Korea Insurance Research Institute

'Impact of COVID-19 on Different Lines of Non-Life Insurance' Report

[Asia Economy Reporter Ki Ha-young] Property and casualty insurance companies are expected to face crises in aspects such as low interest rates and growth rates due to the impact of the novel coronavirus disease (COVID-19). Accordingly, it is advised to establish strategies to prepare for future risks by organizing the digital environment of insurance companies and adjusting the coverage scope of insurance.

The Korea Insurance Research Institute stated this in its report titled "Impact of COVID-19 on Property and Casualty Insurance by Category" on the 24th. According to the report, the short- and long-term threat factors that property and casualty insurers face due to COVID-19 include remote work by employees, low interest rates, and growth rates.

The institute analyzed that if the low interest rate environment persists for a long time, the loss ratio of long-tail lines will worsen, and some insurance products will become uneconomical and thus not underwritten, leading to a decrease in the income of property and casualty insurers. Long-tail insurance refers to cases where there is a long time gap between the occurrence of an accident and the payment of insurance benefits.

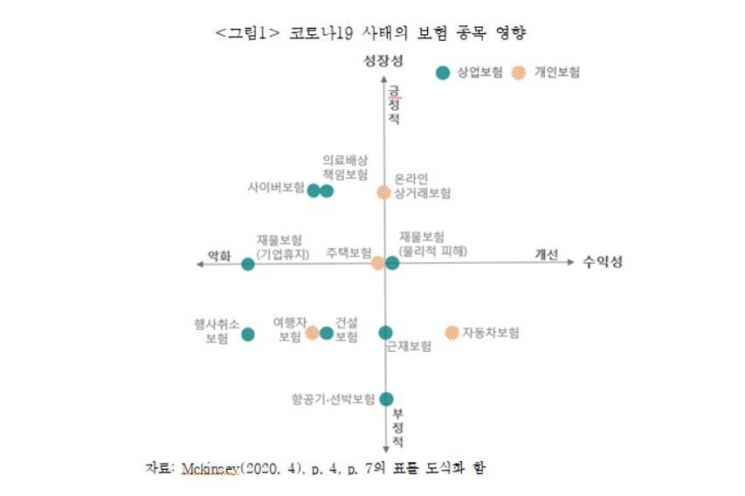

By insurance category, the market size for cyber insurance and medical professional liability insurance is expected to increase, while the markets for aircraft, ship, automobile, and travel insurance are expected to stagnate.

It is explained that cyber risks increase due to remote work, and the resulting increase in demand for cyber insurance will drive the growth of cyber insurance. Additionally, as the workload of medical professionals intensifies, the need to prepare for medical malpractice increases, leading to growth in the medical professional liability insurance market. However, property insurance (physical damage) and homeowners insurance are expected to be only minimally affected by COVID-19.

On the other hand, due to movement restrictions and city lockdowns, the premium volume in the automobile insurance and travel insurance markets is expected to decrease, and the workers' compensation insurance market is also expected to shrink due to rising unemployment rates. Movement restrictions limit the influx of new car buyers and insurance subscribers and reduce demand for travel insurance.

The Korea Insurance Research Institute advised, "As time spent at home increases due to telecommuting and movement restrictions, demand for online shopping rises, and insurance markets for online commerce and delivery services will newly emerge. Property and casualty insurance companies need to organize remote work and digital environments, adjust the coverage scope and premiums of insurance policies, and establish strategies to prepare for future risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)