[Asia Economy Reporter Kim Hyo-jin] With the base interest rate lowered to 0.5%, the interest rates on deposit and loan products at commercial banks are expected to drop one after another soon. It is widely anticipated that the interest rates on major banks' savings and time deposit products, which currently have a base rate around 1%, will officially enter the 0% range starting next week. The historically lowest level of variable mortgage loan interest rates is also expected to decline further following the reduction in deposit interest rates.

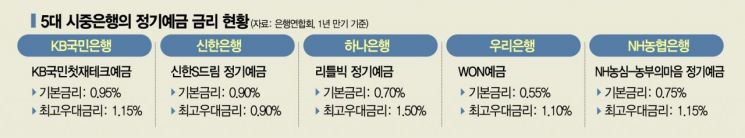

According to the banking sector on the 29th, among 17 deposit products from the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?disclosed by the Korea Federation of Banks, only one product, Shinhan Bank's 'Shinhan S Dream Time Deposit (0.90%)', has an interest rate in the 0% range based on the 'highest preferential interest rate (1-year maturity)' which applies preferential rates on top of the base rate.

However, most products maintain interest rates in the low 1% range, barely holding above 1%, with the highest rates reaching the mid-1% range. This is a result of the prolonged low interest rate environment and the impact of the 'big cut' in the base rate from 1.25% to 0.75% implemented in March.

While many deposit products have already entered the 0% range for their base rates, it is more practical to consider the highest preferential interest rate, which reflects various additional nominal rates applied.

Banks began reviewing adjustments to deposit product interest rates following the Bank of Korea's base rate cut the previous day. A representative from a commercial bank said, "Although we need to go through the interest rate adjustment process to know for sure, products with interest rates below 1% even after applying preferential rates are expected to emerge one after another."

Banks set interest rates based on the base rate while considering factors such as the loan-to-deposit ratio and management strategies.

If banks' interest rate cuts become full-fledged, deposit products will hardly serve as more than a means of storing money, leading to analyses that the growth in deposits will sharply slow down.

Regarding this analysis, a financial sector official said, "From the perspective that the attractiveness of deposit products is gradually diminishing, it can be seen that way. However, considering the rapidly shrinking financial investment market atmosphere recently, there will still be many consumers who choose deposit products with the mindset of 'let's just keep it safe for now.'"

Loan interest rates are also expected to be adjusted soon. Attention is focused on whether the interest rates for major loan products, such as mortgage loans, will fall to the low 1% range.

Mortgage loans are divided into hybrid (5-year fixed, then variable) and variable types, with variable rates moving according to COFIX (Cost of Funds Index). COFIX is calculated based on the costs (interest rates) paid by eight domestic banks when raising funds.

When bank deposit interest rates fall, variable mortgage loan rates also decrease. COFIX is announced once a month, on the 15th of each month. Banks expect the impact to be gradually reflected after the 15th of next month.

Hybrid mortgage loan rates mainly reference the 5-year financial bond (AAA rating), so they change on a daily or weekly basis and are adjusted earlier than variable rates. This week, KB Kookmin Bank's hybrid (fixed) mortgage loan rates range from 2.11% to 3.61%. The effect of the base rate cut could lower the minimum rate to the 1% range.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)