Negative Annual Growth Rate Presented for the First Time in 11 Years

Actual Negative Growth Would Mark First Contraction in 22 Years

Economic Indicators Already Worsening...Exports, Domestic Demand, and Employment All Sluggish

Global Interest Rate Cuts Ease Real Interest Burden

Policy Coordination Effects Also Expected with 3rd Supplementary Budget

[Asia Economy Reporters Eunbyeol Kim and Sehee Jang] The Bank of Korea cut its benchmark interest rate again after two months, forecasting a negative annual economic growth rate for this year. It judged that the economic damage caused by the novel coronavirus infection (COVID-19) would be greater and longer-lasting than expected. The uncertainty about the timing of economic recovery was reinforced by not only sluggish consumption and investment but also the shaking of exports, the foundation of the Korean economy. Since major countries have already implemented zero (0) interest rate policies, the burden of lowering interest rates was reduced.

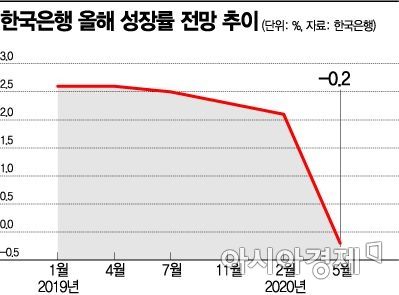

On the 28th, the Bank of Korea projected a growth rate of minus (-0.2%) for this year through its revised economic outlook. Until last month, the Bank of Korea expected positive growth this year, but it acknowledged that negative growth is inevitable. The Bank of Korea has forecast a negative GDP growth rate only twice before: in April 2009 (-2.4%) and July 2009 (-1.6%), the year following the financial crisis. This is the first time in 11 years that a negative forecast has been presented. The last time the annual growth rate actually recorded a negative figure was in 1998 (-5.1%), during the Asian financial crisis. If the growth rate actually turns negative this time, it will be the first negative growth in 22 years. However, the Bank of Korea projected a growth rate of 3.1% for next year.

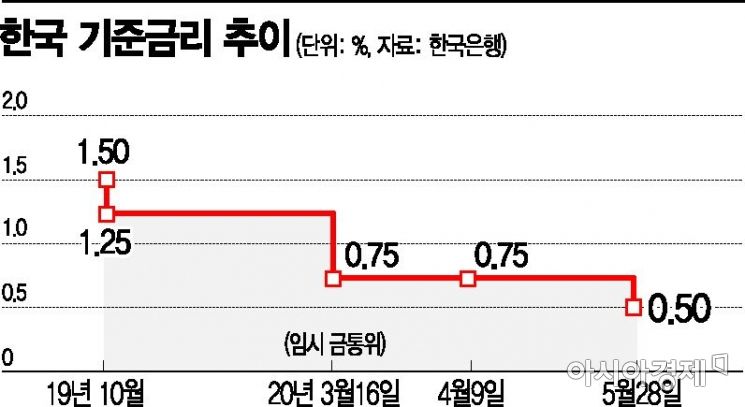

Given the forecast of negative growth, the Monetary Policy Board held a meeting on the same day and lowered the benchmark interest rate by 25 basis points (1bp=0.01 percentage point) from 0.75% to 0.5% per annum. After lowering the benchmark rate by 50bp from 1.25% to 0.75% in March and keeping it unchanged last month, the Bank of Korea cut the rate again this time. Considering that non-reserve currency countries should maintain a higher benchmark rate than the U.S. (currently 0%), the rate has effectively been lowered to near zero.

Bank of Korea Governor Lee Ju-yeol stated, "The domestic economy has significantly slowed down," adding, "Consumption remains sluggish, exports have sharply declined, facility investment recovery is constrained, and construction investment adjustments continue." Compared to last month (when growth was judged to have significantly slowed and exports slightly decreased), the domestic economic situation is viewed as much more serious. He also said, "Employment conditions worsened, with a significant increase in the decrease of employed persons, especially in the service sector," and added, "The domestic economy is expected to continue a sluggish trend for the time being due to the spread of COVID-19." Governor Lee said, "This year's growth rate is expected to be around 0%, significantly below the February forecast (2.1%), and the uncertainty of the growth outlook path is judged to be very high."

Due to the impact of COVID-19, consumer price inflation is also expected to fall further. The Bank of Korea forecasted a consumer price inflation rate of 0.3% for this year. Governor Lee said, "The consumer price inflation rate has dropped sharply to the low 0% range due to declines in petroleum and public service prices and a reduction in the rise of agricultural, livestock, and fishery product prices," adding, "Core inflation (excluding food and energy) also fell to the low 0% range, and general public inflation expectations slightly decreased to the mid-1% range." He further predicted, "Consumer price inflation will be in the low 0% range this year due to the decline in international oil prices and weakening upward pressure from the demand side, and core inflation will be in the mid-0% range."

