Supply to $20 Billion Market Just Over Two Months After Agreement

Largest Among 9 Countries with Temporary Contracts with US Fed

[Asia Economy Reporter Kim Eunbyeol] The Bank of Korea has supplied nearly $20 billion (approximately 24.6 trillion KRW) of the currency swap funds it secured with the U.S. Federal Reserve (Fed) to the market. This amounts to about one-third of the $60 billion limit being released into the market just over two months after the Korea-U.S. currency swap agreement was made. As the U.S. financial market has recently shown signs of recovery, the Bank of Korea has temporarily halted foreign currency lending using the currency swap funds and is closely monitoring the market. Experts point out that, compared to other countries, a significant amount of funds has already been supplied, so a cautious response is necessary. Additionally, concerns arise from the recent escalation of tensions between the U.S. and China, which is showing signs of a currency war.

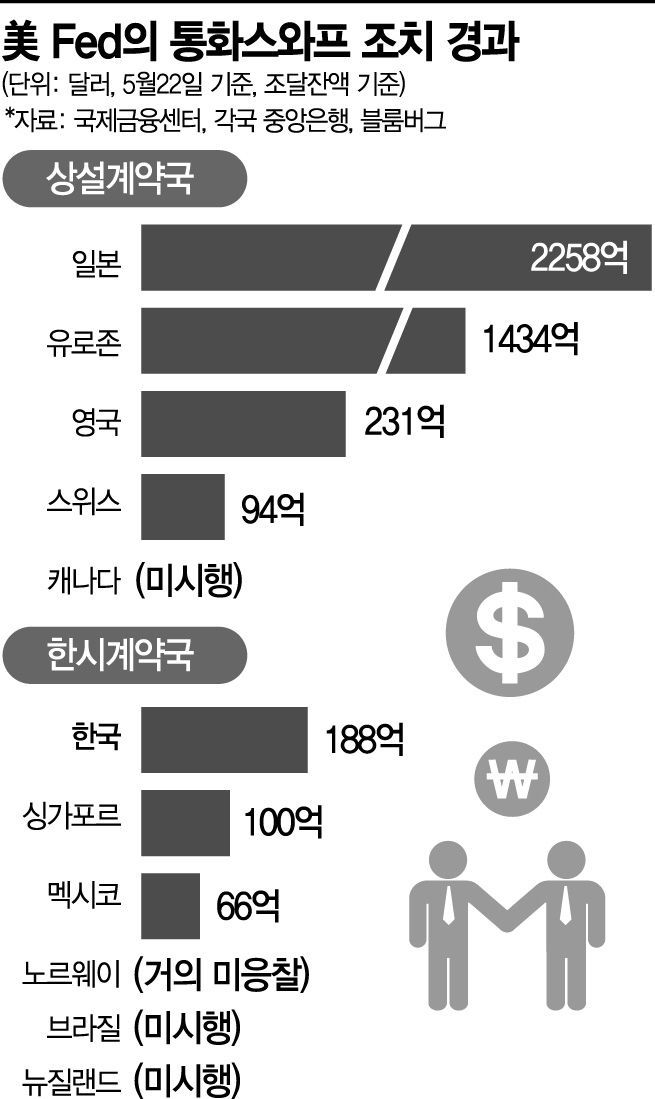

According to the Bank of Korea and the International Finance Center on the 27th, as of the 22nd, Korea had procured $18.8 billion (based on balance) out of the $60 billion currency swap funds. The total amount released into the market through foreign currency loans reached $19.872 billion, some of which has already been repaid after being recovered.

At the same time, compared to other countries that signed contracts with the Fed, Korea’s utilization of currency swap funds is considerable. Lee Sang-won, Deputy Specialist at the International Finance Center, stated, "Korea and Singapore ($10 billion) have already procured large amounts of funds comparable to the unlimited currency swap limits of the UK and Switzerland," adding, "Japan holds a procurement balance of $225.8 billion, the UK $23.1 billion, and Switzerland $9.4 billion." The Eurozone (19 countries using the euro), where dollar demand surged mainly among banks, has a procurement balance of $143.4 billion.

Looking at the average activation rate of the 14 countries where the Fed started operating currency swaps to mitigate the financial market shock caused by the COVID-19 pandemic, the activation rate is about 10.7%. Korea’s currency swap activation rate (31.3%) is higher than the average. An official from the foreign exchange authorities explained, "Compared to other countries, Korea has not supplied fewer dollars," and added, "At that time, dollar demand in the market was high, so the principle was to supply sufficient funds through the currency swap."

Fortunately, the market has calmed down, but since a significant portion of the currency swap funds has already been supplied, experts emphasize the need to closely watch the exchange rate and respond accordingly. The U.S. and China are clashing over the origin of COVID-19, and with the recent enactment of the Hong Kong National Security Law, the conflict between the U.S. and China is escalating into a currency war. China is signaling its intention to respond to U.S. sanctions by devaluing the yuan, and since the Korean won tends to be linked to the yuan, a decline in the won’s value could lead to an increase in the exchange rate. The recent increase in Korea’s economic dependence on China is also a reason for the yuan synchronization phenomenon. The Bank of Korea plans to supply currency swap funds to the market again if the exchange rate rises sharply beyond a certain level. There is also a plan to extend the term depending on the situation.

The prolonged COVID-19 pandemic and the continued damage to export companies are also worrisome factors. Professor Lee Sang-wook of Seoul National University of Science and Technology pointed out, "The reason why the Brazilian real, which has a foreign exchange reserve size similar to Korea’s, has fluctuated is largely due to foreign currency outflows caused by a current account deficit," adding, "Although the government has ample reserves, from another perspective, it is difficult to be complacent just because foreign exchange reserves are sufficient." Meanwhile, the won-dollar exchange rate surged close to 1,300 KRW in March but fell to the low 1,200 KRW range following the currency swap agreement news. Recently, as U.S.-China tensions have intensified, the exchange rate has been fluctuating between 1,230 and 1,240 KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)