Renault Samsung Next Month · Hyundai Motor Scheduled for July

[Asia Economy Reporters Kiho Sung and Jihui Kim] The completed vehicle industry, led by Renault Samsung Motors, will officially begin this year's wage and collective bargaining agreements starting next month. Given the unprecedented economic crisis caused by the COVID-19 pandemic, attention is focused on whether the strong labor unions, which typically represent the completed vehicle sector, will show a sense of communal fate and behave differently from previous years.

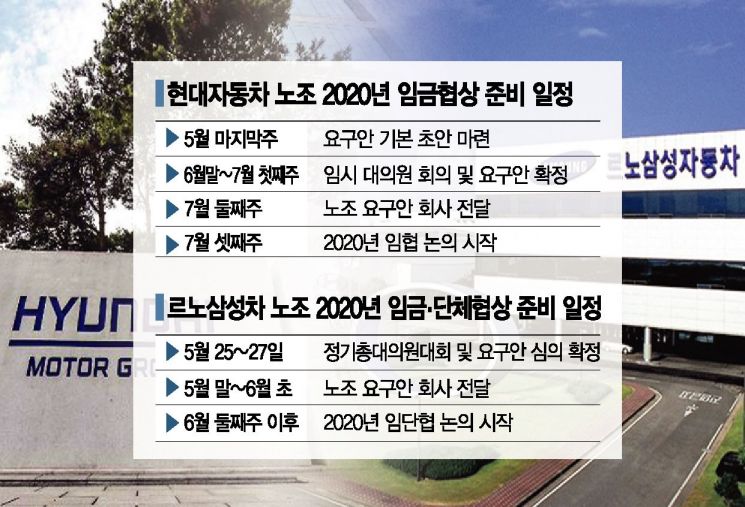

According to the automotive industry on the 28th, the Hyundai Motor Union recently launched a joint on-site committee to lead this year's wage negotiations and is currently collecting the union's demands related to the negotiations. The Hyundai Motor Union plans to prepare its negotiation demands by the end of next month, deliver them to the company, and begin formal negotiations starting with a preliminary meeting in July. A Hyundai Motor Union official stated, "Negotiations with management are scheduled to begin from the third week of July," adding, "Although the schedule is somewhat delayed compared to the usual start in late April or early May, we will proceed with a sense of urgency."

Renault Samsung Motors labor and management will begin wage and collective bargaining negotiations earlier, starting from the second week of next month. A Renault Samsung Motors union official said, "Originally, the union planned to finalize its demands by the 27th and hold a preliminary meeting in the first week of June," but added, "However, the company requested a postponement citing COVID-19 and other reasons, so negotiations will start after the second week."

The industry expects that although this year's wage and collective bargaining negotiations in the completed vehicle sector started 2 to 3 months later than usual, they will be concluded quickly without major conflicts due to the heightened sense of crisis caused by COVID-19. Since February, the completed vehicle industry has been unable to operate factories properly. The COVID-19 situation disrupted parts supply, and the global sales market came to a halt, significantly reducing export volumes.

For example, Korea GM, which operated its factory for only eight days this month (Bupyeong Plant 1), is discussing plans to operate for just six days in June. Hyundai and Kia domestic plants are also repeatedly stopping and starting operations. While there has been no large-scale shutdown like in February, orders from the global market have decreased or been canceled, resulting in alternating shutdowns and operations by production line. Hyundai Motor plans to halt the Porter production line at Ulsan Plant 4 from the 1st to the 5th of next month, and Kia’s Gwangju Plant 2 will also be closed until the 5th of next month. Additionally, the recent changes in the previously strong-willed Hyundai Motor Union are factors that raise expectations for a smoother negotiation process.

However, there are variables in various places, and some predict that it will not be easy for labor and management to quickly find a compromise. For Hyundai Motor, the biggest variable is the Gwangju-type job model. The union has already pressured management several times, demanding a re-examination of the investment from the starting point. Furthermore, the union is opposing the production of the new Tucson model, launched this August, at the U.S. plant.

Discussions on the wage increase rate are also expected to be difficult. Management hopes for a wage freeze, citing the global automotive industry's damage from COVID-19 and an uncertain future. However, strong opposition to a wage freeze remains within the union. Previously, when the Hyundai Motor Union mentioned a wage freeze on the condition of job retention, representatives of nine business units at Hyundai Motor’s Ulsan plant pressured both the union leadership and management, saying, "Management should not even dream of a wage freeze in the 2020 negotiations."

Senior Research Fellow Hanggu Lee of the Korea Institute for Industrial Economics & Trade said, "Because of the COVID-19 crisis, major conflicts are unlikely," and added, "Also, for the three mid-sized companies facing survival threats, unions may focus more on demanding survival blueprints."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.