Researcher Cho Young-moo of LG Economic Research Institute said, "Lowering interest rates and injecting money to respond to COVID-19 is a global trend," adding, "Only countries facing serious capital outflow situations will choose to raise interest rates." There is also an interpretation that the Bank of Korea's interest rate cut aims to induce a policymix effect in conjunction with the government's supplementary budget.

◆Annual Growth Rate Faces Negative Risk for the First Time in 22 Years= The Bank of Korea's negative growth forecast is the first in 11 years since April 2009 (-2.4%) and July 2009 (-1.6%) during the financial crisis. However, the real GDP growth rate that year was 0.2%, showing relatively good performance.

The real GDP growth rate has recorded negative figures twice since the Bank of Korea started compiling GDP statistics in 1953: in 1980 (right after the second oil shock) at -1.6%, and in 1998 (financial crisis) at -5.1%. If this year's forecast is realized, it will be the first negative growth in 22 years. The Bank of Korea's growth forecast reflects the economic damage caused by the spread of COVID-19, including the slowdown in domestic export growth and China's growth rate decline. Earlier in February, the Bank of Korea lowered its expected growth rate for this year from 2.3% to 2.1% once.

Negative economic indicators have already been confirmed. April exports plunged 24.3% year-on-year, and the trade balance turned into a deficit for the first time in 99 months. Exports from May 1 to 20 decreased by 20.3%. Although the U.S. and the European Union (EU) have eased lockdown measures, it is difficult to predict when the economy will fully normalize, so export uncertainty remains high. The sharply falling consumer price index also encouraged the interest rate cut. According to Statistics Korea, the consumer price index in April rose only 0.1% compared to the same month last year.

Although there is slight improvement, domestic demand has also been hit hard. Due to the COVID-19 crisis, private consumption and the service sector were damaged, and the first-quarter growth rate recorded the lowest in 11 years and 3 months since the fourth quarter of 2008 (-3.3%). The bigger problem is that if export sluggishness prolongs, domestic demand may weaken again due to economic recession, and low inflation may persist, leading to deflation (a continuous price decline during economic recession). In deflation, people expect prices to fall further, reducing consumption and causing a vicious cycle of further price drops. In this context, if the benchmark interest rate is not lowered, the real interest rate (nominal benchmark rate minus consumer price inflation) rises. The real interest rate is the effective interest rate felt by households and businesses; if it rises, the debt burden on those who already have significant debt increases, making a rate cut necessary. Researcher Lee Mi-seon of Hana Financial Investment said, "Since expansionary fiscal policy is underway and nominal interest rates need to be maintained at low levels, lowering interest rates reduces debt burdens."

Earlier, the International Monetary Fund (IMF) projected Korea's economic growth rate at -1.2% this year. The three major global credit rating agencies also forecast negative growth: Moody's at -0.5%, Standard & Poor's (S&P) at -0.6%, and Fitch at -1.2%. Professor Kim So-young of Seoul National University's Department of Economics said, "Although the Bank of Korea's growth forecast has been revised downward, -0.2% is still an optimistic outlook." She added, "The second quarter will be more severely affected than the first quarter, and if export damage worsens, the decline could be greater than -0.2%."

◆Timing Is Crucial for Interest Rate Cuts= Of course, there are concerns about lowering interest rates. First, the effective lower bound is estimated by the market to be between 0.25% and 0.50%. The effective lower bound is the minimum interest rate at which monetary policy by central banks of non-reserve currency countries remains effective. Lowering the benchmark rate below this bound reduces the stimulus effect. Excessive rate cuts may also lead to capital outflows.

However, since the whole world is lowering rates to near zero due to COVID-19, Monetary Policy Board members seem to have judged that the side effects of the effective lower bound are not a major concern. Following the U.S. lowering rates to near 0%, countries with similar economic size and openness to Korea have also cut rates simultaneously. Currently, Australia's benchmark rate is 0.25%, and Thailand's is 0.50%. In fact, the effective lower bound is believed to be below 0.50%, suggesting that further rate cuts may be possible. Governor Lee said at a press briefing after the Monetary Policy Board meeting, "With the domestic economy expected to remain sluggish and demand-side inflationary pressures low, we will maintain a monetary easing stance." The recent slowdown in household loan growth and housing price increases due to COVID-19 also reduced the Bank of Korea's burden in cutting rates.

The need to generate a policymix effect in conjunction with the government's third supplementary budget is another reason for the rate cut. With the government's deficit bond issuance expected to exceed 100 trillion won this year, lowering the benchmark rate can reduce the government's financing costs. The Bank of Korea is also expected to mobilize other measures besides rate cuts, such as additional purchases of government bonds.

Meanwhile, new Monetary Policy Board member Cho Yoon-je did not attend the meeting. It was judged that excluding him from the discussion was appropriate because the value of stocks he holds exceeded the level set by the Public Officials Ethics Act.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.