Actual Positive Growth During Financial Crisis

Uncertainty Incentives Increasingly Expanding

This Time Negative Margin Expected to Widen

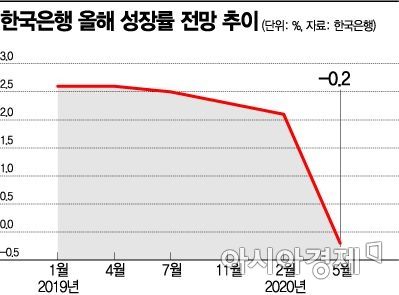

[Asia Economy Reporter Jang Sehee] The Bank of Korea has significantly revised down its economic growth forecast for this year to -0.2% amid the growing economic shock caused by the COVID-19 pandemic.

In the revised economic outlook announced on the 28th, the Bank of Korea lowered this year's growth forecast by 2.3 percentage points from the previous 2.1% to -0.2%. This is the first time in 11 years that the Bank has issued a negative growth forecast since April 2009 (-2.4%) and July 2009 (-1.6%) during the financial crisis. However, the real gross domestic product (GDP) growth rate that year recorded 0.2%, showing a relatively strong performance.

The real GDP growth rate recorded negative figures twice since the Bank of Korea began compiling GDP statistics in 1953: -1.6% in 1980 (right after the second oil shock) and -5.1% in 1998 (financial crisis). If this year's forecast is realized, it will mark the first negative growth rate in 22 years. The Bank's growth forecast for this year appears to consider the economic damage caused by the spread of COVID-19, including a slowdown in domestic export growth and a decline in China's growth rate. Earlier in February, the Bank had already lowered its expected growth rate for this year from 2.3% to 2.1% once.

Bank of Korea Governor Lee Ju-yeol stated, "The domestic economy has significantly slowed down," adding, "Consumption continues to be sluggish, exports have sharply decreased, facility investment recovery is constrained, and construction investment adjustments have continued." Compared to last month (when the growth slowdown was judged significant and exports slightly decreased), the domestic economic situation is viewed as much more serious. He also said, "The employment situation has worsened, with a significant increase in the decrease of employed persons mainly in the service sector," and added, "The domestic economy is expected to continue a sluggish trend for the time being due to the impact of the COVID-19 spread." Governor Lee said, "This year's growth rate is expected to be around 0%, significantly below the February forecast of 2.1%, and the uncertainty of the growth outlook path is judged to be very high."

Due to the impact of COVID-19, the consumer price inflation rate is also expected to fall further. Governor Lee said, "The consumer price inflation rate has dropped sharply to the low 0% range due to declines in petroleum and public service prices and a reduction in the rise of agricultural, livestock, and fishery product prices," adding, "The core inflation rate (excluding food and energy) also fell to the low 0% range, and the general public's expected inflation rate slightly decreased to the mid-1% range." Furthermore, he predicted, "The consumer price inflation rate will be in the low 0% range this year due to the impact of the international oil price decline and weakened upward pressure from the demand side, and the core inflation rate will be in the mid-0% range."

Experts point out that with domestic and international uncertainties remaining, a precise diagnosis of the upward and downward factors of the economy will likely reveal an even larger negative growth margin.

In fact, the International Monetary Fund (IMF) projected South Korea's economic growth rate this year at -1.2%. Additionally, the three major global credit rating agencies forecast negative growth rates: Moody's at -0.5%, Standard & Poor's (S&P) at -0.6%, and Fitch at -1.2%. Professor Kim Soyoung of Seoul National University's Department of Economics said, "Although the Bank of Korea's growth forecast has been revised downward, -0.2% is still an optimistic projection." He added, "The second quarter will be more severely impacted than the first quarter, and especially if the export damage worsens, the decline could be greater than -0.2%."

Researcher Lee Miseon of Hana Financial Investment said, "With the first quarter figures already out, there is no assumption that the recovery speed in the third and fourth quarters will be better than usual," adding, "Even among advanced countries, both the U.S. and Europe are experiencing negative growth." She further noted, "If GDP damage is significant, it will take time to recover."

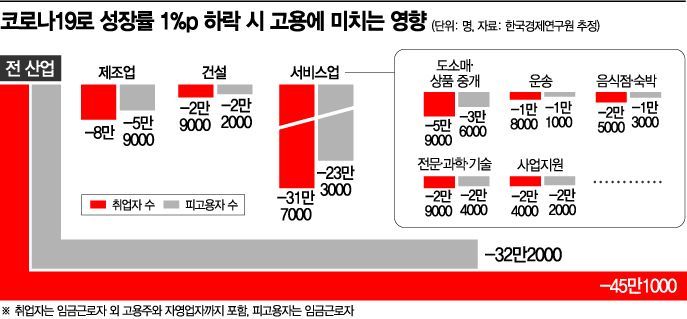

As economic growth increasingly impacts employment following the global financial crisis, an analysis has emerged that a 1 percentage point drop in economic growth rate would reduce the number of employed persons by 451,000. The Korea Economic Research Institute stated this in its report titled "Analysis of the Impact of Growth Contraction Due to COVID-19 on Employment and Its Implications" released on the same day.

Moreover, the Korea Economic Research Institute analyzed the impact of GDP changes on unemployment rates by economic cycle phase and found that during recession phases, the increase in unemployment rate is more than twice the decrease in unemployment rate during expansion phases. When the GDP cycle value is 1 trillion won below zero?the threshold between economic expansion and contraction?the unemployment rate rises by 0.055 percentage points, whereas when it is 1 trillion won above zero, the unemployment rate falls by only 0.021 percentage points. This suggests that the current recession caused by COVID-19 could lead to a major employment disaster.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)