3rd Supplementary Budget Fiscal Policy and Coordination

Effect of Reduced Deficit Bond Financing Costs

Additional Treasury Bond Purchases Expected

Lee Ju-yeol "Likely to Maintain Easing Stance"

[Asia Economy Reporter Kim Eun-byeol] The Bank of Korea's Monetary Policy Committee ultimately could not ignore the deteriorating economic indicators. With all indicators?exports, domestic demand, employment, and inflation?showing negative trends, theoretically, it was even harder to find a reason not to cut interest rates. Since the United States lowered rates to 0%, and major countries have successively cut rates, timing the rate cut to coincide with these moves would maximize its effectiveness, which is why the committee leaned toward lowering rates. It also signifies aligning monetary policy with the government's plan to finalize the third supplementary budget next month.

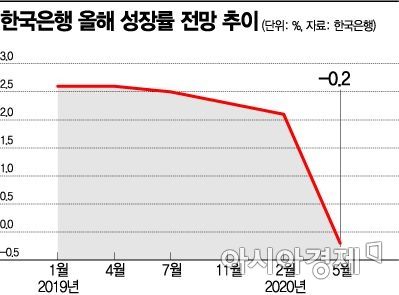

◆Nothing was favorable= On the 28th, the Bank of Korea lowered its economic growth forecast for this year from 2.1% to -0.2%, significantly revising it downward to reflect the impact of the COVID-19 pandemic.

Negative economic indicators have already been confirmed. April exports plunged 24.3% compared to the same period last year, and the trade balance turned to a deficit for the first time in 99 months. Exports from May 1 to 20 decreased by 20.3%. Although the United States and the European Union (EU) have eased lockdown measures, it is difficult to predict when the economy will fully normalize, leaving export uncertainty high. The sharply falling consumer price index also encouraged interest rate cuts. According to Statistics Korea, the consumer price index in April rose by only 0.1% year-on-year. The Bank of Korea projected that the consumer price inflation rate for this year would remain in the low 0% range.

Although there are slight improvements, domestic demand has also taken a direct hit. Private consumption and the service sector were impacted by the COVID-19 crisis, resulting in the first-quarter growth rate hitting its lowest level in 11 years and 3 months since the fourth quarter of 2008 (-3.3%). A bigger concern is that if export sluggishness prolongs, domestic demand may weaken again due to economic recession, and low inflation could persist, potentially leading to deflation (a sustained decline in prices amid economic downturn). In a deflationary environment, consumers expect prices to fall further, reducing consumption and causing a vicious cycle of further price drops. If the base interest rate is not lowered under these conditions, the real interest rate (nominal base rate minus consumer price inflation) rises. The real interest rate reflects the effective interest rate experienced by households and businesses; if it increases, the debt burden on those already heavily indebted grows, making a rate cut necessary. Lee Seon, a researcher at Hana Financial Investment, said, "Since expansionary fiscal policy is underway and nominal interest rates need to be maintained at low levels, lowering rates will reduce debt burdens."

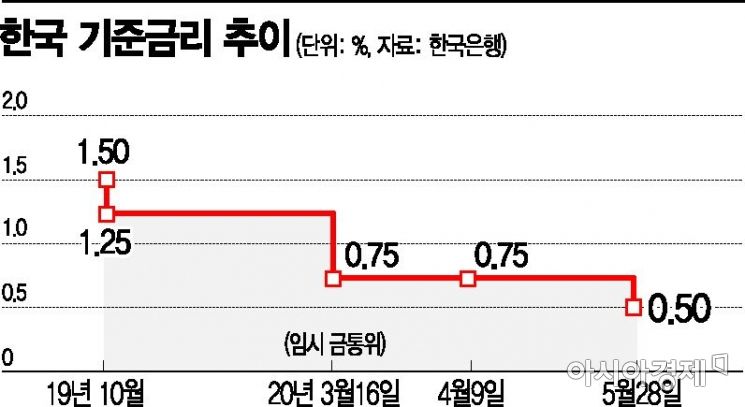

◆Timing is crucial for rate cuts= Of course, there are concerns associated with cutting interest rates. First is the effective lower bound, estimated by the market to be around 0.25% to 0.50%. The effective lower bound is the minimum interest rate at which monetary policy remains effective for central banks of non-reserve currency countries. Lowering the base rate below this bound diminishes the stimulative effect on the economy. Excessive rate cuts could also trigger capital outflows.

However, given that the entire world is lowering rates to near zero due to COVID-19, the Monetary Policy Committee seems to have judged that the side effects of the effective lower bound are not a major concern. Following the U.S. lowering rates to near 0%, countries with similar economic size and openness to Korea have also cut rates simultaneously. Currently, Australia's base rate is 0.25%, and Thailand's is 0.50%. In fact, the effective lower bound is believed to be below 0.50%, suggesting that further rate cuts are possible. Governor Lee stated at a press briefing after the Monetary Policy Committee meeting, "With the domestic economy expected to remain sluggish and demand-side inflationary pressures staying low, we will maintain an accommodative monetary policy stance." The recent slowdown in household loan growth and the deceleration of housing price increases due to COVID-19 have also eased the Bank of Korea's burden in cutting rates.

The need to generate a policy mix effect in conjunction with the government's third supplementary budget is another reason for the rate cut. With the government's deficit bond issuance expected to exceed 100 trillion won this year, a rate cut by the Bank of Korea would reduce the government's financing costs for issuing deficit bonds. The Bank of Korea is also expected to deploy additional measures beyond rate cuts, such as further purchases of government bonds.

Meanwhile, new Monetary Policy Committee member Cho Yoon-je did not attend the meeting that day. It was determined that Cho should be excluded from the committee's discussions because the value of stocks he holds exceeded the limit set by the Public Officials Ethics Act.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.