Secondary batteries. They are core components of electronic devices and electric vehicles that require mobility. Demand surged with the popularization of mobile phones and has entered a second boom period with the spread of electric vehicles. Global companies are accelerating competition in battery technology that is safe, long-lasting, and fast-charging. The outcome of this competition depends not only on technological competitiveness but also on how many global automakers they can secure as customers. This is why the stock prices of related companies such as Samsung SDI and EcoPro BM surged following the meeting between Samsung Group Vice Chairman Lee Jae-yong and Hyundai Motor Group Chief Executive Officer Chung Eui-sun. However, concerns have also been raised that the COVID-19 pandemic might dampen the momentum. We take a closer look at the current management status of Samsung SDI and EcoPro BM, the most notable companies in the domestic secondary battery industry, and gauge their future growth trajectory.

[Asia Economy Reporter Yoo Hyun-seok] EcoPro BM, a KOSDAQ-listed secondary battery materials company, is expected to continue its steep growth trend based on overwhelming technological prowess. EcoPro BM was established in 2016 as a spin-off from the battery materials division of EcoPro, a KOSDAQ-listed company. It produces cathode materials for secondary batteries. It is the only company in Korea that possesses mass production technology for nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA) cathode materials.

EcoPro BM has secured high-nickel cathode material technology with increased nickel content. In secondary batteries, the higher the nickel content, the longer the driving range of electric vehicles. The initial cathode material, NCM333, has a nickel, cobalt, and manganese ratio of 3:3:3, providing a driving range of 124 km per charge. NCM811, with a ratio of 8:1:1, can travel up to 590 km on a single charge.

EcoPro BM is also developing cathode materials for all-solid-state batteries. Currently used lithium-ion batteries have drawbacks such as explosion risk, size, and lifespan. However, all-solid-state batteries replace the electrolyte between the cathode and anode from liquid to solid, significantly overcoming the shortcomings of conventional lithium-ion batteries. Jumin Woo, a researcher at Meritz Securities, stated, "EcoPro BM has commercialized nickel content up to 88% and is developing nickel 90%, single-crystal cathode materials, and cathode materials for all-solid-state batteries. Competitors are still stuck at nickel content levels in the 60% range for mass production, indicating a significant technological gap."

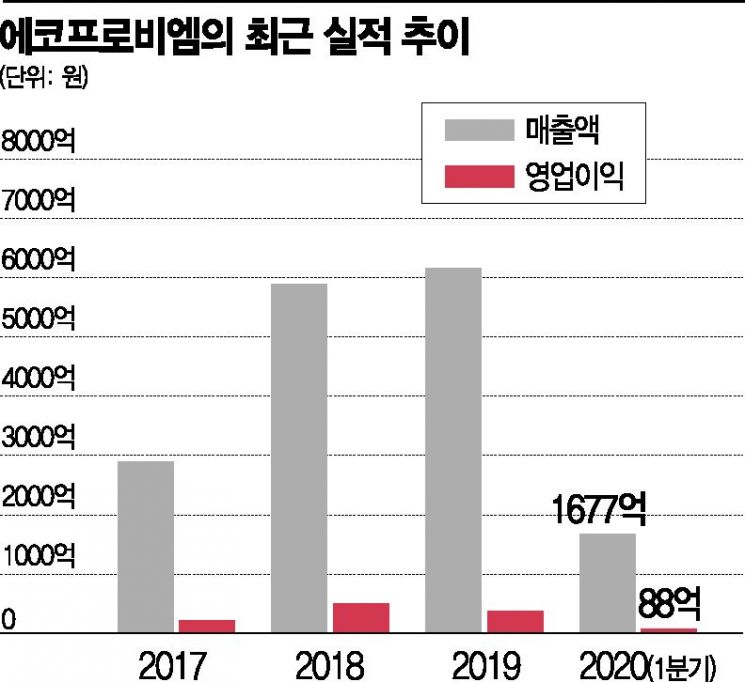

Thanks to its unique technological capabilities, its performance is steadily growing. On a standalone basis, sales increased from 289.8 billion KRW in 2017 to 616 billion KRW last year. Operating profit also rose from 22.2 billion KRW to 37 billion KRW during the same period. In the first quarter, sales and operating profit were 167.7 billion KRW and 8.8 billion KRW, respectively. Although these figures represent decreases of 7.2% and 39.4% compared to the same period last year, they increased by 13.8% and 441.8% compared to the previous quarter.

The financial situation is also stable. The debt ratio, which was 157% in 2017, rose to 189.3% in 2018 but dropped to 75.7% last year. Additionally, reliance on short-term borrowings is only 11.2%. Performance is expected to improve even amid COVID-19. According to FnGuide, securities firms estimate EcoPro BM's sales and operating profit for this year to be 821.2 billion KRW and 50.1 billion KRW, respectively, representing increases of 33.30% and 35.14% compared to the previous year. This is attributed to the full-scale operation of the Pohang plant, completed at the end of last year, starting from the second quarter, which is expected to improve sales and profitability.

Its growth potential is also attracting attention. In February, EcoPro BM established a joint venture (JV) called EcoPro EM with Samsung SDI, with a 60:40 investment ratio. The two companies plan to build a new plant in Pohang to mass-produce NCA cathode materials. In the same month, EcoPro BM also signed a supply contract worth 2.7 trillion KRW for NCM cathode materials with SK Innovation.

If cooperation between Samsung SDI and Hyundai Motor Group becomes visible, the growth trend is expected to become even steeper. Lee Jong-won, a researcher at Sangsangin Securities, evaluated, "In the future, NCM811 will be supplied to SK Innovation, and NCA811 to Samsung SDI. With factory expansions and securing definite customers simultaneously, EcoPro BM holds outstanding competitiveness compared to other material companies." He added, "If Hyundai Motor Group uses Samsung SDI's cylindrical, prismatic, and pouch-type batteries in addition to existing batteries in the future, EcoPro BM's competitiveness will further increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.