Additional Digital Tax Burden on Global Companies in Korea Leads to Corporate Tax Revenue Loss

Disadvantageous for Asian Export Countries Focused on Consumer Businesses like Korea, China, Japan, and India

[Asia Economy Reporter Ki-min Lee] There has been a claim that consumer-targeted businesses, including manufacturing, should be excluded from the scope of the digital tax being promoted by the Organisation for Economic Co-operation and Development (OECD). The current OECD agreement is said to require improvement as it does not align with the original purpose of introducing the digital tax and South Korea's national interests.

The Korea Economic Research Institute (KERI) made this assertion in a report titled "Current Status and Implications of Overseas Adoption of the Digital Tax" on the 25th. The digital tax, also known as the "Google tax" or "Apple tax," is a tax designed to impose levies on global IT companies generating revenue regardless of the presence of a fixed establishment in a specific country.

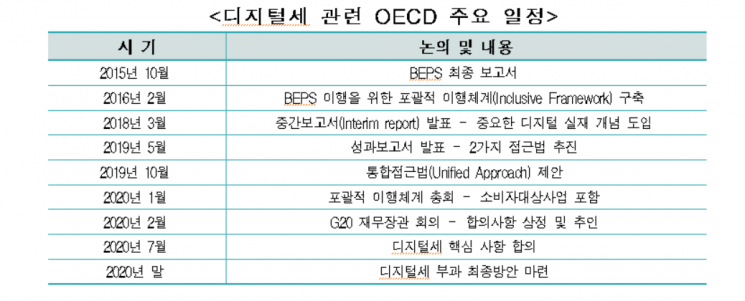

The digital tax is considered one of the most important discussion topics in the Base Erosion and Profit Shifting (BEPS) project, which aims to address issues of international tax avoidance. The OECD and the Group of Twenty (G20) are expected to establish new definitions of fixed establishments and principles for allocating taxing rights by the end of this year, with plans to implement the digital tax within three years.

KERI pointed out in the report that agreeing to apply the digital tax to global companies with revenues exceeding 750 million euros (approximately 1 trillion KRW) engaged in broad consumer-targeted businesses, including manufacturing, is problematic. Consumer-targeted businesses include major sectors of global companies operating in South Korea, such as mobile phones, home appliances, and automobiles. If these are confirmed as taxable under the OECD's final recommendations at the end of this year, major domestic companies will face additional digital tax burdens overseas.

KERI anticipates that the digital tax paid by South Korean global companies abroad will exceed the digital tax paid by foreign companies operating domestically. Since South Korean companies receive foreign tax credits for digital taxes paid overseas, this could lead to a loss in national tax revenue.

Dong-won Lim, a senior researcher at KERI, stated, "If the OECD-level introduction of the digital tax is decided, South Korea must keep pace internationally, but the government needs to assert the necessity of correcting mistakes such as including manufacturing from the perspective of the digital tax's purpose and national interests."

Furthermore, KERI criticized in the report that the OECD's attempt to legislate by including consumer-targeted businesses unrelated to digital services contradicts the legislative purpose of the digital tax. Consumer-targeted businesses, which primarily involve tangible assets, pay taxes on overseas operating profits related to locally produced products according to principles, so there is no reason for tax avoidance issues.

Senior researcher Lim added, "As a country dependent on exports with many consumer-targeted companies, South Korea should build a cooperative system with Asian countries to ensure that consumer-targeted businesses are excluded from the digital tax scope."

The report explained that if consumer-targeted businesses are included in the digital tax, it would be absolutely disadvantageous to Asian countries such as South Korea, China, India, Japan, and Vietnam, where consumer-targeted businesses are relatively prevalent, and could also infringe on the taxing sovereignty of the United States and the EU. Lim further stated, "If exclusion from the tax base is not possible, efforts should be made to at least distinguish between digital service businesses and consumer-targeted businesses and introduce a system to tax consumer-targeted businesses at a lower rate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.