Bank of Korea to Conduct CBDC Pilot Test Next Year

[Asia Economy Reporter Eunbyeol Kim] Central banks around the world are actively conducting pilot projects for central bank digital currencies (CBDCs). Especially, vigorous research is being carried out mainly in countries where cash usage has significantly declined or where financial accessibility is low. The Bank of Korea has also expressed its intention to join the effort by accelerating research on overseas CBDC projects.

In a recent report on the status of overseas CBDC initiatives, the Bank of Korea stated, "Most central banks are reviewing the feasibility of implementing CBDCs," adding, "The Bank of Korea will exchange information with domestic and international technology holders and form an external technical advisory group to ensure that the latest IT technologies such as blockchain are incorporated into the CBDC pilot system to be developed in the future, aiming to innovate and advance future payment systems."

CBDC refers to central bank money issued in electronic form. Since CBDCs are implemented electronically, unlike cash, they can limit the anonymity of related transactions. Additionally, depending on policy objectives, interest payments, holding limits, and usage time controls are possible. Based on their intended use, CBDCs are classified into small-value payment CBDCs used for general transactions by all economic agents and large-value payment CBDCs used for transactions between banks and other financial institutions.

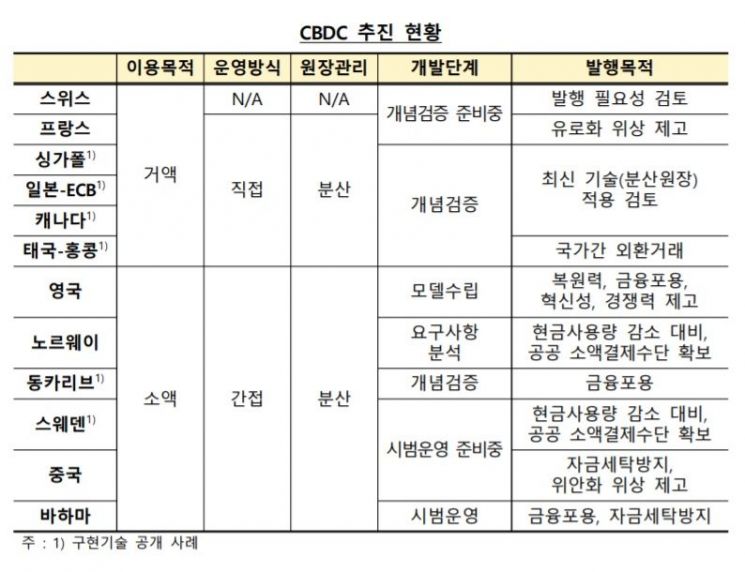

According to the Bank of Korea’s investigation of 12 research cases from 14 central banks, most of the surveyed central banks are developing IT systems to verify the validity of their established CBDC models, and cooperation with external parties is ongoing during this process.

By country, Norway, the Eastern Caribbean, the Bahamas, Sweden, the United Kingdom, and China are researching small-value payment CBDCs. Switzerland, Singapore, Japan-European Central Bank (ECB), Canada, Thailand-Hong Kong, and France are examining ways to utilize CBDCs for large-value payments.

Central banks aiming to introduce large-value CBDCs are all considering a direct operation method, while those focusing on small-value CBDCs are reviewing technology with an indirect operation method in mind. Ledger management is decentralized for both large-value and small-value CBDCs.

The Bahamas, Sweden, and China have completed proof-of-concept stages and are preparing for or conducting pilot operations. In particular, China is progressing rapidly with its CBDC; the People’s Bank of China is preparing to issue a CBDC to counter the threat to the international status of the yuan posed by private digital currencies such as Facebook’s Libra.

China is reportedly considering an indirect operation method that issues separate CBDCs for large-value and small-value payments. Using centralized distributed ledger technology, it plans to build a large-value payment network between the central bank and financial institutions, allowing participation not only by banks but also by online payment service providers such as Alibaba and Tencent. For small-value payments, financial institutions will supply and reclaim CBDCs to and from the public, with each institution building and operating its own small-value payment network.

China aims for the CBDC system to process 300,000 transactions per second. Considering that Bitcoin processes 7 transactions per second, Ethereum 15, and Facebook’s Libra 1,000, this indicates a focus on enhancing system performance.

In Sweden, where cash usage is rapidly declining, there is currently no alternative small-value electronic payment method in the public sector. Sweden is also considering issuing separate CBDCs for large-value and small-value payments. The goal is to provide peer-to-peer (P2P) transaction functionality through CBDC issuance. Users will use an app developed by the Swedish central bank during the pilot phase and later switch to apps developed by intermediaries.

The Central Bank of the Bahamas selected the private company NZIA as the CBDC solution provider in March last year, but specific details have not been disclosed.

Meanwhile, the Bank of Korea plans to conduct a CBDC pilot test next year. It aims to preliminarily review the technical and legal requirements for CBDC adoption within this year and to build and test the pilot system over a one-year period from January to December next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)