During the three months of rapid COVID-19 spread, 29 firms downgraded by Hanshin Rating and 21 by Nasin Rating

Faster than the global financial crisis prelude in 2007... Concerns of mass downgrades after Q2 settlements

"Worsening corporate financing and financial market liquidity crunch... Crisis may arise from rating agencies"

[Asia Economy Reporter Kwon Haeyoung] Domestic credit rating agencies are accelerating the downgrade of corporate credit ratings (including rating outlooks) since the outbreak of the novel coronavirus infection (COVID-19). The pace is faster than during the 2008 global financial crisis. There is growing fear that a tsunami of credit rating downgrades will come after June, when regular credit ratings are completed and companies finish their second-quarter operations. There are concerns that the rapid downgrades of credit ratings could worsen corporate financial burdens and cause credit and liquidity crunches in the financial sector, potentially triggering a crisis originating from the rating agencies.

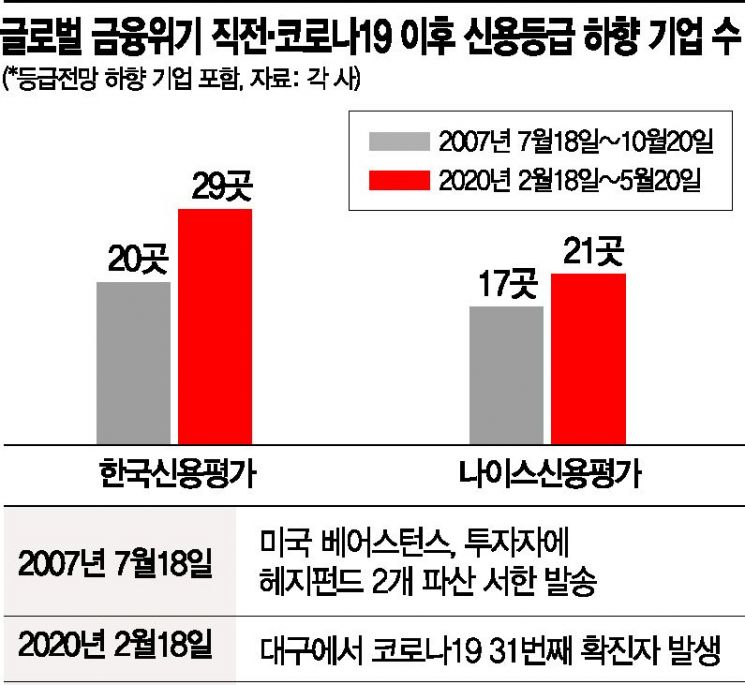

According to the financial sector on the 22nd, Korea Ratings lowered the credit ratings and rating outlooks of 29 companies over the past three months since February 18, when the 31st confirmed COVID-19 case, a Shincheonji Church member in Daegu, the epicenter of the outbreak in Korea, was reported. During the same period, NICE Investors Service downgraded the credit ratings and rating outlooks of 21 companies.

This pace is considerably faster compared to just before the 2008 global financial crisis. The global financial crisis triggered by the subprime mortgage (non-prime home mortgage) default began on July 18, 2007, when Bear Stearns, one of the five major U.S. investment banks, announced the bankruptcy of two hedge funds. From that point, over three months (July 18, 2007 to October 20, 2007), Korea Ratings and NICE Investors Service downgraded the credit ratings and rating outlooks of 20 and 17 companies, respectively. In the recent three months of rapid COVID-19 spread, the rating agencies downgraded approximately 45% and 23% more companies’ credit ratings than just before the global financial crisis, which was considered the prelude to a 'perfect storm' (a massive economic crisis).

Park Eui-taek, head of the coverage division at Deutsche Bank Seoul Branch, said, "Credit rating agencies, which were criticized for inaccurate and delayed downgrades just before the 2008 global financial crisis, are now downgrading corporate credit ratings faster than ever before." He added, "The rating agencies’ downgrades could lead to deterioration of corporate financial structures and credit tightening in financial markets, raising the possibility of a financial crisis similar to 2008."

There is a concern about a vicious cycle: credit rating downgrades by rating agencies → increase in corporate borrowing costs and financial expenses → difficulties in issuing corporate bonds and obtaining loans → deterioration of corporate financial structures → credit and liquidity crunch in financial markets. According to the Korea Financial Investment Association, the domestic corporate bond market has doubled in size over the past 10 years, from 149.4886 trillion KRW at the end of 2010 to 300.994 trillion KRW as of yesterday, so credit rating downgrades have a greater impact on companies’ financing conditions.

Rating agencies say that the real economy shock caused by COVID-19 is severe and it is impossible to predict when it will return to normal, so they have no choice but to issue warnings to the market. An industry insider explained, "Economic conditions have worsened, and since the end of last year, the business outlook has been negative. On top of that, the external variable of COVID-19 hit at the beginning of this year. During the regular credit rating period from April to June, as companies’ credit is comprehensively reviewed, the number of credit rating and rating outlook downgrades has increased."

The default rate, which is the ratio of defaults occurring within a certain period after investment-grade ratings are assigned, is also higher compared to 2007. For NICE Investors Service, the default rate for speculative-grade corporate bonds rose from 0% in 2007 to 2.27% in the first quarter of this year.

Recently, there has been criticism that rating agencies’ rapid downgrades of corporate rating outlooks and credit ratings are a cautious behavior. After being criticized for failing to proactively reflect crises during the global financial crisis and the 2013 Dongyang incident and being accused of 'rating business,' they are now responding with a 'downgrade first, see later' approach.

A financial sector official said, "While the government is actively supporting companies facing bankruptcy risks due to COVID-19 through unprecedented financial support, excessively rapid credit rating downgrades deepen the crisis." He emphasized, "Since the Financial Stability Board (FSB) has also warned about crises triggered by credit rating downgrades, rating agencies should be cautious in adjusting corporate credit ratings to contain the crisis."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.