[Asia Economy Reporter Changhwan Lee] According to a survey conducted by the Business and Industry Advisory Committee (BIAC) under the Organisation for Economic Co-operation and Development (OECD) involving economic organizations from 20 OECD member countries, the economic damage caused by the novel coronavirus disease (COVID-19) is expected to last more than a year. It was suggested that strong structural reforms and private sector investment are necessary for post-COVID economic recovery.

The Federation of Korean Industries (FKI) announced on the 27th that these findings were revealed through the ‘2020 Economic Policy Survey’ presented at the 2020 BIAC Board of Directors and General Assembly. The FKI serves as a full member of BIAC and acts as the Korean representative secretariat.

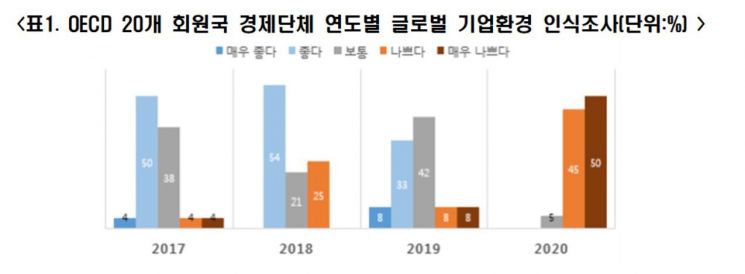

According to the survey, economic organizations from 20 OECD member countries, which account for 73% of the world’s gross domestic product (GDP), showed a sharp increase in the perception that the global business environment is ‘bad or very bad,’ rising from 16% last year to 95% this year, indicating a pessimistic outlook on the business environment due to the COVID-19 crisis.

This figure is about 12 times higher compared to 8% in 2017, when the global economy enjoyed a boom with growth rates exceeding 3% for the first time since 2010. BIAC explained that this is consistent with the sharp decline in economic confidence indices, such as the Eurozone economic sentiment index dropping from 94.6 points (March) to 65.8 points (April), and the US composite production PMI plunging from 40.9 points (March) to 27.4 points (April).

This pessimistic view is based on predictions that exports will sharply decline (55%) and investment will drastically decrease (75%), making a steep drop in exports and investment inevitable.

This is interpreted as the uncertainty caused by COVID-19 dampening investment sentiment, with the impact expected to be relatively greater on investment than on trade. Furthermore, not only the slowdown in global demand but also the increase in non-tariff barriers due to economic uncertainty and rising tensions such as trade disputes between countries are expected to hinder exports.

◆Global economic recession more severe than the 2008 financial crisis, recovery will take more than 12 months= Seventy-five percent of the economic organizations participating in the survey viewed the economic crisis caused by COVID-19 as more severe than the 2008 financial crisis. Regarding the ‘expected duration of COVID-19’s global economic impact,’ 55% responded that the economic shock from COVID-19 would last more than 12 months. Thirty-five percent expected it to last between 6 to 12 months, while only 10% believed the negative impact would decrease within 6 months.

Regarding the ‘time required for economic recovery if COVID-19 is effectively contained before June,’ 65% predicted it would take more than 12 months. The majority of respondents expected that even if COVID-19 is successfully contained and lockdowns lifted before June, it would take a considerable amount of time to recover to pre-COVID economic levels.

Thirty percent responded that normalization would occur within 6 to 12 months, and only 5% expected it to take less than 6 months, indicating that the global industry anticipates significant aftereffects even after COVID-19 is controlled.

Meanwhile, disparities are expected among industries. Regarding the three sectors expected to be most affected by COVID-19, respondents unanimously predicted that the hospitality industry, including accommodation and travel, would suffer the greatest damage, followed by the transportation industry (65%), trade and commerce (38%), media and cultural industries (23%), and construction industry (20%) in order of negative impact.

Since the outbreak of COVID-19, the most frequently implemented short-term economic policies by countries to respond to the economic downturn were ‘public institution joint guarantees (85%),’ ‘deferment of tax, social security contributions, and debt repayments (85%),’ ‘increased spending related to COVID-19 containment (85%),’ ‘emergency corporate loans (75%),’ and ‘expansion of sickness and unemployment benefits (60%).’

Regarding these government short-term responses, about 50% of respondents considered them ‘appropriate,’ contrasting with 45% who viewed them as ‘weak or very weak.’

OECD member country economic organizations suggested that additional measures such as extending liquidity expansion, further deferral of tax and debt payments, and employment-related support are necessary for short-term economic stimulus. For long-term economic recovery after overcoming COVID-19, policies supporting ‘structural reforms such as enhancing labor market flexibility,’ ‘investment in health and R&D,’ and ‘public infrastructure investment’ are needed.

Regarding structural reforms, 79% responded that the intensity of reforms in their countries over the past year was ‘average or slow,’ highlighting the need for stronger structural reforms. The biggest obstacle to structural reform was identified as ‘lack of political will or leadership (1st place, 32%),’ followed by ‘lack of political consistency (2nd place, 16%).’

Kim Bongman, Director of International Cooperation at FKI, said, “Although warnings about the economic recession caused by COVID-19 have been issued several times, this recent meeting of economic organizations from major economic powers concretely confirmed the serious concerns of the global economic community regarding the aftereffects of COVID-19.”

He added, “Countries that reorganize their economic structure through structural reforms that can promote long-term growth along with short-term economic stimulus measures will survive the competition in the post-COVID era.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.