[Asia Economy Reporter Kim Hyo-jin] The final preparations for the full-scale operation of the 40 trillion won-scale Period Industry Stabilization Fund (GISF) are accelerating.

According to financial authorities on the 23rd, the Korea Development Bank established an internal Period Industry Stabilization Fund Headquarters to operate the GISF following the board decision on the 20th.

The headquarters consists of 35 members. It is composed of two offices: the Fund Secretariat and the Fund Operation Office, and was established under the Corporate Finance Division.

The headquarters plans to hold an official launch ceremony next week and prepare for the 1st Fund Operation Deliberation Committee meeting to decide on the fund operation plan.

Based on this, the government plans to issue GISF bonds in early next month and start accepting support applications.

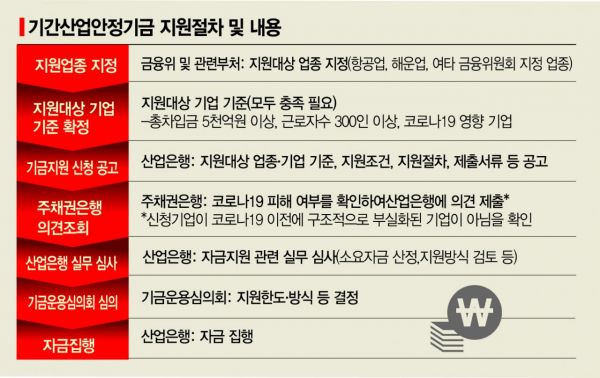

At the Emergency Economic Central Countermeasures Headquarters (Economic Central Headquarters) meeting on the 20th, the government finalized the target companies for GISF support and the support requirements.

The recently confirmed amendment to the Enforcement Decree of the Korea Development Bank Act reduced the originally seven eligible industries to aviation and shipping.

However, if it significantly affects core technology protection, industrial ecosystem maintenance, the national economy, employment stability, or national security, the Ministry of Strategy and Finance and the Financial Services Commission may consult and provide support regardless of the industry regulations in the enforcement decree.

The condition of 'maintaining a certain employment ratio' was defined as maintaining at least 90% employment as of June 1 for six months from the start date of fund support.

Companies receiving support must submit efforts by labor and management to maintain employment to the Korea Development Bank, and if necessary, the bank will verify this with the cooperation of the Ministry of Employment and Labor.

To ensure that the benefits from financial support are shared beyond the company to the public, at least 10% of the support amount will be provided in the form of subscription to stock-related bonds such as convertible bonds (CB) and bonds with warrants (BW). Measures to prevent moral hazard, such as restrictions on dividends and treasury stock acquisition, are also maintained.

The key issue is the detailed support requirements of 'total borrowings of 500 billion won or more and 300 or more employees.'

In the aviation industry, only Korean Air and Asiana Airlines meet the criteria when considering only long- and short-term borrowings, making it difficult for low-cost carriers (LCCs) facing bankruptcy to receive support.

However, if lease liabilities, both current and non-current, are included in the calculation of long- and short-term borrowings, some LCCs may meet the requirements. The government is additionally discussing the timing of the total borrowing criteria, including this.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.