[Asia Economy Reporter Haeyoung Kwon] As the global real economy and commercial real estate slump intensifies due to the impact of the novel coronavirus infection (COVID-19), it has been revealed that the domestic real estate fund market, valued at 160 trillion won, is being hit.

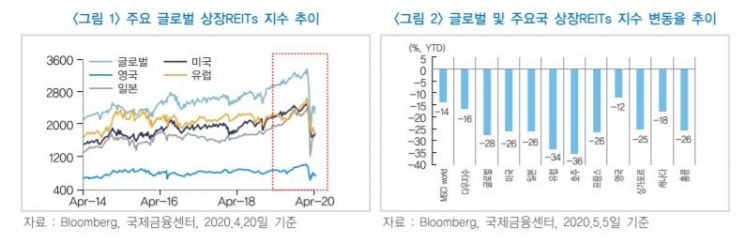

According to the report "Impact and Implications of the COVID-19 Shock on the Real Estate Indirect Investment Market" released by the Korea Institute of Finance on the 23rd, the global REITs fund of funds yield reached -12.7% compared to the beginning of the year as of the end of April. The global REITs fund of funds invests in listed stocks related to overseas commercial real estate, reflecting the recent real estate market downturn.

The market capitalization of seven domestic listed REITs also decreased by 15.89% compared to the beginning of the year, standing at 1.7309 trillion won as of the end of April 2020, significantly underperforming the KOSPI index decline (-11.38%). The overall real estate fund yield showed 2.16% compared to the beginning of the year.

The size of the domestic real estate indirect investment product market grew threefold in four and a half years, from 54 trillion won at the end of 2015 to 160.5 trillion won at the end of April 2020. Real estate funds account for 65.9%, and REITs account for 34.1%. The amount of overseas investment real estate funds surged from 13.5 trillion won at the end of 2015 to 58.2 trillion won at the end of April 2020.

Recently, in countries such as the United States and Europe, where the real estate COVID-19 impact is significant, consumption contraction and corporate profit reduction have appeared, causing the overall commercial real estate market to show weakness.

Senior Research Fellow Sang Shin of the Korea Institute of Finance predicted, "Most real estate indirect investment products operate as closed-end private funds with fixed maturities, so there is no immediate sharp deterioration in yields, but properties approaching maturity will face yield deterioration and redemption risks."

Institutional investors are also inevitably affected. Securities companies and pension funds that invested in sectors directly hit by COVID-19, such as hotels, resorts, and retail, are expected to face the spread of damage such as declines in investment property values, reductions and suspensions of REIT dividends, and stock price drops.

Senior Research Fellow Shin advised, "It is necessary to strengthen overall monitoring of domestic and overseas commercial real estate indirect investment products," adding, "By grasping the status of each investment property, including the structure of incorporated assets, lease contract details, and related exposures, the feasibility and scale of risks should be identified to proactively prepare for potential liquidity risks faced by institutional investors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.