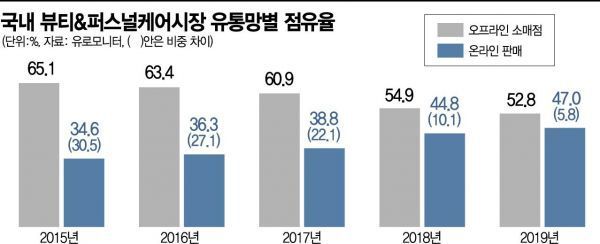

Domestic Cosmetics Sales Market

Last Year, Single-Digit Decline in Store and Non-Store Based Market Share

Including E-commerce, Direct Sales, and Home Shopping

Expectations for Reversal This Year Due to COVID-19

11st presents the 'Hera' beauty live broadcast promotion every month in collaboration with Amorepacific

11st presents the 'Hera' beauty live broadcast promotion every month in collaboration with Amorepacific

[Asia Economy Reporter Cha Min-young] The domestic online cosmetics sales market is heating up. Last year, the gap in market share between online and offline sales channels narrowed to single digits, leading to expectations that this year will be the first year when online sales surpass offline sales, driven by the COVID-19 pandemic. With the increase in large-scale online promotional events, new records are being set, such as selling over 5,000 units of a single product in a short time.

◆ Online Closely Chasing Offline = According to global research firm Euromonitor on the 24th, the market share of offline retail stores for cosmetics in Korea was 52.8% in 2019, narrowing the gap with online sales (47.0%) to 5.8 percentage points. The gap between online and offline cosmetics sales was 30.5% in 2015 but steadily decreased to 27.1% in 2016, 22.1% in 2017, and 10.1% in 2018. Expectations are high that the proportions of online and offline channels will reverse this year. Especially after the COVID-19 outbreak that began spreading at the end of January, the non-face-to-face (untact) trend has intensified this phenomenon. Even when many offline road shops faced sales slumps and could not afford rent, online sales remained steady. However, online sales here refer to a relative concept based on store sales and include e-commerce, direct sales, and home shopping combined.

The cosmetics industry cites the advantages of online malls as low entry fees and flexibility in marketing. The entry fee required by department stores is estimated to be around 35%, considering minor differences. Large e-commerce companies operating open-market platforms charge around 10%, showing a significant difference. Online curated shops that handle everything from product sourcing to planning and after-sales service (AS) charge around 25-30%.

Another strength is the advantage in online marketing, such as beauty YouTubers. Most cosmetic demonstrations and viral videos are linked to online and mobile-based platforms like Instagram and YouTube, which are often underutilized offline. There is also a growing tendency to trust influencers' reviews more than personal use. Additionally, the relative ease of overseas expansion is another advantage. LF’s own men’s cosmetics brand, 'Hazzys Man Rule429,' entered Xiaohongshu, China’s largest social network service (SNS) commerce platform, in January and has been achieving 50% monthly sales growth. The MZ generation (a combination of Millennials and Generation Z), which values empathy, is enthusiastic about online and mobile platforms with many reviews, which is also considered a factor.

◆ Both Large and Indie Beauty Companies Focus on Online = Since COVID-19, not only indie cosmetics but also large beauty companies have been thoroughly reviewing their annual offline event plans and reorganizing marketing channels to focus on online. For example, the online fashion and lifestyle curated shop 'Hago' has increased its cosmetics brand entries to 10 since the beginning of the year. About 40 other brands have also signed contracts and are waiting to enter. eBay Korea, which operates Gmarket and Auction, is holding a large cosmetics event during this month’s 'Big Smile Day' in the first half of the year. Amorepacific is actively conducting specialized promotions for 'Hera,' 'Laneige,' and 'Innisfree.' Nature Republic also explains that products popular online first on platforms like 11st are gaining popularity in offline road shops as well. This trend is even more pronounced among indie cosmetics brands that lack funding and have difficulty mass-producing.

Hong Hee-jung, Senior Researcher of Beauty & Fashion at Euromonitor International Korea, said, "The Korean cosmetics market, which was already seeing an increase in non-store sales, is expected to shift even faster to non-store channels after COVID-19. E-commerce is expected to play a major role, and convenient refund policies, inclusion of cosmetic samples, and detailed explanatory strategies will be key weapons." Analysis suggests that the possibility of online sales surpassing offline store-based sales in the beauty industry depends on oral care products and perfumes. So far, the e-commerce market has been focused on hair care and masstige cosmetics, which are frequently used and have less individual variation.

A representative of an online curated shop said, "New subscribers have increased since the COVID-19 outbreak, but a more interesting phenomenon is the temporary surge in return rates, which we view positively. We estimate that more customers in their 40s and 50s, who are using online malls for the first time, are adapting, and this is part of the process. It is a positive signal that loyal customers may increase in the future."

Another cosmetics industry insider said, "If a product gets good exposure in a promotional event, even indie brands can sell over 5,000 units of a single product. With the increasing effect of large-scale purchases comparable to Alibaba’s November Singles’ Day, there is no reason to avoid online events. Some are already preparing strategies to compete in online promotional events in earnest this fall after the slow summer season."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.