removed, the approval process will resume."

A Mirae Asset representative said, "We will decide on responses such as administrative litigation after reviewing the full FTC resolution document. We will thoroughly review the processes and social responsibilities pointed out by the FTC to establish a stricter compliance culture and focus on the mega investment banking (IB) business to contribute to revitalizing the capital market."

On November 14, 2018, Kim Yong-beom, then Vice Chairman of the Financial Services Commission and Chairman of the Securities and Futures Commission (currently the 1st Vice Minister of the Ministry of Economy and Finance), is seen answering questions from reporters after announcing the results of the regular meeting of the Securities and Futures Commission, including sanctions related to Samsung Biologics' accounting fraud allegations, at the Seoul Government Complex in Jongno-gu, Seoul. Photo by Kim Hyun-min kimhyun81@

On November 14, 2018, Kim Yong-beom, then Vice Chairman of the Financial Services Commission and Chairman of the Securities and Futures Commission (currently the 1st Vice Minister of the Ministry of Economy and Finance), is seen answering questions from reporters after announcing the results of the regular meeting of the Securities and Futures Commission, including sanctions related to Samsung Biologics' accounting fraud allegations, at the Seoul Government Complex in Jongno-gu, Seoul. Photo by Kim Hyun-min kimhyun81@

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.