[Asia Economy Reporter Eunmo Koo] As the novel coronavirus disease (COVID-19) has brought attention to 'contactless (untact)' services, stocks of companies providing untact services have recorded outstanding returns in the exchange-traded fund (ETF) market.

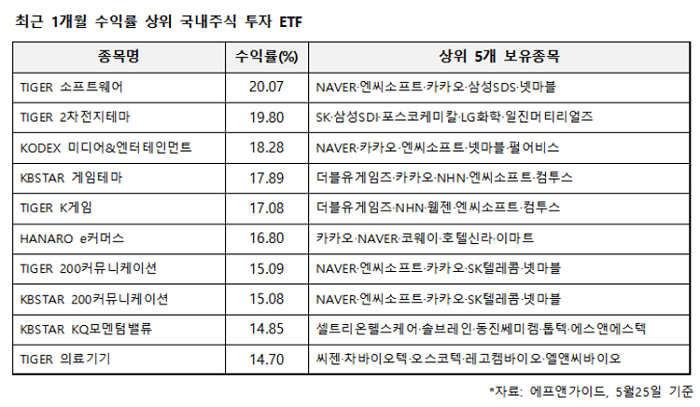

According to FnGuide, a fund evaluation company, as of the 25th, among ETFs investing in domestic stocks over the past month, excluding leveraged ETFs, seven out of the top 10 highest-yielding ETFs contained untact-related stocks. During this period, TIGER Software recorded the highest return at 20.07%, followed by KODEX Media & Entertainment (18.28%), KBSTAR Game Theme (17.89%), TIGER K-Game (17.08%), HANARO e-Commerce (16.80%), and TIGER 200 Communication Services (15.09%). These figures significantly outperform both the KOSPI (5.58%) and KOSDAQ indices (11.94%).

The ETFs with the highest recent returns can be summarized by two keywords: 'Internet' and 'Game.' Despite the overall economic slowdown due to reduced demand across major industries following the spread of COVID-19, these sectors have shown potential for profit growth, resulting in favorable recent stock performance. Lee Kyung-il, a researcher at Cape Investment & Securities, explained, "The internet sector's growth is mainly driven by better-than-expected advertising revenue and strong performance in the e-commerce segment, while the gaming sector is expected to see improved user metrics and expanded sales as indoor activities increase."

Mirae Asset Global Investments' TIGER Software, which achieved the highest returns over the past month, holds about 80% of its assets in its top five stocks: NAVER, NCSoft, Kakao, Samsung SDS, and Netmarble. Following closely, KODEX Media & Entertainment has assets allocated in the order of Kakao, NAVER, NCSoft, Netmarble, and Pearl Abyss.

The strength of ETFs mainly composed of untact-related stocks is expected to continue for the time being. The collective untact experience initiated by COVID-19 is acting as a significant driving force for social change, which is likely to increase investor interest in stocks influenced by this trend. Lee Sang-heon, a researcher at Hi Investment & Securities, stated, "Post-COVID, individualistic tendencies and untact lifestyles enabled by digital technology will accelerate. Accordingly, the business focus will shift online, and preferences for untact services will become more prominent."

As social changes centered on untact and online activities are expected to continue long-term, it is analyzed that investors should increase their interest in related stocks when investing in ETFs. Kim Hoo-jung, a researcher at Yuanta Securities, advised, "Since March, investors' attention in the domestic stock market has been focused on leveraged, inverse, and oil-related ETFs with high volatility. However, in the current phase where the market is stabilizing, it is advantageous to focus on ETFs that can benefit from long-term social changes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.